SummarySummary 小结

In our 25-criterion evaluation of conversation intelligence for B2B revenue providers, we identified the most significant ones and researched, analyzed, and scored them. This report shows how each provider measures up and helps conversation intelligence for B2B revenue professionals select the right one for their needs.In our 25-criterion evaluation of conversation intelligence for B2B revenue providers, we identified the most significant ones and researched, analyzed, and scored them. This report shows how each provider measures up and helps conversation intelligence for B2B revenue professionals select the right one for their needs.在我们对B2B收入提供商的会话智能的25项标准评估中,我们确定了最重要的标准,并对其进行了研究、分析和评分。这份报告展示了每个提供商如何衡量并帮助B2B收入专业人士选择适合他们需求的会话智能。

TopicsTopics 主题

Conversation Intelligence Enables Revenue Teams To Harness The Power Of AIConversation Intelligence Enables Revenue Teams To Harness The Power Of AI对话智能使收入团队能够利用人工智能的力量

Right now, there is a frenzy of interest and activity around generative AI (genAI) and foundational large language models (LLMs). According to Forrester’s new forecast, genAI will have an average annual growth rate of 36% up to 2030, capturing 55% of the AI software market. Conversation intelligence (CI) tools will be the most important AI investment for sales organizations. The AI capabilities of these platforms will convert unstructured data from spoken, written, and video conversations between buyers and sellers and turn them into deal and coaching insights that improve seller performance. Sales technology vendors are building or acquiring CI platforms to better enable AI insights within their solutions. This evaluation revealed that while the race to acquire CI companies or build CI capabilities is almost over, the competition to fully leverage the power of CI is just beginning. Copycat products abound, but few vendors have delivered innovative use cases such as trainable triggers or scorecard automation and even fewer have capabilities that span across multiple use cases such as sales readiness and deal insights. Right now, there is a frenzy of interest and activity around generative AI (genAI) and foundational large language models (LLMs). According to Forrester’s new forecast, genAI will have an average annual growth rate of 36% up to 2030, capturing 55% of the AI software market. Conversation intelligence (CI) tools will be the most important AI investment for sales organizations. The AI capabilities of these platforms will convert unstructured data from spoken, written, and video conversations between buyers and sellers and turn them into deal and coaching insights that improve seller performance. Sales technology vendors are building or acquiring CI platforms to better enable AI insights within their solutions. This evaluation revealed that while the race to acquire CI companies or build CI capabilities is almost over, the competition to fully leverage the power of CI is just beginning. Copycat products abound, but few vendors have delivered innovative use cases such as trainable triggers or scorecard automation and even fewer have capabilities that span across multiple use cases such as sales readiness and deal insights. 目前,围绕生成式AI(genAI)和基础大语言模型(LLM)的兴趣和活动狂热。根据Forrester的新预测,到2030年genAI的年均增长率将达到36%,占据AI软件市场的55%。对话智能(CI)工具将是销售组织最重要的AI投资。这些平台的AI功能将转换买卖双方之间的口头、书面和视频对话中的非结构化数据,并将其转化为交易和指导洞察力,从而提高卖方绩效。销售技术供应商正在构建或收购CI平台,以便在其解决方案中更好地实现AI洞察力。这项评估显示,虽然收购CI公司或构建CI能力的竞赛几乎已经结束,但充分利用CI力量的竞争才刚刚开始。山寨产品比比皆是,但很少有供应商提供创新的用例,如可训练的触发器或记分卡自动化,更少的供应商拥有跨越多个用例的功能,如销售准备和交易洞察。

As a result of these trends, conversation intelligence for B2B revenue customers should look for providers that: As a result of these trends, conversation intelligence for B2B revenue customers should look for providers that: 由于这些趋势,B2B收入客户的对话智能应该寻找以下提供商:

- Have a track record of delivering innovative use cases. With innovation, most CI solutions focus on either deal insights or sales readiness. This designation is important because deal insights are about execution whereas readiness is focused on seller enablement. Vendors will focus their innovation efforts accordingly. Look for vendors that have a track record of innovation for the use cases that are most important to your company. Have a track record of delivering innovative use cases. With innovation, most CI solutions focus on either deal insights or sales readiness. This designation is important because deal insights are about execution whereas readiness is focused on seller enablement. Vendors will focus their innovation efforts accordingly. Look for vendors that have a track record of innovation for the use cases that are most important to your company. 有交付创新用例的记录。在创新方面,大多数CI解决方案都专注于交易洞察力或销售准备情况。这一指定很重要,因为交易洞察力是关于执行的,而准备情况侧重于卖方支持。供应商将相应地集中他们的创新努力。寻找对您的公司最重要的用例有创新记录的供应商。

- Have advanced coaching capabilities. The only CI capability every reference customer has adopted is coaching. However, although it was the most used, it was also rated the least valuable. This is because most companies only use CI to record and listen to calls, which creates more work for managers and sellers. The top solutions are providing advanced scorecards and triggers that reduce the effort needed to evaluate and improve performance based on conversations while increasing coaching results. Have advanced coaching capabilities. The only CI capability every reference customer has adopted is coaching. However, although it was the most used, it was also rated the least valuable. This is because most companies only use CI to record and listen to calls, which creates more work for managers and sellers. The top solutions are providing advanced scorecards and triggers that reduce the effort needed to evaluate and improve performance based on conversations while increasing coaching results. 拥有高级教练能力。每个参考客户都采用的唯一CI能力是教练。然而,尽管它被使用最多,但它也被评为最没有价值的。这是因为大多数公司只使用CI来记录和收听电话,这为经理和卖家创造了更多的工作。顶级解决方案是提供高级记分卡和触发器,减少了评估和根据对话提高绩效所需的努力同时增加教练结果。

- Leverage triggers to drive results. The most valuable capability for reference customers was analyzing and reporting on conversations. Despite this, most reference customers are using less than 20 triggers to do their analysis with many not using any. This is low compared to what companies will need to identify key insights from conversations. Additionally, sellers need accurate triggers to drive results, as they will ignore those that are consistently inaccurate. Evaluate and test CI vendors’ ability to create accurate triggers to ensure you receive the insights needed to improve performance. Leverage triggers to drive results. The most valuable capability for reference customers was analyzing and reporting on conversations. Despite this, most reference customers are using less than 20 triggers to do their analysis with many not using any. This is low compared to what companies will need to identify key insights from conversations. Additionally, sellers need accurate triggers to drive results, as they will ignore those that are consistently inaccurate. Evaluate and test CI vendors’ ability to create accurate triggers to ensure you receive the insights needed to improve performance. 利用触发器来推动结果。对参考客户来说,最有价值的能力是分析和报告对话。尽管如此,大多数参考客户使用不到20个触发器来进行分析,其中许多人没有使用任何触发器。与公司从对话中识别关键见解所需的触发器相比,这是较低的。此外,卖家需要准确的触发器来推动结果,因为他们会忽略那些一直不准确的触发器。评估和测试CI供应商创建准确触发器的能力,以确保您获得提高绩效所需的见解。

Evaluation SummaryEvaluation Summary 评估总结

The Forrester Wave™ evaluation highlights Leaders, Strong Performers, Contenders, and Challengers. It’s an assessment of the top vendors in the market; it doesn’t represent the entire vendor landscape. You’ll find more information about this market in our report on The Conversation Intelligence For B2B Revenue Landscape, Q2 2023. The Forrester Wave™ evaluation highlights Leaders, Strong Performers, Contenders, and Challengers. It’s an assessment of the top vendors in the market; it doesn’t represent the entire vendor landscape. You’ll find more information about this market in our report on The Conversation Intelligence For B2B Revenue Landscape, Q2 2023. 弗雷斯特浪潮™评估突出了领导者、表现强劲者、竞争者和挑战者。这是对市场上顶级供应商的评估;它并不代表整个供应商格局。您可以在我们关于Q2 2023年B2B收入格局的对话智能的报告中找到更多关于这个市场的信息。

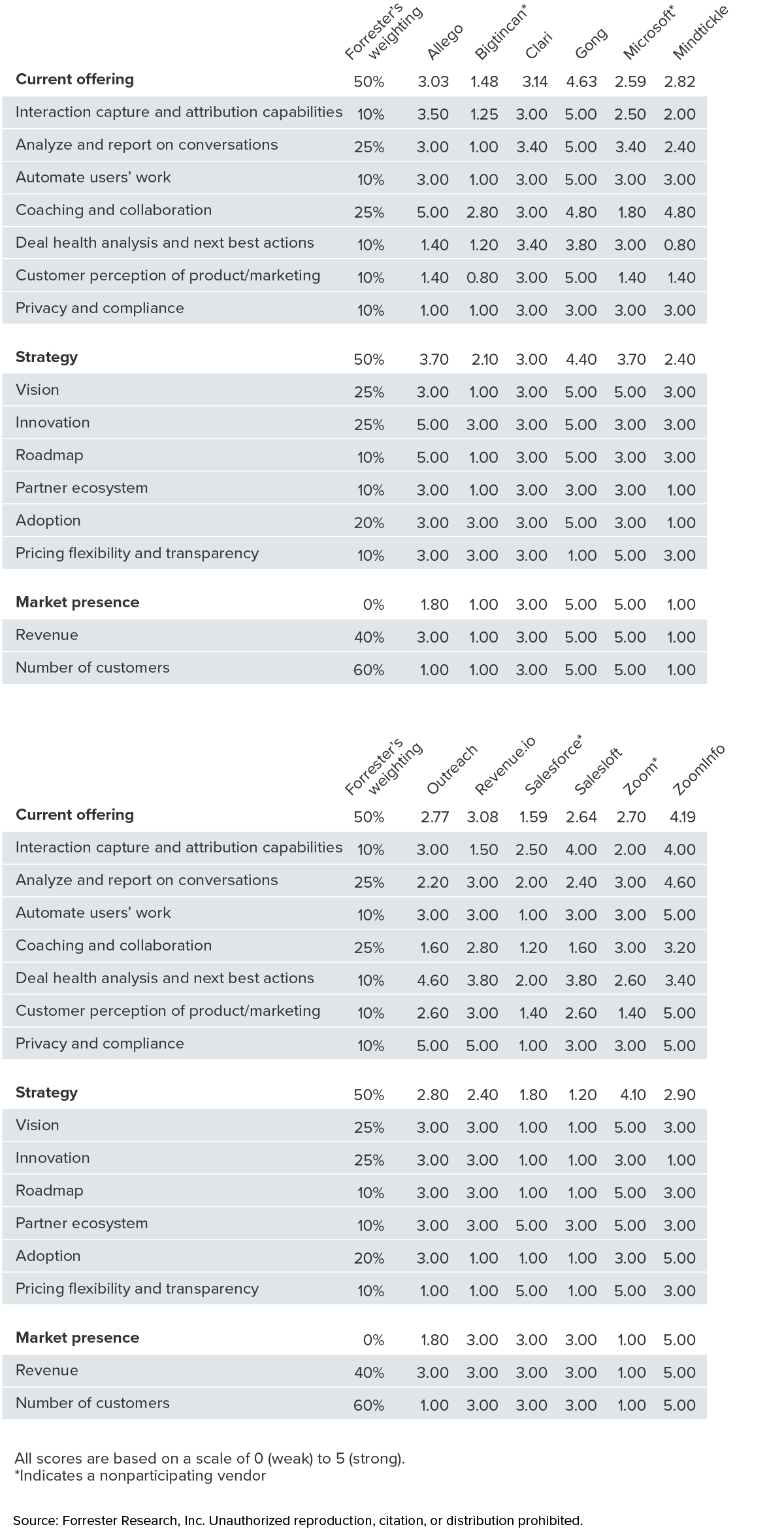

We intend this evaluation to be a starting point only and encourage clients to view product evaluations and adapt criteria weightings using the Excel-based vendor comparison tool (see Figures 1 and 2). Click the link at the beginning of this report on Forrester.com to download the tool. We intend this evaluation to be a starting point only and encourage clients to view product evaluations and adapt criteria weightings using the Excel-based vendor comparison tool (see Figures 1 and 2). Click the link at the beginning of this report on Forrester.com to download the tool. 我们打算将此评估仅作为一个起点,并鼓励客户使用基于Excel的供应商比较工具查看产品评估并调整标准权重(参见图1和图2)。

Figure 1Figure 1 图1

Forrester Wave™: Conversation Intelligence For B2B Revenue, Q4 2023 Forrester Wave™: Conversation Intelligence For B2B Revenue, Q4 2023 Forrester Wave™:B2B收入的对话智能,2023年第四季度

Figure 2Figure 2 图2

Forrester Wave™: Conversation Intelligence For B2B Revenue Scorecard, Q4 2023 Forrester Wave™: Conversation Intelligence For B2B Revenue Scorecard, Q4 2023 Forrester Wave™:B2B收入记分卡的对话智能,2023年第四季度

Vendor OfferingsVendor Offerings 供应商产品

Forrester evaluated the offerings listed below (see Figure 3). Forrester evaluated the offerings listed below (see Figure 3). Forrester评估了下面列出的产品(参见图3)。

Figure 3Figure 3 图3

Evaluated Vendors And Product Information Evaluated Vendors And Product Information 评估供应商和产品信息

Vendor ProfilesVendor Profiles 供应商简介

Our analysis uncovered the following strengths and weaknesses of individual vendors. Our analysis uncovered the following strengths and weaknesses of individual vendors. 我们的分析发现了个别供应商的以下优势和劣势。

LeadersLeaders 领导者

- Gong delivers a differentiated, innovative, and feature-rich solution. As one of the pioneers of B2B conversation intelligence, Gong has never wavered from its focus on turning conversations into insights. This has served Gong well as it has grown to over 4,000 customers and extended into categories such as sales engagement and deal management. Gong’s innovation in this category extends beyond others because of years of delivering on a focused roadmap, which has resulted in advanced features only discussed in the roadmap of other evaluated vendors. The only blemish on its strategy is pricing flexibility, as other vendors have a more flexible approach and don’t charge a separate platform fee. Gong delivers a differentiated, innovative, and feature-rich solution. As one of the pioneers of B2B conversation intelligence, Gong has never wavered from its focus on turning conversations into insights. This has served Gong well as it has grown to over 4,000 customers and extended into categories such as sales engagement and deal management. Gong’s innovation in this category extends beyond others because of years of delivering on a focused roadmap, which has resulted in advanced features only discussed in the roadmap of other evaluated vendors. The only blemish on its strategy is pricing flexibility, as other vendors have a more flexible approach and don’t charge a separate platform fee. 龚提供了一个差异化、创新和功能丰富的解决方案。作为B2B对话智能的先驱之一,龚从未动摇过将对话转化为洞察力的专注。这对龚很有帮助,因为它已经发展到4000多名客户,并扩展到销售参与和交易管理等类别。龚在这一类别中的创新超越了其他类别,因为多年来一直在交付重点路线图,这导致高级功能只在其他评估供应商的路线图中讨论。其战略的唯一缺陷是定价灵活性,因为其他供应商有更灵活的方法,并且不收取单独的平台费用。

Gong is the most feature-rich CI solution available in the market today. Its extensive investment in capturing and analyzing interactions has allowed it to productize insights. It has supervised and unsupervised AI models that analyze calls and surfaces trends that Gong validates and provides for its customers. Users can train triggers beyond keywords and phrases, leading to more accurate results. In addition, Gong allows users to tie scorecards to triggers, enabling the tracking of key moments (e.g., objection handling). With the release of Gong’s genAI product “Call Spotlight” in June, even more features are on the way. The only gap is in real-time triggers and a lack of out-of-the-box sentiment tracking. Reference customers value deal health analysis and called out how the automation capabilities reduced seller administrative time. Gong is best for companies looking for an advanced CI solution that will generate unique insights that improve company performance. Gong is the most feature-rich CI solution available in the market today. Its extensive investment in capturing and analyzing interactions has allowed it to productize insights. It has supervised and unsupervised AI models that analyze calls and surfaces trends that Gong validates and provides for its customers. Users can train triggers beyond keywords and phrases, leading to more accurate results. In addition, Gong allows users to tie scorecards to triggers, enabling the tracking of key moments (e.g., objection handling). With the release of Gong’s genAI product “Call Spotlight” in June, even more features are on the way. The only gap is in real-time triggers and a lack of out-of-the-box sentiment tracking. Reference customers value deal health analysis and called out how the automation capabilities reduced seller administrative time. Gong is best for companies looking for an advanced CI solution that will generate unique insights that improve company performance.

Strong PerformersStrong Performers

- Chorus by ZoomInfo has a strong CI base but lags in innovation. A data company at its core, ZoomInfo’s acquisition of Chorus in 2021 landed itself one of the best CI solutions available. Exposing this solution to ZoomInfo customers has led to significant adoption of Chorus, as companies opted to add it alongside other investments in ZoomInfo. Since the acquisition, the roadmap has been sparse except for data integrations. This has led to a lack of focus on innovation. Recent releases have shown an effort to reestablish a robust roadmap, but the vendor has fallen behind others evaluated and will need a big effort to catch up. Chorus by ZoomInfo has a strong CI base but lags in innovation. A data company at its core, ZoomInfo’s acquisition of Chorus in 2021 landed itself one of the best CI solutions available. Exposing this solution to ZoomInfo customers has led to significant adoption of Chorus, as companies opted to add it alongside other investments in ZoomInfo. Since the acquisition, the roadmap has been sparse except for data integrations. This has led to a lack of focus on innovation. Recent releases have shown an effort to reestablish a robust roadmap, but the vendor has fallen behind others evaluated and will need a big effort to catch up.

As one of the first providers in this category, Chorus had spent years enhancing its solution. For this reason, it has a strong foundation in key areas. Its transcription model is one of the most advanced and contains all the core features a company is looking for from a CI solution. It provides a set of advanced preconfigured triggers to improve insight accuracy and has advanced reporting with proactive keyword analysis. Chorus also has advanced automation capabilities that allow companies to configure triggers to autoupdate fields in a CRM platform. Its sentiment analysis goes beyond the transcript and incorporating tonality and the alignment with ZoomInfo enables companies to enrich account and contact data. A weakness in the solution is a lack of deal scoring and sales execution workflows. Although reference customers pointed out the quality of the transcription, they wanted to see improvements in interaction attribution and customer support. ZoomInfo is great for users looking for a high-quality solution that is integrated with ZoomInfo data and insights. As one of the first providers in this category, Chorus had spent years enhancing its solution. For this reason, it has a strong foundation in key areas. Its transcription model is one of the most advanced and contains all the core features a company is looking for from a CI solution. It provides a set of advanced preconfigured triggers to improve insight accuracy and has advanced reporting with proactive keyword analysis. Chorus also has advanced automation capabilities that allow companies to configure triggers to autoupdate fields in a CRM platform. Its sentiment analysis goes beyond the transcript and incorporating tonality and the alignment with ZoomInfo enables companies to enrich account and contact data. A weakness in the solution is a lack of deal scoring and sales execution workflows. Although reference customers pointed out the quality of the transcription, they wanted to see improvements in interaction attribution and customer support. ZoomInfo is great for users looking for a high-quality solution that is integrated with ZoomInfo data and insights. - Zoom is developing advanced capabilities but faces a steep climb to a complete solution. After thriving as the preferred web-conferencing solution, Zoom has established itself as a platform for all communication channels. Zoom Revenue Accelerator started as the entry point for its AI capabilities and has quickly developed into a strong CI solution for B2B revenue teams. It has the innovation pedigree and funding to become a top-tier solution in this category. Zoom’s CI solution has been delivering on an aggressive roadmap since it was launched in 2022. It has aligned its innovation to catch up to what currently exists in the market and is positioned to continue innovating once it’s on par with top vendors. This will need to include expanding its interaction-capture capabilities outside of its own communication products to meet the needs of a larger base of customers. Zoom is developing advanced capabilities but faces a steep climb to a complete solution. After thriving as the preferred web-conferencing solution, Zoom has established itself as a platform for all communication channels. Zoom Revenue Accelerator started as the entry point for its AI capabilities and has quickly developed into a strong CI solution for B2B revenue teams. It has the innovation pedigree and funding to become a top-tier solution in this category. Zoom’s CI solution has been delivering on an aggressive roadmap since it was launched in 2022. It has aligned its innovation to catch up to what currently exists in the market and is positioned to continue innovating once it’s on par with top vendors. This will need to include expanding its interaction-capture capabilities outside of its own communication products to meet the needs of a larger base of customers.

Zoom Revenue Accelerator offers a host of features, including the ability to set up risk signals using keywords and CRM fields that flag opportunities that are in jeopardy. It also has basic scorecard capabilities that can be assigned to each call and triggers built on keywords and sentiment. Triggers are also filterable based on Boolean logic (a series of true, false criteria), enabling more targeted reports. Because Zoom is new to this category, it does not have standard features such as a mobile app or a robust set of integrations. It is perfect for those who want CI and are already using Zoom for the interactions they want to track. Zoom declined to participate in the full Forrester Wave evaluation process. Zoom Revenue Accelerator offers a host of features, including the ability to set up risk signals using keywords and CRM fields that flag opportunities that are in jeopardy. It also has basic scorecard capabilities that can be assigned to each call and triggers built on keywords and sentiment. Triggers are also filterable based on Boolean logic (a series of true, false criteria), enabling more targeted reports. Because Zoom is new to this category, it does not have standard features such as a mobile app or a robust set of integrations. It is perfect for those who want CI and are already using Zoom for the interactions they want to track. Zoom declined to participate in the full Forrester Wave evaluation process. - Allego excels in innovative enablement but has not focused on deal execution. With a platform built to drive modern revenue enablement organizations, Allego provides a full suite of learning and coaching solutions for its customers. The company’s true north is building innovative features to support its customer’s enablement needs. Combine this with its proven track record of delivering on aggressive roadmaps and you have a differentiated solution. However, innovation requires adoption to add value, and Allego has not been as successful at ensuring CI customers are using its innovative features. Allego excels in innovative enablement but has not focused on deal execution. With a platform built to drive modern revenue enablement organizations, Allego provides a full suite of learning and coaching solutions for its customers. The company’s true north is building innovative features to support its customer’s enablement needs. Combine this with its proven track record of delivering on aggressive roadmaps and you have a differentiated solution. However, innovation requires adoption to add value, and Allego has not been as successful at ensuring CI customers are using its innovative features.

Allego’s solution is packed with valuable coaching and collaboration features. Showreels allow customers to evaluate key insights on a topic by identifying and grouping snippets from multiple calls. Its dialogue simulator makes it easy to build and implement training scenarios that sellers can use to simulate calls with an AI-generated virtual actor. In 2023, Allego leveraged genAI to add paraphrasing and listening in real time, making it the most advanced simulator to date. Allego’s focus on enablement is clear but has left a gap in deal execution features such as opportunity aggregation, deal management, workflow, and real-time capabilities. The solution lacks the interaction aggregation, seller automation, and deal management capabilities of vendors in this evaluation. Reference customers rave about the value provided by customer service but also confirmed the lack of deal execution features. Allego is best for companies looking for an innovative revenue enablement solution for their sales organization. Allego’s solution is packed with valuable coaching and collaboration features. Showreels allow customers to evaluate key insights on a topic by identifying and grouping snippets from multiple calls. Its dialogue simulator makes it easy to build and implement training scenarios that sellers can use to simulate calls with an AI-generated virtual actor. In 2023, Allego leveraged genAI to add paraphrasing and listening in real time, making it the most advanced simulator to date. Allego’s focus on enablement is clear but has left a gap in deal execution features such as opportunity aggregation, deal management, workflow, and real-time capabilities. The solution lacks the interaction aggregation, seller automation, and deal management capabilities of vendors in this evaluation. Reference customers rave about the value provided by customer service but also confirmed the lack of deal execution features. Allego is best for companies looking for an innovative revenue enablement solution for their sales organization. - Microsoft offers an integrated experience, but its genAI attention is elsewhere. With a full-service CRM and unlimited development resources, Microsoft has the size and scale to create market-leading products across a host of categories. This translates into a vision for CI that can identify the value of new technology before others. It started building genAI into its solutions a year before the wider market focused on it. This strength is also a weakness as there are more lucrative categories taking its attention, which means the roadmap for CI will not take advantage of its vast resources, allowing smaller, more focused vendors to move ahead. Microsoft offers an integrated experience, but its genAI attention is elsewhere. With a full-service CRM and unlimited development resources, Microsoft has the size and scale to create market-leading products across a host of categories. This translates into a vision for CI that can identify the value of new technology before others. It started building genAI into its solutions a year before the wider market focused on it. This strength is also a weakness as there are more lucrative categories taking its attention, which means the roadmap for CI will not take advantage of its vast resources, allowing smaller, more focused vendors to move ahead.

Microsoft does a host of things to allow users to make the most of its CI solution. It improves call prep by allowing companies to benchmark sellers against top performers. Microsoft’s ability to break up calls into segments to allow for evaluation of key phases, such as the opening and closing of a call, helps improve the analysis of calls. Its approach to sentiment analysis provides sentiment progression throughout the call and a score at the end. This provides multiple sentiment analysis options. There are gaps in the solution, such as a lack of scorecard capabilities and a mobile application that are common for others in this category. Microsoft declined to participate in the full Forrester Wave evaluation process. Microsoft does a host of things to allow users to make the most of its CI solution. It improves call prep by allowing companies to benchmark sellers against top performers. Microsoft’s ability to break up calls into segments to allow for evaluation of key phases, such as the opening and closing of a call, helps improve the analysis of calls. Its approach to sentiment analysis provides sentiment progression throughout the call and a score at the end. This provides multiple sentiment analysis options. There are gaps in the solution, such as a lack of scorecard capabilities and a mobile application that are common for others in this category. Microsoft declined to participate in the full Forrester Wave evaluation process. - Clari Copilot focuses on optimizing deal execution but faces a disparate feature set. With a goal of eliminating revenue leakage, Clari is working to deliver a platform that allows companies to manage all facets of their growth engine. The acquisition of Wingman (Clari Copilot) was its first push into revenue execution. This has continued with its recent acquisition of sales engagement solution Groove. Clari’s vision is to deliver a unified platform that can support all facets of revenue, including forecasting cadences and conversation intelligence. Its roadmap is ambitious considering the demands of its overall platform strategy. Clari Copilot focuses on optimizing deal execution but faces a disparate feature set. With a goal of eliminating revenue leakage, Clari is working to deliver a platform that allows companies to manage all facets of their growth engine. The acquisition of Wingman (Clari Copilot) was its first push into revenue execution. This has continued with its recent acquisition of sales engagement solution Groove. Clari’s vision is to deliver a unified platform that can support all facets of revenue, including forecasting cadences and conversation intelligence. Its roadmap is ambitious considering the demands of its overall platform strategy.

Clari has embraced genAI and added valuable features into its solution. The release of “RevAI” started with smart summaries and actions from conversations and has advanced to generating emails and postcall follow-ups. Clari also used this technology to improve its real-time CI capabilities by enabling the creation of smart real-time trackers from long-form content. Its CI solution requires additional Clari products to take advantage of capabilities such as opportunity attribution and deal health analysis. At this point, Clari Copilot’s user experience is not fully integrated. This is apparent in situations such as needing a separate Clari and Copilot mobile application to use all features. Reference customers emphasized the value for money provided with their CI solution and are also looking forward to a more unified platform. Clari is best for companies wanting an enterprise deal management solution that includes real-time conversation intelligence. Clari has embraced genAI and added valuable features into its solution. The release of “RevAI” started with smart summaries and actions from conversations and has advanced to generating emails and postcall follow-ups. Clari also used this technology to improve its real-time CI capabilities by enabling the creation of smart real-time trackers from long-form content. Its CI solution requires additional Clari products to take advantage of capabilities such as opportunity attribution and deal health analysis. At this point, Clari Copilot’s user experience is not fully integrated. This is apparent in situations such as needing a separate Clari and Copilot mobile application to use all features. Reference customers emphasized the value for money provided with their CI solution and are also looking forward to a more unified platform. Clari is best for companies wanting an enterprise deal management solution that includes real-time conversation intelligence. - Outreach aligns real-time insights with seller execution but overlooks key elements. With a strong background in sales engagement, Outreach has always focused on building a platform that improves sales productivity. After starting as an engagement provider, Outreach has added CI and forecasting to support full-cycle sellers. It focused its vision and roadmap on creating a complete revenue execution platform. This focus has a downside that has materialized in its pricing. Customers only looking for a CI solution will incur charges such as paying for listen-only licenses and managing pricing tiers that reserve key features for full solution professional and enterprise packages. Outreach aligns real-time insights with seller execution but overlooks key elements. With a strong background in sales engagement, Outreach has always focused on building a platform that improves sales productivity. After starting as an engagement provider, Outreach has added CI and forecasting to support full-cycle sellers. It focused its vision and roadmap on creating a complete revenue execution platform. This focus has a downside that has materialized in its pricing. Customers only looking for a CI solution will incur charges such as paying for listen-only licenses and managing pricing tiers that reserve key features for full solution professional and enterprise packages.

This solution is not lacking in features. It has strong opportunity attribution capabilities allowing users to see all the interactions in their deals. The out-of-the-box reporting capabilities are strong with explainable deal scoring and includes an integration with Snowflake to export data for additional analysis, including the wider company dataset. As a sales engagement provider, it is easy for users to enhance deal execution by leveraging conversations within cadences. The weaknesses of the solution are more foundational. Trigger analysis lacks the ability to filter on CRM fields and the solution is missing scorecards and a mobile app. GenAI capabilities are not publicly available, but expected to be out by the time this report is released. Reference customers confirmed the value of the sales execution capabilities but lamented the lack of key features, such as scorecards and a mobile app. Outreach is a fit for companies looking for real-time support for their sales teams paired with a strong sales engagement solution. This solution is not lacking in features. It has strong opportunity attribution capabilities allowing users to see all the interactions in their deals. The out-of-the-box reporting capabilities are strong with explainable deal scoring and includes an integration with Snowflake to export data for additional analysis, including the wider company dataset. As a sales engagement provider, it is easy for users to enhance deal execution by leveraging conversations within cadences. The weaknesses of the solution are more foundational. Trigger analysis lacks the ability to filter on CRM fields and the solution is missing scorecards and a mobile app. GenAI capabilities are not publicly available, but expected to be out by the time this report is released. Reference customers confirmed the value of the sales execution capabilities but lamented the lack of key features, such as scorecards and a mobile app. Outreach is a fit for companies looking for real-time support for their sales teams paired with a strong sales engagement solution. - Revenue.io delivers a range of valuable features but the burden is on users to navigate. Founded with the purpose of aligning marketing spend with sales execution, Revenue.io has developed into a solution with strong CI and sales engagement capabilities. Real-time conversation capabilities are at the center of its vision and shape its product roadmap. This strategy is optimal for companies with transactional sales, which is one of several use cases for B2B conversation intelligence vendors. A gap in long-cycle sales capabilities leads to a lack of overall adoption from some customers. Revenue.io delivers a range of valuable features but the burden is on users to navigate. Founded with the purpose of aligning marketing spend with sales execution, Revenue.io has developed into a solution with strong CI and sales engagement capabilities. Real-time conversation capabilities are at the center of its vision and shape its product roadmap. This strategy is optimal for companies with transactional sales, which is one of several use cases for B2B conversation intelligence vendors. A gap in long-cycle sales capabilities leads to a lack of overall adoption from some customers.

This product has standout real-time capabilities such as hyperpersonalized triggers that can be built using keywords and structured data (e.g., deal stage). The system can detect what has not been said and remind the seller to cover these missed topics. Privacy and compliance also stand out with advanced features such as the ability to capture and log insights without recording the call, redaction capabilities, and recording one side of the call on phone conversations where consent isn’t given. Despite this, the solution lacks an overall cohesive experience and leveraging all features requires access to multiple applications. This requires additional clicks, a key weakness compared to other solutions in this evaluation. The solution also lacks a mobile app and has fewer integrations than vendors evaluated. Reference customers loved the real-time capabilities but were not aware of some key features. Revenue.io is best for companies looking for a real-time solution to support high-transaction sales and customer success teams. This product has standout real-time capabilities such as hyperpersonalized triggers that can be built using keywords and structured data (e.g., deal stage). The system can detect what has not been said and remind the seller to cover these missed topics. Privacy and compliance also stand out with advanced features such as the ability to capture and log insights without recording the call, redaction capabilities, and recording one side of the call on phone conversations where consent isn’t given. Despite this, the solution lacks an overall cohesive experience and leveraging all features requires access to multiple applications. This requires additional clicks, a key weakness compared to other solutions in this evaluation. The solution also lacks a mobile app and has fewer integrations than vendors evaluated. Reference customers loved the real-time capabilities but were not aware of some key features. Revenue.io is best for companies looking for a real-time solution to support high-transaction sales and customer success teams.

ContendersContenders

- Mindtickle aligns conversations with readiness but relies on integrations for execution. With a powerful set of readiness and enablement capabilities, Mindtickle is focused on improving seller performance. It has also built a strong integration with BoostUp to support sales execution capabilities. Mindtickle’s product vision calls out key issues faced by sales organizations and provides a solid roadmap to achieve those objectives. Advanced genAI capabilities are on the near-term roadmap and will allow users to ask for coaching guidance and/or write follow-up emails. Dependence on a partner for some CI features puts Mindtickle at a disadvantage compared to peers who have complete control of their product ecosystem. Mindtickle aligns conversations with readiness but relies on integrations for execution. With a powerful set of readiness and enablement capabilities, Mindtickle is focused on improving seller performance. It has also built a strong integration with BoostUp to support sales execution capabilities. Mindtickle’s product vision calls out key issues faced by sales organizations and provides a solid roadmap to achieve those objectives. Advanced genAI capabilities are on the near-term roadmap and will allow users to ask for coaching guidance and/or write follow-up emails. Dependence on a partner for some CI features puts Mindtickle at a disadvantage compared to peers who have complete control of their product ecosystem.

Coaching and collaboration are strengths for Mindtickle. It has advanced scorecard capabilities that allow for a range of question types along with the ability to weight the value of different questions. In addition, scorecards can be aligned with the company’s readiness index, enabling companies to use scorecards as part of its seller evaluation process. It also has strong call prep features, including automated scoring based on company themes that determine what went well and what must be improved. Mindtickle’s solution does not have sentiment capabilities and lacks the transcription accuracy and interaction attribution capabilities of peers. Reference customers wanted better transcription accuracy and were not aware of key features of the solution, such as triggers, deal health analysis, and the mobile app. Mindtickle is a fit for customers focused on using CI to enhance their sales readiness capabilities. Coaching and collaboration are strengths for Mindtickle. It has advanced scorecard capabilities that allow for a range of question types along with the ability to weight the value of different questions. In addition, scorecards can be aligned with the company’s readiness index, enabling companies to use scorecards as part of its seller evaluation process. It also has strong call prep features, including automated scoring based on company themes that determine what went well and what must be improved. Mindtickle’s solution does not have sentiment capabilities and lacks the transcription accuracy and interaction attribution capabilities of peers. Reference customers wanted better transcription accuracy and were not aware of key features of the solution, such as triggers, deal health analysis, and the mobile app. Mindtickle is a fit for customers focused on using CI to enhance their sales readiness capabilities. - Salesloft prioritizes unifying CI over delivering advanced features. As one of the pioneers in the sales engagement category, Salesloft has expanded its focus to providing a unified platform that can support the entire revenue motion. Salesloft benefits from a strong partner ecosystem that was built to support their sales engagement efforts and is now driving their focus on Rhythm, its unified place of work for sellers released earlier this year. Its focus on unification has meant that the CI aspects of its platform have been focused on integrating core CI capabilities across a seller’s workflow over advanced features. This has resulted in a roadmap and vision that is less ambitious than others in this evaluation. Salesloft prioritizes unifying CI over delivering advanced features. As one of the pioneers in the sales engagement category, Salesloft has expanded its focus to providing a unified platform that can support the entire revenue motion. Salesloft benefits from a strong partner ecosystem that was built to support their sales engagement efforts and is now driving their focus on Rhythm, its unified place of work for sellers released earlier this year. Its focus on unification has meant that the CI aspects of its platform have been focused on integrating core CI capabilities across a seller’s workflow over advanced features. This has resulted in a roadmap and vision that is less ambitious than others in this evaluation.

The strengths of Salesloft’s solution lies in the power of its “Conductor AI” model, which identifies and prioritizes the work a seller must execute to achieve their objectives. Opportunity attribution and deal management workflows drive this new solution and are standout features. The solution has basic keyword triggers with limited reporting and does not offer a scorecard to evaluate call performance. Reference customers believe in Salesloft as a company and are using the capabilities provided but are eager for more advanced features. Salesloft is a fit for customers looking for an integrated sales engagement platform to support seller execution. The strengths of Salesloft’s solution lies in the power of its “Conductor AI” model, which identifies and prioritizes the work a seller must execute to achieve their objectives. Opportunity attribution and deal management workflows drive this new solution and are standout features. The solution has basic keyword triggers with limited reporting and does not offer a scorecard to evaluate call performance. Reference customers believe in Salesloft as a company and are using the capabilities provided but are eager for more advanced features. Salesloft is a fit for customers looking for an integrated sales engagement platform to support seller execution. - Bigtincan is all in on improving seller emotional impact but has core functionality gaps. Built from a host of acquisitions such as Brainshark and VoiceVibes, Australia-based Bigtincan has a broad set of sales enablement capabilities. Bigtincan has a narrow strategy focused on voice coaching for conversation intelligence. This has resulted in an innovative feature companies can use to train sellers. However, because of this focus, the solution has a narrow vision and roadmap with very few features compared to peers. Bigtincan is all in on improving seller emotional impact but has core functionality gaps. Built from a host of acquisitions such as Brainshark and VoiceVibes, Australia-based Bigtincan has a broad set of sales enablement capabilities. Bigtincan has a narrow strategy focused on voice coaching for conversation intelligence. This has resulted in an innovative feature companies can use to train sellers. However, because of this focus, the solution has a narrow vision and roadmap with very few features compared to peers.

Bigtincan call prep and sentiment analysis stand out among evaluated vendors. The solution acts as a voice coach that can detect and improve emotional impact and help sellers set the right tone in their conversations with customers. Outside of this feature, the solution is lacking in most other areas, including interaction capture, call analysis, automation, and deal health analysis. A more expansive focus will be required to move Bigtincan from a niche product to a CI solution. Bigtincan declined to participate in the full Forrester Wave evaluation process. Bigtincan call prep and sentiment analysis stand out among evaluated vendors. The solution acts as a voice coach that can detect and improve emotional impact and help sellers set the right tone in their conversations with customers. Outside of this feature, the solution is lacking in most other areas, including interaction capture, call analysis, automation, and deal health analysis. A more expansive focus will be required to move Bigtincan from a niche product to a CI solution. Bigtincan declined to participate in the full Forrester Wave evaluation process.

ChallengersChallengers

- Salesforce provides CRM users with a native solution but has not prioritized innovation. With a CRM customer base of over 150,000 companies, Salesforce has the reputation and scale to perform at the highest level in any revenue category. However, it typically prefers to serve as the system of record and allow other companies to innovate before entering with a product once the market has been established. This is the strategy Salesforce is using for conversation intelligence. With a strong install base, its focus is on leveraging bundling with their CRM to drive growth. Salesforce has adjusted its pricing to include conversation intelligence as a part of its premium offering, providing all its premium customers with this solution at no additional charge. Although this approach provides access to many users, the tradeoff is that the vision and roadmap do not have the innovation of others in this evaluation. Salesforce provides CRM users with a native solution but has not prioritized innovation. With a CRM customer base of over 150,000 companies, Salesforce has the reputation and scale to perform at the highest level in any revenue category. However, it typically prefers to serve as the system of record and allow other companies to innovate before entering with a product once the market has been established. This is the strategy Salesforce is using for conversation intelligence. With a strong install base, its focus is on leveraging bundling with their CRM to drive growth. Salesforce has adjusted its pricing to include conversation intelligence as a part of its premium offering, providing all its premium customers with this solution at no additional charge. Although this approach provides access to many users, the tradeoff is that the vision and roadmap do not have the innovation of others in this evaluation.

Salesforce’s most valuable feature is linked to its native integration with its CRM. It takes advantage of a wide range of established Salesforce integrations and because the solution is part of the CRM, sellers can work inside the systems views for deal management and conversation sharing. The weaknesses of this solution reflect its lack of focus in this area. Coaching capabilities are lacking with no ability to create scorecards outside of adding fields to the call object. The system also lacks the reporting and analysis capabilities of others in this evaluation. Salesforce is a fit for companies that have a premium CRM license and are interested in getting started using CI. Salesforce declined to participate in the full Forrester Wave evaluation process. Salesforce’s most valuable feature is linked to its native integration with its CRM. It takes advantage of a wide range of established Salesforce integrations and because the solution is part of the CRM, sellers can work inside the systems views for deal management and conversation sharing. The weaknesses of this solution reflect its lack of focus in this area. Coaching capabilities are lacking with no ability to create scorecards outside of adding fields to the call object. The system also lacks the reporting and analysis capabilities of others in this evaluation. Salesforce is a fit for companies that have a premium CRM license and are interested in getting started using CI. Salesforce declined to participate in the full Forrester Wave evaluation process.

Evaluation OverviewEvaluation Overview

We grouped our evaluation criteria into three high-level categories: We grouped our evaluation criteria into three high-level categories:

- Current offering. Each vendor’s position on the vertical axis of the Forrester Wave graphic indicates the strength of its current offering. Key criteria for these solutions include interaction capture and attribution capabilities, analyze and report on conversations, automate users’ work, and coaching and collaboration. Current offering. Each vendor’s position on the vertical axis of the Forrester Wave graphic indicates the strength of its current offering. Key criteria for these solutions include interaction capture and attribution capabilities, analyze and report on conversations, automate users’ work, and coaching and collaboration.

- Strategy. Placement on the horizontal axis indicates the strength of the vendors’ strategies. We evaluated vision, innovation, roadmap, partner ecosystem, adoption, and pricing flexibility and transparency. Strategy. Placement on the horizontal axis indicates the strength of the vendors’ strategies. We evaluated vision, innovation, roadmap, partner ecosystem, adoption, and pricing flexibility and transparency.

- Market presence. Represented by the size of the markers on the graphic, our market presence scores reflect each vendor’s revenue and number of customers. Market presence. Represented by the size of the markers on the graphic, our market presence scores reflect each vendor’s revenue and number of customers.

Vendor Inclusion CriteriaVendor Inclusion Criteria

Each of the vendors we included in this assessment has: Each of the vendors we included in this assessment has:

- Client saturation. At least one-third of the company’s revenue intelligence or sales readiness seat holders have conversation intelligence included as a part of their license. Client saturation. At least one-third of the company’s revenue intelligence or sales readiness seat holders have conversation intelligence included as a part of their license.

- Company revenue. Each vendor has more than $20 million in annual revenue. Company revenue. Each vendor has more than $20 million in annual revenue.

- Significant interest from Forrester customers. We considered the level of interest and feedback from our clients based on our various interactions including inquiry, advisory, and consulting engagements. Significant interest from Forrester customers. We considered the level of interest and feedback from our clients based on our various interactions including inquiry, advisory, and consulting engagements.

Supplemental MaterialSupplemental Material

Online ResourceOnline Resource

We publish all our Forrester Wave scores and weightings in an Excel file that provides detailed product evaluations and customizable rankings; download this tool by clicking the link at the beginning of this report on Forrester.com. We intend these scores and default weightings to serve only as a starting point and encourage readers to adapt the weightings to fit their individual needs. We publish all our Forrester Wave scores and weightings in an Excel file that provides detailed product evaluations and customizable rankings; download this tool by clicking the link at the beginning of this report on Forrester.com. We intend these scores and default weightings to serve only as a starting point and encourage readers to adapt the weightings to fit their individual needs.

The Forrester Wave MethodologyThe Forrester Wave Methodology

A Forrester Wave is a guide for buyers considering their purchasing options in a technology marketplace. To offer an equitable process for all participants, Forrester follows The Forrester Wave™ Methodology to evaluate participating vendors. A Forrester Wave is a guide for buyers considering their purchasing options in a technology marketplace. To offer an equitable process for all participants, Forrester follows The Forrester Wave™ Methodology to evaluate participating vendors.

In our review, we conduct primary research to develop a list of vendors to consider for the evaluation. From that initial pool of vendors, we narrow our final list based on the inclusion criteria. We then gather details of product and strategy through a detailed questionnaire, demos/briefings, and customer reference surveys/interviews. We use those inputs, along with the analyst’s experience and expertise in the marketplace, to score vendors, using a relative rating system that compares each vendor against the others in the evaluation. In our review, we conduct primary research to develop a list of vendors to consider for the evaluation. From that initial pool of vendors, we narrow our final list based on the inclusion criteria. We then gather details of product and strategy through a detailed questionnaire, demos/briefings, and customer reference surveys/interviews. We use those inputs, along with the analyst’s experience and expertise in the marketplace, to score vendors, using a relative rating system that compares each vendor against the others in the evaluation.

We include the Forrester Wave publishing date (quarter and year) clearly in the title of each Forrester Wave report. We evaluated the vendors participating in this Forrester Wave using materials they provided to us by July 24, 2023 and did not allow additional information after that point. We encourage readers to evaluate how the market and vendor offerings change over time. We include the Forrester Wave publishing date (quarter and year) clearly in the title of each Forrester Wave report. We evaluated the vendors participating in this Forrester Wave using materials they provided to us by July 24, 2023 and did not allow additional information after that point. We encourage readers to evaluate how the market and vendor offerings change over time.

In accordance with our vendor review policy, Forrester asks vendors to review our findings prior to publishing to check for accuracy. Vendors marked as nonparticipating vendors in the Forrester Wave graphic met our defined inclusion criteria but declined to participate in or contributed only partially to the evaluation. We score these vendors in accordance with our vendor participation policy and publish their positioning along with those of the participating vendors. In accordance with our vendor review policy, Forrester asks vendors to review our findings prior to publishing to check for accuracy. Vendors marked as nonparticipating vendors in the Forrester Wave graphic met our defined inclusion criteria but declined to participate in or contributed only partially to the evaluation. We score these vendors in accordance with our vendor participation policy and publish their positioning along with those of the participating vendors.

Integrity PolicyIntegrity Policy

We conduct all our research, including Forrester Wave evaluations, in accordance with the integrity policy posted on our website. We conduct all our research, including Forrester Wave evaluations, in accordance with the integrity policy posted on our website.

About Forrester Reprints About Forrester Reprints 关于Forrester重印

![Seth Marrs author['fullName']](https://www.forrester.com/staticassets/forresterDotCom/NEOanalyst/Seth-Marrs.png)