TMTB EOD Wrap

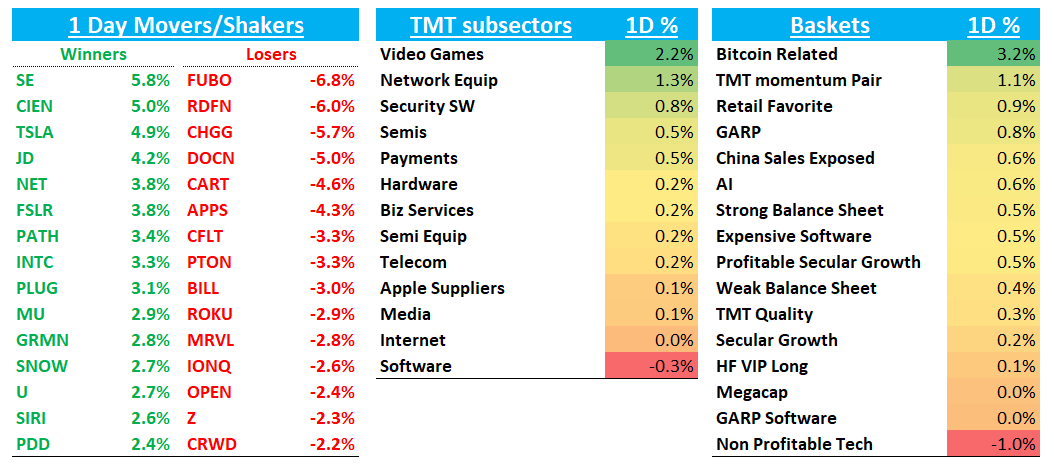

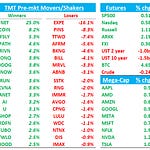

Good afternoon. Sorry for delay - internet maintenance going on in our neighborhood. QQQs +27bps as yields finished flat on the day and fed expectations didn’t change with market still pricing in 75bps worth of cuts over the final two meetings of the year. Let’s get straight to the recap…

Internet

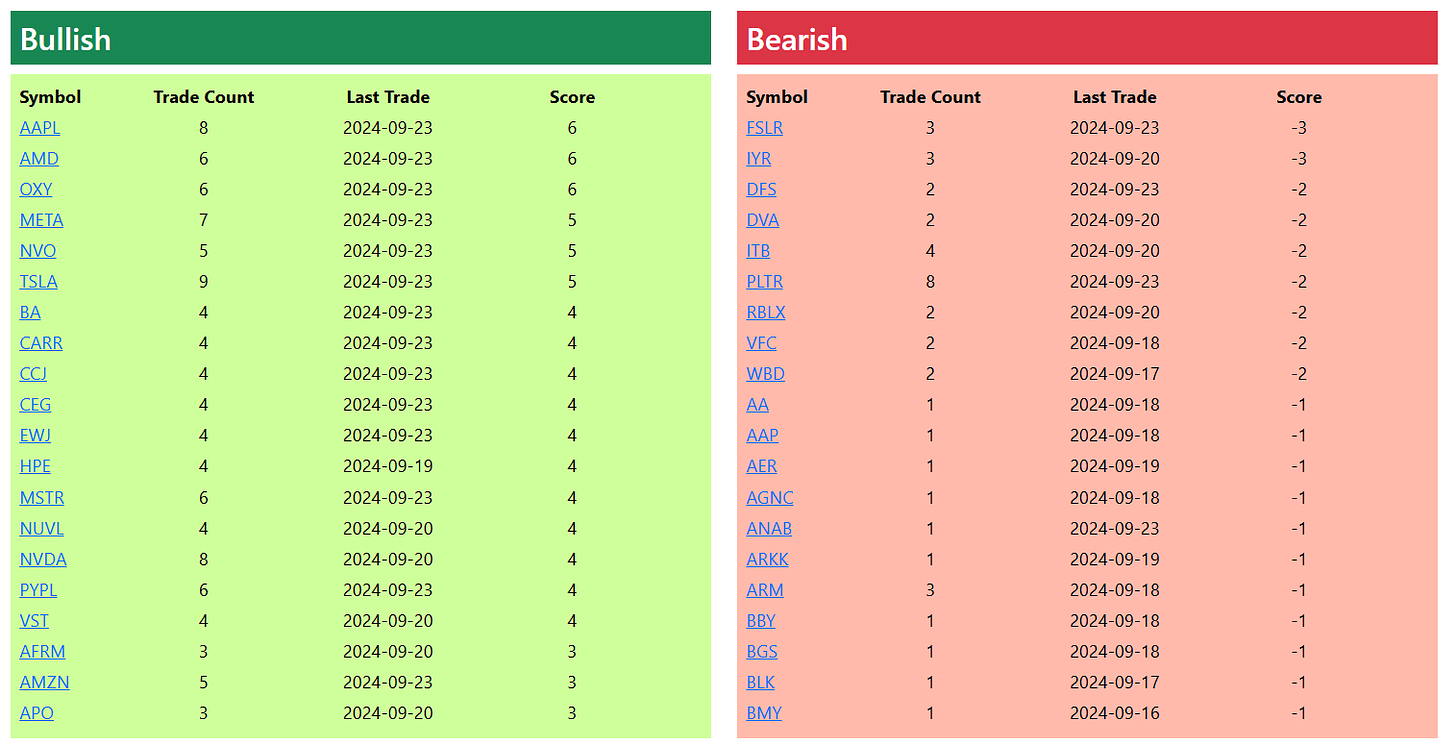

META +55bps as Citi raised PT to $645 ahead of Connect conference on Wed saying Reels ad load and usage continues to ramp and META’s outperformance proving ROI of capex investments. was +2% at one point in the day

AMZN +1.1% getting closer to $200 ATHs despite mixed WSJ article on Alexa

SHOP +1.8% continues to break out

PINS +26bps as DB initiated at Buy

UBER +1% as Jefferies positive after meeting with CFO

SE +6% as both Barclays and BAML were positive on the stock

RBLX -1% despite Jefferies raising EBITDA numbers

GOOGL -1% as FT had an article talking up Perplexity

CART -4.5% (prob missed something here but couldnt find anythign)

Semis

NVDA +22bps as digitimes and fubon wrote up that H20 likely to be banned after US DoC updates its export restrictions

MCHP flat / ADI -35bps as Truist downgraded to hold

AMD +50bps - 10/10 event next catalyst here

MU +3% ahead of earnings later this week

INTC +3% on Apollo/QCOM news … QCOM - 2% as most of sellside negative on potential acquisition

ARM +2% outperformed most semis

VRT +1.5% as power names continue to get a bid

AVGO +1% / MRVL - 3%…AVGO (200Bpts/lane DSP) and COHR (incorporating NVDA’s DSP) announcements at a large optical conference (ECOC)…unclear to me what it exactly means from MRVL…some say nothing as NVDA DSP consumes 50% more power than MRVL, some say means DSP reign over from 1.6T onwards with NVDA taking internal and AVGO splitting rest of share

Software

MSFT -40bps as DA Davidson downgraded citing other AI competition catching up

PLTR +2% despite RJ downgrade to hold - still have never seen a sell-side downgrade mark the top in a stock.

CRWD -2% despite Needham assuming with a Buy

U +2.5% continues to rally

SNOW +3% finally up one day, but will be down tomorrow on convert offering

ADBE +1% as Barrons wrote them up over the weekend

WIX +2% on Piper’s upgrade

Elsewhere

AAPL -75bps as M-sci and Barclays were both out saying iPhone 16 weak

CIEN +5% on Citi’s double upgrade to Buy

TSLA +5% as Barclays said they see Tesla Q3 deliveries topping street estimates - stock continues to rally into 10/10 robotaxi event. If demand truly better than expected, bears going have trouble

PYPL +1% as DB raised tgt to $95 saying 8bps of upside to unbranded take rates vs their core estimates in FY25 as company continues to price for value