The United States Federal Reserve cut interest rates on Sep. 19 (U.S. time) for the first time in four years, dialling back its aggressive bid to reduce inflation by cooling the world’s largest economy.

美国联邦储备委员会 (Federal Reserve) 于 9 月 19 日(美国时间)四年来首次降息,收敛了其通过为世界最大经济体降温来降低通胀的激进努力。

The Fed announced a cut of 50 basis points and lowered its key rate to roughly 4.8 per cent, Associated Press (AP) reported.

据美联社 (AP) 报道,美联储宣布降息 50 个基点,并将关键利率下调至 4.8% 左右。

This is down from a two-decade high of 5.3 per cent, where it had stood for 14 months, as it struggled to curb the worst inflation streak in four decades.

这低于 5.3% 的二十年高点,该水平已经持续了 14 个月,因为它正在努力遏制四十年来最严重的通胀。

Inflation has tumbled from a peak of 9.1 per cent in mid-2022 to a three-year low of 2.5 per cent in August, not far above the Fed’s 2 per cent target.

通胀率已从 2022 年年中 9.1% 的峰值跌至 8 月份 2.5% 的三年低点,远高于美联储 2% 的目标。

The central bank had made 5.25 percentage points of increases between March 2022 and July 2023.

央行在 2022 年 3 月至 2023 年 7 月期间加息了 5.25 个百分点。

This latest cut is the first and biggest cut since March 2020 when Covid-19 was hammering the economy.

最新的降息是自 2020 年 3 月 Covid-19 重创经济以来的第一次也是最大的一次降息。

More cuts to come 更多剪辑即将推出

Policymakers at the Fed also expect to cut rates by an additional 50 basis points before 2024 is up, according to projections.

根据预测,美联储的政策制定者还预计在 2024 年结束之前再降息 50 个基点。

The projected decline will see the interest rate reach the 2.75 per cent to 3 per per cent range in 2026.

预计的下降将使利率在 2026 年达到 2.75% 至 3% 的区间。

The Fed now sees its benchmark rate falling by another half of a percentage point by the end of 2024, another full percentage point in 2025, and by a final half of a percentage point in 2026.

美联储现在预计,到 2024 年底,其基准利率将再下降半个百分点,2025 年再下降整整一个百分点,2026 年将下降最后半个百分点。

US job market weakening 美国就业市场疲软

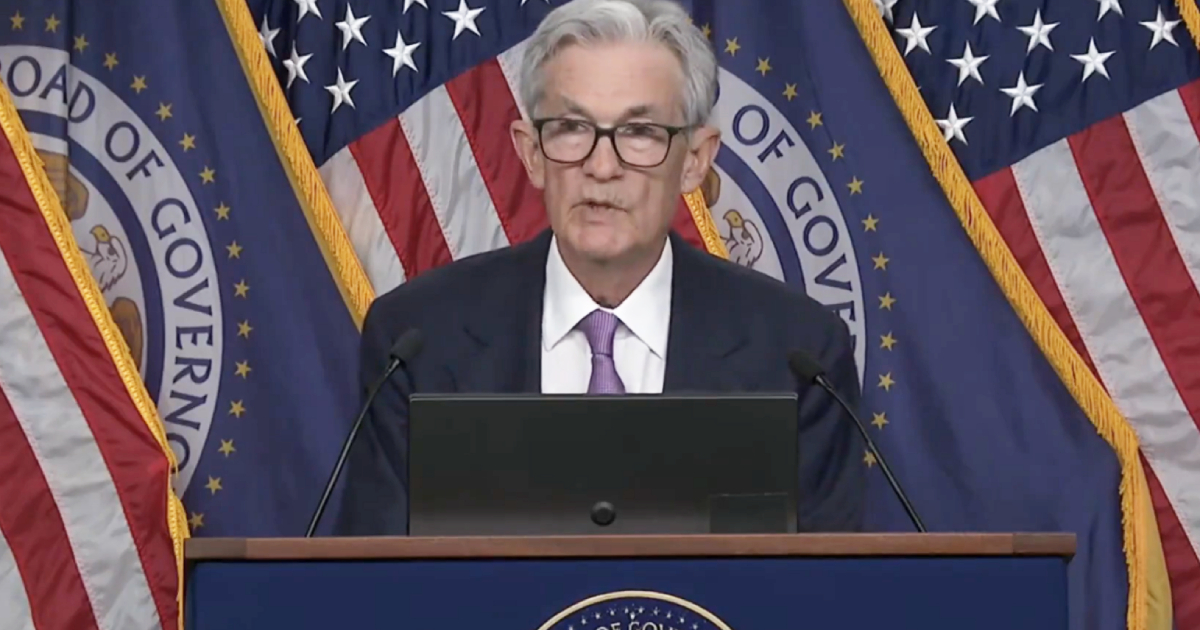

“This decision reflects our growing confidence that with an appropriate recallibration of our policy stance, strength in the labour market can be maintained in a context of moderate growth and inflation moving sustainably down to 2 per cent,” Fed chairman Jerome Powell said at a press conference following the meeting.

美联储主席杰罗姆·鲍威尔(Jerome Powell)在会后的新闻发布会上表示:“这一决定反映了我们日益增长的信心,即通过适当地回顾我们的政策立场,劳动力市场的实力可以在温和增长和通胀可持续降至2%的背景下保持。

The pivot comes in the wake of fading inflation for months now, and it is meant to prevent the economy from slowing and the job market to weaken.

这一转变是在通胀几个月来消退之后出现的,旨在防止经济放缓和就业市场疲软。

This latest big rate cut can be explained as the Fed taking out insurance against a bigger employment slowdown, given the recent uptick in the unemployment rate.

鉴于最近失业率的上升,最近的一次大幅降息可以解释为美联储为更大的就业放缓购买了保险。

The U.S. economy so far has averted a recession, referred to as a "hard landing".

到目前为止,美国经济已经避免了一场被称为“硬着陆”的衰退。

Hiring and wage growth, which remained robust during rate hikes, have slowed.

在加息期间保持强劲的招聘和工资增长已经放缓。

Lower interest rates are aimed at easing those trends by making it less expensive for businesses and households to borrow and spend more freely.

较低的利率旨在通过降低企业和家庭更自由地借贷和消费的成本来缓解这些趋势。

Low rates of the past aren't coming back

过去的低利率不会回来

Fed policymakers have said that they do not see the policy rate returning to the sub-2 per cent levels that prevailed for more than a decade before 2022, Reuters reported.

据路透社报道,美联储政策制定者表示,他们认为政策利率不会恢复到 2022 年之前十多年来一直存在的低于 2% 的水平。

That era's low mortgage rates, often under 4 per cent, are not coming back any time soon.

那个时代的低抵押贷款利率(通常低于 4%)不会很快恢复。

Fed has no preset course

美联储没有预设的路线

Even though inflation “remains somewhat elevated”, the Fed’s latest statement said policymakers chose to cut the overnight rate “in light of the progress on inflation and the balance of risks”.

尽管通胀“仍然有些高企”,但美联储的最新声明表示,“鉴于通胀的进展和风险平衡”,政策制定者选择下调隔夜利率。

The worry has been that the more aggressive rate cut risks could ignite inflation again.

人们一直担心,更激进的降息风险可能会再次点燃通胀。

However, the central bank said it “would be prepared to adjust the stance of monetary policy" and Powell said the Fed is not on a "preset course".

然而,央行表示“将准备调整货币政策立场”,鲍威尔表示美联储没有走上“预设路线”。

Next big thing: US presidential election

下一件大事:美国总统大选

The Fed’s policy meeting this week was its last before voters go to the polls for the U.S. presidential election on Nov. 5.

美联储本周的政策会议是选民在 11 月 5 日美国总统大选投票前的最后一次会议。

The central bank’s next two-day policy meeting begins a day after the U.S. election.

央行下一次为期两天的政策会议在美国大选后一天开始。

If you like what you read, follow us on Facebook, Instagram, Twitter and Telegram to get the latest updates.

如果您喜欢您阅读的内容,请在 Facebook、Instagram、Twitter 和 Telegram 上关注我们以获取最新更新。