TMTB Morning Wrap

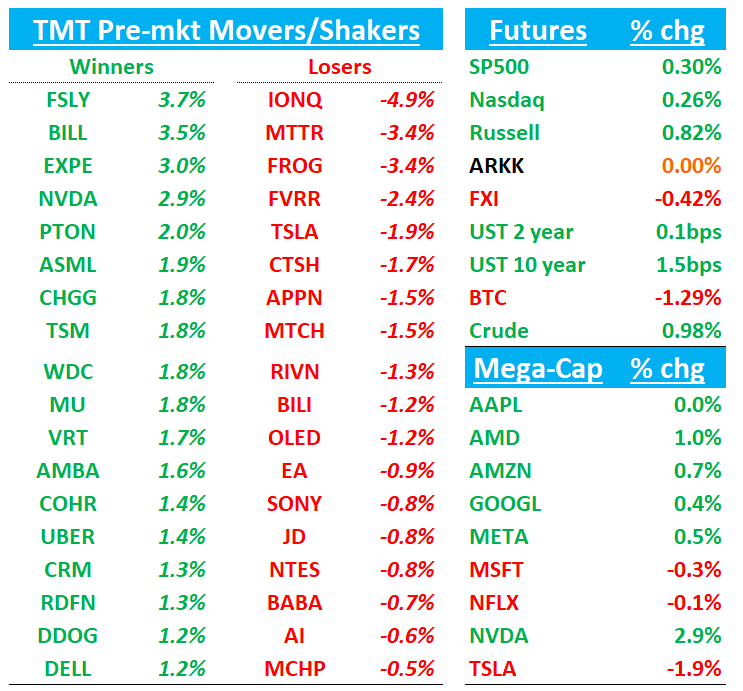

QQQs +17bpsbps as all eyes on FOMC this afternoon. MU EPS after the close. BTC -1.3% back to $105k. Yields ticking up slightly. NVDA +3% green in the pre-market! TSLA -2% red in the pre-market! What’s happening!!!

Let’s dive straight in…

MU Bogeys (reports after the close)

Sentiment generally subdued as DRAM pricing checks have been weak, but has improved over the last week (stock +15%) after AVGO’s print as bulls still comfortable looking past near-term DRAM weakness while remaining more positive on HBM ramp in ‘25 and beyond. Investors don’t want a repeat of AVGO and remember last q when MU beat despite weak checks so I’ve heard of short covering over the last week. Bears will point to Samsung ramping up and continued DRAM weakness given PC/smartphone weakness. Bogeys generally inline with street…

Q1 Revs: $8.75B vs street at $8.72B

Q2 Revs: In-line vs street at $9B

Q2 EPS: $1.90 vs street at $1.93

3p Roundup:

NFLX: Yip saw slight decline in net adds near the end of last week, according to their weekly US tracking, likely influenced by increased cancellations as we run into one month anniversary of Tyson v Paul fight (11/15). Not totally unexpected and US net adds still tracking well above street. Doesn’t change much for the q, but I believe Yip usually puts out a weekly note describing trends on Thursday so could read a bit neg when it comes out.

EBAY: M-sci positive saying GMV tracking above street and high end of guide

BABA: M-sci positive saying GMV tracking above street

TSLA: Yip showing uptick in latest weekly orders in US

Several NVDA News items this morning…

NVDA/AVGO/MRVL: Citi revisits GPU vs custom ASIC debate

Following strong MRVL/AVGO custom ASIC results, firm addresses GPU versus ASIC debate. Expects coexistence, with NVIDIA's CUDA software flexibility remaining key GPU advantage. Citi projects $380B 2028 AI accelerator market with GPUs maintaining 75% revenue share despite ASICs reaching 35%+ unit share, due to higher GPU ASPs. Citi’s supply chain checks indicate NVIDIA's CoWoS capacity allocation increasing to 60% in 2025 from 56% in 2024, supporting continued GPU momentum.

NVDA: Broadcom’s AI Success Won’t All Come at Nvidia’s Expense - WSJ

WSJ:

But such in-house chips don’t fully offset the need for Nvidia’s market-leading silicon. Notably, the two tech giants furthest along in their chip efforts, Google and Amazon, both also frequently tout their relationship with the AI kingmaker.

“We have a wonderful partnership with Nvidia,” Google CEO Sundar Pichai said on the company’s latest earnings call.

“It’s not a zero-sum game,” said analyst Stacy Rasgon of Bernstein in an interview. Big tech companies with the resources can design chips to run certain highly specific workloads more efficiently than chips from outside providers. “But there’s no free lunch,” Rasgon said, adding that such chips aren’t flexible.

He also noted that major customers of the cloud services those big tech companies provide don’t want to get locked into a single, proprietary computing source. “Enterprise customers all want flexibility, and they’re all writing on CUDA,” he said, referring to Nvidia’s large AI software coding library that is key to the company’s deep competitive moat.

NVDA/MRVL: Mizuho out with some Taiwan Supply Checks

Based on extensive Taiwan checks, firm adjusts NVIDIA GB200 NVL72 rack server estimate down to 35-40K units from 40-45K due to cooling and test challenges. Blackwell peak production now expected Q2-Q3 2025, potentially impacting April/July quarter estimates. However, GB300 NVL acceleration expected to offset GB200 weakness, supporting stronger H2 performance. Mizuho also raises MRVL’s Trainium2 volume forecast to 1.5M from 1.2M for 2025 on stronger orders. Combined with AVGO's TPUv6, expects AI ASIC volumes to grow over 80% year-over-year.

NVDA: Barrons also out positive: NVDA: Nvidia Stock Looks Dead in the Water. Here’s When It Comes Back to Life – link

AMZN: Named '2025 Best Idea', price target raised to $265 at Bernstein

Bernstein raises target to $265 from $235, maintaining Outperform and naming top 2025 pick. Sees continued retail margin improvement from regionalization and fulfillment efficiencies, while AWS margins expected to exceed 30% on supply constraints and cost management. Bernstein projects Prime Video to contribute $800M Q4 EBIT, growing to $4B-$5B by 2026.

NTGR +15%: U.S. Weighs Ban on Chinese-Made Router in Millions of American Homes

Home connected gear is about 60% of NTGR’s revs and TP-link is 65% of the market so could be a really big deal for NTGR

U.S. authorities are investigating whether a Chinese company whose popular home-internet routers have been linked to cyberattacks poses a national-security risk and are considering banning the devices.

The router-manufacturer TP-Link, established in China, has roughly 65% of the U.S. market for routers for homes and small businesses. It is also the top choice on Amazon.com, and powers internet communications for the Defense Department and other federal government agencies.

FSLY: Opp raises PT to $15 from $12 as Edgio a positive as is improved volume growth

Oppenheimer notes channel checks indicate improving CDN volumes and pricing trends, with Fastly gaining market share. Company seeing expected Edgio customer migration and edge compute momentum, with new feature launches planned for coming quarters targeting go-to-market improvement. Opp says growth is being driven by latency-sensitive AI applications creating new use cases across CX, digital advertising, and observability. Notes successful convertible debt offering reducing risk profile.

DIS: Morgan Stanley swaps Spotify for Disney as top media pick into 2025

Morgan Stanley shifts top media pick to Disney from Spotify, maintaining Overweight and $125 target. Following two years of restructuring, pricing actions, and password sharing initiatives reducing competitive pressure and achieving streaming profitability in 2024, firm expects significant 2025 streaming profits for both Disney and Warner Bros Discovery. Views Disney as best positioned to emerge as content distribution leader while leveraging experiential asset growth.

EXPE: BAML ugs on improving U.S. travel data, easy comps

BofA upgrades Expedia to Buy from Neutral, raising target to $221 from $187. Cites improving U.S. travel trends from RevPAR and card data, favorable 2025 comparisons, and achievable 10% FY25 EBITDA growth estimates. New CEO appointment could attract long-term investors through improved messaging and execution, notes the analyst

NFLX: Netflix price target raised to $1,050 from $830 at Morgan Stanley

Morgan Stanley analyst Benjamin Swinburne raised the firm's price target on Netflix to $1,050 from $830 and keeps an Overweight rating on the shares. In the media and entertainment group, the firm anticipates another strong year of advertising growth in the U.S. and forecasts year-over-year total U.S. advertising up 6%-plus, or 8%-plus excluding political and Olympic spending. The firm also continues to believe the box office has another two years of growth ahead of it as film supply normalizes back to pre-pandemic levels, the analyst added in a year-ahead outlook note for the group.

MNDY: Weakness yesterday as WB had them on the road and they called out some macro softness in Europe

WB recaps meetings with mgmt/investors saying the company noted unexpected macro weakness in European markets (France/Germany) during November, representing ~32% of revenue. While this revelation drove ~8% share decline, management emphasizes challenges stem from macro conditions rather than execution or competitive issues. Notably, U.S. business (~50% of revenue) shows acceleration, demonstrating strong competitive position. Despite European softness, WB’s broader outlook on MNDY remains positive with momentum across multiple initiatives: Service beta traction, CRM adoption, midmarket growth, pricing power, and favorable competitive dynamics. Firm maintains constructive view on the co as emerging platform leader, suggesting European headwinds represent temporary challenge and recommending share weakness as buying opportunity.

TSLA: Baird raises PT to $480 from $280

Firm raises target to $480 from $280 citing multiple catalysts: accelerated Cybercab regulatory pathway, ongoing cost reductions, affordable model launches in H1'25, and Trump relationship benefits. Target based on 57x 2028 EBITDA discounted to YE'25 at 9%, premium to high-growth peer range of 4-53x (22x mean). Updates estimates with lower 2025 gross profit forecast, offset by increased regulatory credit revenue, which firm now views as more sustainable given competitors' production challenges.

ALso: TESLA SHANGHAI PLANT MANAGER SONG GANG TO LEAVE THE COMPANY "Today is my last day at Tesla, and I feel extremely fortunate to have worked and fought with everyone on this plot of land."

BILL: KeyBanc upgrades Bill to Buy, says 'on the road to recovery'

KeyBanc upgrades with a $115 price target. The firm is "hopping back on the BILL train," citing the company's execution and its belief competition from INTU as had little impact on the company's near-term results. KeyBanc says Bill is "on the road to recovery."

CIEN: Jefferies makes top pick for 2025 and takes PT to street high $105

Jefferies’ bull thesis centers on three key drivers: underappreciated AI-driven traffic impact, structural leadership in optical market, and recovery from Tier 1 customer inventory normalization. Trading at ~20x forward P/E. Further, Jefferies highlights edge computing opportunity as latency-sensitive inferencing applications drive metro optical network expansion and projects potential CY26 EPS of $5.40 (versus current $4.21 estimate), based on 15%/20% revenue growth in 2025/26, compared to Street's 11%/10%. Key quote: “We like the idea of buying the structural long-term winner in the space at a relatively pedestrian forward P/E multiple (20x) while benefiting from a multi-year AI traffic growth cycle."

RIVN: Baird downgrades to Neutral from Buy

Baird downgrades Rivian to Neutral from Outperform, cutting target to $16 from $18. Cites challenging EV and renewables outlook due to IRA uncertainty and 2025 growth concerns, along with shifting post-election geopolitical landscape. Notes lack of 2025 catalysts and expects shares to track weak EV sales trends.

TTWO: JPM ups target to $225 from $195 and names top pick

JPMorgan raises Take-Two target to $225 from $195, maintaining Overweight. Carpenter highlights strongest-ever game pipeline entering 2025, including GTA VI, Borderlands 4, Civilization 7, and Mafia: The Old Country. Projects significant bookings and profit acceleration in FY26/27, outpacing gaming industry and broader market.

MTCH: JPM downgrades to Hold

Follows Jefferies downgrade yesterday…

JPMorgan downgraded Match Group to Neutral from Overweight with a price target of $33, down from $40. Global online dating spend remained stagnant in 2024, and JPMorgan expects "muted growth" to persist in 2025, the analyst tells investors in a research note. The firm's newly updated global online dating model projects industry growth of 1% in 2024 and 0% in 2025. It believes product-driven turnarounds take time, with artificial intelligence product enhancements limited to date. Match is still early in its efforts to reinvigorate user growth, contends JPMorgan.

EA: Electronic Arts downgraded to Hold from Buy at Stifel

Stifel analyst Drew Crum downgraded Electronic Arts to Hold from Buy with an unchanged $167 price target. The firm remains positive on the stock longer term given its fundamental outlook for the company, but it is reducing its net booking estimates following its "review of game model", the analyst tells investors in a research note. Stifel adds that it sees "limited upside" for shares in the near term.

EVs: Trump Team Eyes EV Subsidy Cuts in Plan to Reshape Auto Industry

Advisers to President-elect Donald Trump are recommending a two-pronged approach to reshape the U.S. auto industry: cut federal subsidies to boost electric-vehicle sales while still fostering a domestic supply chain to produce them.

Trump’s advisers encouraged relaxing environmental reviews and speeding up permitting for federally funded EV and infrastructure projects, including the development of batteries and critical minerals, according to the document and the people, who asked not to be identified because the deliberations are private.

At the same time, the officials are calling for an end to federal policies to boost consumer demand for EVs, including the $7,500 federal tax credit for purchasers of plug-in cars, according to the document, which was reported earlier by Reuters.

Biden-era fuel-economy and tailpipe pollution regulations would also be rolled back and reset to 2019 levels. US Environmental Protection Agency approvals that allow California to impose its own limits on tailpipe emissions – including a mandate for 100% EV sales in 2035 – would also be on the chopping block.

Other News:

ADSK: November US Architecture Billings Index (ABI) falls to 49.6 vs 50.3 in October

AFRM: prices $800M private offering of 0.75% convertible senior notes due 2029

AI, Cloud: Nvidia Says It Could Build a Cloud Business Rivaling AWS. Is That Possible? – The Information

AMZN: Taiwan in talks with Amazon’s Kuiper on satellite communications amid China fears – FT

CRM: Salesforce will hire 2,000 people to sell AI products, CEO Marc Benioff says – CNBC

NVDA: Microsoft acquires twice as many Nvidia AI chips as tech rivals – FT

TikTok: TikTok Must Turn Over Code, Financial Data in Trade Secrets Suit – Bloomberg