TMTB Morning Wrap

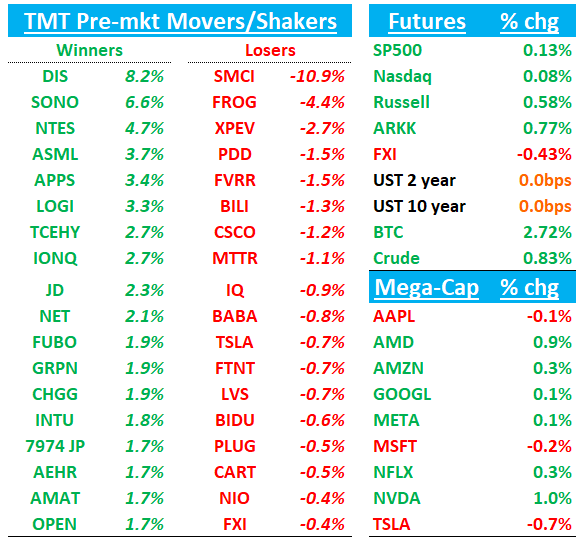

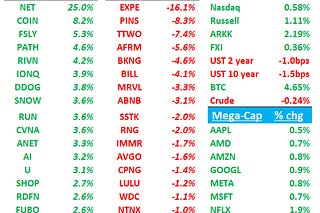

Good morning. QQQs +5bps; yields roughly flat; BTC +2.5% getting past $90k; DXY spiking another 40bps.

Let’s get straight to the recap…DIS/CSCO earnings recaps first then on to news/research…

DIS +9%: FYQ4 slight rev/eps beat and DIS+ subs beat (123M vs 120M), but big story is better 25 and 26/27 outlooks

The quarter came in slightly better with big DIS+ beat, a little better than what buyside/3p had been expecting.

The bigger positive is that DIS guided FY25 EPS to high single digit growth vs buyside something closer to 1-2% and their FY'26/27 outlook calls for low double digit EPS growth, which implies something close to about ~$6.75+ in EPS for FY27 (15x P/E). Street is closer to mid single digit growth for those two years.

Bulls will like this print as there had been some concern around initial guide and it seems like bundling strategy is paying off for DIS + and be able to feel comfortable with FY27 P/E of 15x for low double digit EPS growth, which is likely conservative. Not a ton to nitpick here for bears other than expectations were high, but quarter looked solid and guide a nice upside surprise. Bulls will say that improving DIS subs and guidance enough to get this to re-rate higher and why not pay 20x for $7 EPS power = $140. Doesn’t sound too bad to us.

DIS 2025 F/Y GUIDANCE

- Guides high-single digit adj. EPS growth (implies $5.3 - $5.4 vs buyside at $5)

- Guides CAPEX about $8B

- Targets $3B in buybacks

- Guides experiences operating income +6% to +8% y/y

2026 F/Y GUIDANCE

- Guides double-digit adj. EPS growth

- Guides double-digit growth in cash from operations

2027 F/Y GUIDANCE

- Guides double-digit adj. EPS growth

RESULTS: Q4

- ADJ EPS $1.14 vs. $0.82 y/y, EST $1.10

- Revenue $22.57B, +6.3% y/y, EST $22.47B

- Entertainment revenue $10.83B, +14% y/y, EST $10.66B

- Sports revenue $3.91B, +0.1% y/y, EST $3.95B

- Experiences revenue $8.24B, +1% y/y, EST $8.2B

- Total segment operating income $3.66B, +23% y/y, EST $3.71B

- Entertainment operating income $1.07B vs. $236M y/y, EST $1.16B

- Sports operating income $929M, -5.3% y/y, EST $904.4M

- Experiences operating income $1.66B, -5.7% y/y, EST $1.66B

- Disney+ Core subscribers 122.7M, EST 119.85M

- Disney+ Hotstar subscribers 35.9M, EST 35.63M

- Total Hulu subscribers 52M, EST 51.93M

- Hulu & Live TV subscribers 4.6M, EST 4.58M

- Disney+ Core ARPU $7.30, EST $7.34

- Disney+ Hotstar ARPU $0.78, EST $0.88

- Hulu SVOD ARPU $12.54, EST $12.82

- Hulu Live TV + SVOD ARPU $95.82, EST $95.83

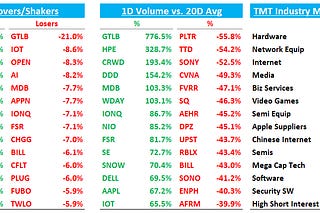

CSCO - 1.5%: Solid quarter and better guide but concerns over order growth and weaker networking keep lid on stock

Overall, several puts and takes in the quarter. Stock was near highs and this print won’t shake bulls conviction of continued enterprise, networking and AI tailwinds as mgmt sounded confident in all of those, but not surprising to see stock down given big run up and several things for the bears to point to.

Bears will point to weaker orders (9% ex SPLK with tough comps ahead), security and observability #s which seem to imply SPLK revs were flat to down on a y/y basis, weaker Federal commentary (although mgmt said that is likely to come back), and GMs that were helped by a one time benefit. They’ll say unexciting for a mid single digit top line grower at 15x P/E.

No strong view on the stock here at TMTB

More details…

The positives:

Gross Margin rose +240bps to its highest in >20 years helped by Splunk, product mix, productivity enhancements) but they also called out it was helped by a one-time material benefit.

Cisco continues to highlight gains in both front-end and back-end cloud networks with webscale orders up triple digits and $300M in AI orders booked in the quarter (well positioned to exceed $1.0B orders for FY25).

Mgmt sounded good on the call talking up rev trends at cloud giants, allowing mgmt to feel comfortable with LT growth of 4-6%.

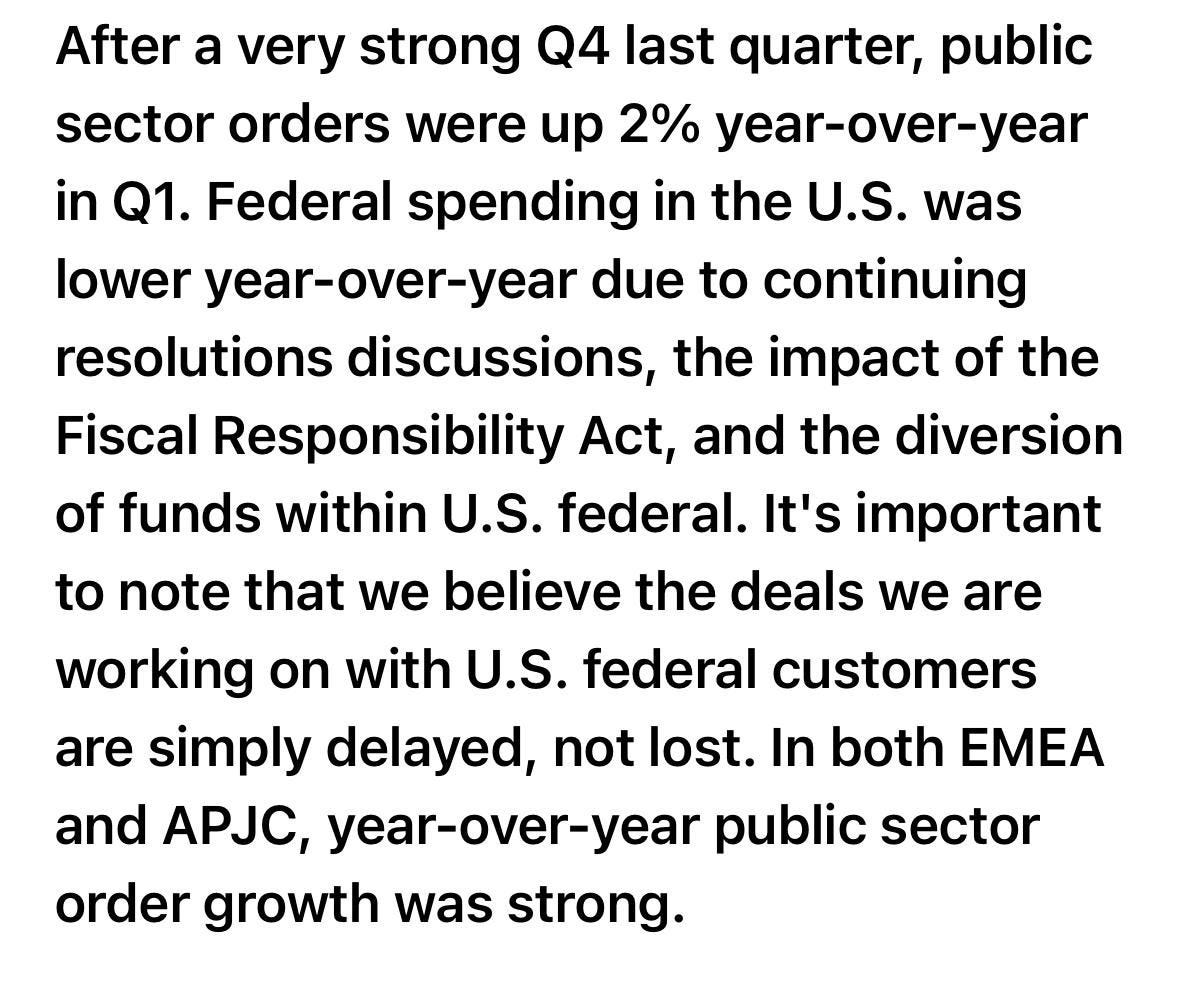

Total software revenue grew 25% and software subscription revenues were up 35% Y/Y. Enterprise orders were up 33% and Service Provider and Cloud orders were up 28% due to triple-digit growth for webscale, and public sector orders were up 2%. The telco environment remains muted but management mentioned a few points of growth, and also highlighted seeing early signs of enterprise refresh as these customers prepare to upgrade infrastructure.

Concerns/nitpicks:

GMs guided down to 68-69% next quarter

Overall product growth only 9% ex SPLK weaker as buyside wanted something in the 10s, especially as tough comps loom ahead.

Federal spending was weaker y/y as mgmt blamed continuing resolutions discussions, the impact of the Fiscal Responsibility Act and the diversion of funds within US federal, but said orders were “simply delayed, not lost.” Key quote:

CSCO GUIDANCE: Q2

- Guides revenue $13.75B to $13.95B, EST $13.74B

- Guides ADJ EPS $0.89 to $0.91, EST $0.87

- Guides ADJ gross margin 68% to 69%, EST 67.6%

- Guides ADJ operating margin 33.5% to 34.5%, EST 32.7%

2025 F/Y GUIDANCE

- Guides revenue $55.3B to $56.3B, saw $55B to $56.2B, EST $55.88B

- Guides ADJ EPS $3.60 to $3.66, saw $3.52 to $3.58, EST $3.57

RESULTS: Q1

- Revenue $13.84B, -5.6% y/y, EST $13.77B

- Product revenue $10.11B, -9.2% y/y, EST $9.96B

- Networking revenue $6.75B, -23% y/y, EST $6.75B

- Security revenue $2.02B, +100% y/y, EST $1.84B

- Collaboration rev. $1.09B, -3% y/y, EST $1.05B

- Observability revenue $258M, +36% y/y, EST $299.7M

- Service revenue $3.73B, +6% y/y, EST $3.72B

- Remaining performance obligations $39.99B

- ADJ EPS $0.91 vs. $1.11 y/y, EST $0.87

- ADJ gross margin 69.3% vs. 67.1% y/y, EST 67.6%

- ADJ operating margin 34.1% vs. 36.6% y/y, EST 32.6%

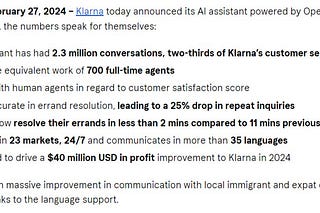

News/Research:

NVDA: Sell-side previews this morning (Susq, opco, RJ, HSBC) as we get geared up for next week’s print. Recaps below…

We’ll have our full preview this weekend.

Susq:

SUSQ expects better results/guidance as checks around H100/H200 and early Blackwell remain on track. However, SUSQ notes new products create some uncertainty around margins and the level of dilution. For DC, AI demand continues to be helped by expanding hyperscale CAPEX plans (from Meta, Amazon, etc.) and commentary from the likes of xAI (100,000 H100 cluster in 19 days) suggesting sustained large GPU purchases through 2H. Enterprise/Consumer Internet (>50% of DC revenue last quarter) and Sovereign AI should further help drive demand. On the supply side, SUSQ sees improvements being a mixed picture as Nvidia again noted that the supply of Hopper GPUs is improving, corroborated by reports of shorter lead-times and lower aftermarket pricing. While SUSQ believes these changes mostly reflect improved supply (a positive), it does note a recent round of price declines from GPU Clouds with some prices below $2/hour (too much cloud capacity online… a negative?). On BW, Susq expects several B dollars in revs for the Jan q .

Oppenheimer:

OPCO sees upside to FQ3 (Oct) results and FQ4 (Jan) outlook led by sustained CSP/enterprise demand for AI accelerators. OPCO is raising estimates. Hopper leads NT. Blackwell ramp begins FQ4 and should contribute low-mid-single digit $BS in the Q. Blackwell supply remains constrained by CoWoS-L capacity. OPCO sees meaningful acceleration in Blackwell FQ1 (Apr). Opco notes that conversations w/ investors suggest buyside modeling 5-6M GPUs next year. CY25 mix likely favors “drop-in” HGX modules and air-cooled NVL36 GB200 racks as they best accommodate existing DC infrastructure while liquid cooling “kinks” are worked out. Opco notes NVDA rack-scale solutions a ~10x ASP multiplier vs module—incl. CPU and networking content.

Raymond James:

RAJA expects another strong quarter driven by healthy Hopper demand and early Blackwell ramps. However, consensus has already moved up and supply remains a wildcard, which could limit near term upside. RAJA believes ~$34B revenue for 3QF25 (Cons. $32.9B) and $37-37.5B guide (consensus $36.7B) is a more likely outcome. RAJA's base case is for NVDA to ship ~100K Blackwell GPUs in Q4, which it believes is near the low-end of investor expectations. While demand is not an issue, NVDA's B/S inventory (D/O) is at a 4-year low, Blackwell cycle times are longer, and NVL systems are much more complex compared to HGX boards. October monthly sales data from key NVL assemblers Foxconn (up 10% m/m) and Quanta (down 12% m/m) also point to gradual ramps. That said, RAJA expects Blackwell ramps to accelerate in 1H25 and see strong demand through 2025. Spectrum-X is another tailwind as GPU cluster sizes increase rapidly. RAJA raises estimates and its price target from $140 to $170, and view any pullback due to high-expectations as an opportunity

HSBC: Raising PT to $200

HSBC raised the firm's price target on Nvidia to $200 from $145 and keeps a Buy rating on the shares. The analyst expects more upside in the company's data center momentum, saying its Q3 sales and Q4 guidance are on track to beat consensus estimates. Nvidia's growth "is still not over despite being in uncharted territory as the AI train is back on track.”

3P Roundup:

CRM: hearing 3p positive on strength in Q3

OKTA: Hearing M-sci calling out net adds more than double Q2 levels in Q3

RBLX: Hearing Yip saying bookings decel’d to low 20s from mid 20s in Q4 so far, slightly above street while DAUs/Hours engaged tracking below

ABNB: Hearing big uptick in weekly 3p data

AMZN: Hearing AWS tracking to slightly below 21% vs street at 19%. Also MS saying they are hearing positive feedback from long only meetings in Seattle this week.

Digital Ads (META/PINS/RDDT/GOOGL): Hearing Edgewater saying they are seeing a post-election surge in spend…most positive on search, then META…

ASML +4%: Releases targets ahead of analyst day in Europe

ASML maintained its 2030 targets at analyst day, both inline with where street roughly expecting, which should help alleviate some concerns investors had about potential cuts:

Revenue target: €44-60bn

Gross margin: 56-60%

Mgmt said AI opportunities potentially offsetting weaknesses elsewhere and expects increased EUV exposure demand in advanced logic and DRAM through decade-end. Mgmt projects double-digit EUV spending CAGR for 2025-30. This guidance helps address concerns about lithography intensity peaking, though uncertainty remains about leading edge landscape clarity (expected in ~12 months). Capital allocation strategy confirmation suggests large buyback restart likely needed soon.

TSLA: Jefferies ups TSLA target to $300, recommends equity raise post rally

Jefferies says Tesla should take advantage of its shares re-rating 30% since Trump's election to raise equity. Jefferies otes assuming markets remain competitive, de-regulation raises the company's growth path but also the investment requirements for TSLA and competitors in ventures where returns remain unclear. Jefferies increased estimates on a mix of software, zero-emission vehicle credits and storage more than auto.

NFLX: Jefferies says FLX still a buy despite recent rally and reiterates top pick

TheFly:

JPMorgan analyst Doug Anmuth says Netflix shares are up 21% since the Q3 earnings report as investor sentiment remains strong on the Q4 content slate. There is confidence in Netflix meeting and beating its 11%-13% 2025 revenue outlook and 28% 2025 operating margin guide, while delivering meaningful free cash flow growth, the analyst tells investors in a research note. The firm believes the company's 2025 revenue will be supported by healthy organic and secular growth, ramping advertising contribution, and price increases. Netflix's organic growth "remains healthy," contends JPMorgan. It keeps an Overweight rating on the shares with an $850 price target, saying the stock remains a top pick.

PSTG: ISI defends saying Coreweave deal could yield sizeable contributions

After PSTG announced a strategic investment in GPU cloud provider Coreweave as part of the latter’s latest funding round, PSTG will deploy its storage solutions at Coreweave’s cloud environments. ISI noted that investors appear to view this partnership as disappointing compared to the likes of Tier 1 hyperscalers. However, ISI thinks the deal at scale in 26/27 timeframe could results in sizeable rev/eps contributions for Pure, which could help PSTG sustain or accelerate double digit top line growth in the out years. ISI thinks PSTGs, joint collab will enable its solutions to be designed in for future deployments.

PANW: Stiefel raises tgt to $440 as they preview the quarter next week

Following Palo's October quarter, Stifel spoke with five cybersecurity VARs/SIs for an updated view on overall cyber demand trends along with a closer look at Palo-specific results. Checks were generally positive on the cyber spending demand environment as well as Palo's October quarter, with 2 VARs above expectations, two in line, and one modestly missing expectations. NET/NET, Stifel believes checks point to an in line to upside print on the top-line, and it expects FY25 guidance to be reaffirmed-to-walked-up in line with any beat. That said, given the move in shares off the February bottom (+54% off February lows vs the S&P +20%), Stifel thinks FY25 guidance (especially for NGS ARR and operating margin) will need to move higher for the stock to trade up following the print

PLUG: Plug Power downgraded to Neutral from Buy at BTIG

TheFly:

BTIG analyst Gregory Lewis downgraded Plug Power to Neutral from Buy. The company continues to take the necessary steps to extend its liquidity runway as it waits for hydrogen order momentum to accelerate, but while global hydrogen demand continues to grow, the slope of that growth continues to be lower than expected, the analyst tells investors in a research note. The firm adds that Plug Power's product offering is well positioned for the global hydrogen buildout and its downgrade is a function of demand and more product sales that are needed to improve margins being pushed out

FN: Initiated with an Equal Weight at Barclays

Barclays believes upside is "baked in at the current premium valuation." While Barclays appreciates Fabrinet's "strong positioning" with NVDA optical transceivers, it says the timing and magnitude uncertainty on 1.6T ramp could be a concern for shares. It sees a balanced risk/reward at current FN share levels

Samsung/MU/Memory: Samsung completing HBM4 development to secure Nvidia orders. Samsung (SSNLF) is set to finish the development of its sixth-generation high bandwidth memory by 2025 to secure orders for Nvidia's (NVDA) graphics processing units - Digitimes

Meta to Launch Ads on Threads in Early 2025

Out mid day yesterday…

Meta Platforms plans to introduce advertisements to its text app, Threads, early next year, hoping to cash in on the app’s rapid growth, according to three people with direct knowledge of the company’s plans.

A team inside Instagram’s advertising division is leading the effort, which is still in the early stages, the people said. Threads is planning to kick off the effort by letting a small number of advertisers create and publish ads on the app starting in January, one of those people said.

Other News:

AAPL: Apple faces a $3.8B antitrust legal claim over abusing its dominance by tying customers to its iCloud storage service – MSN

BKNG: EU Commission announces as from today Booking Holdings must ensure that Booking.com complies with all relevant obligations of the Digital Markets Act

GOOGL: Following OpenAI, Google Changes Tack to Overcome AI Slowdown – The Information

NVDA: Nvidia Readies Jetson Thor Computers for Humanoid Robots in 2025 – WSJ

SYNA: announces private offering of $400M convertible senior notes due 2031