TMTB Morning Wrap

Lots of interesting stuff going on while I was out yesterday: More rumors of AAPL building out AI chip w AVGO +6% in 2026; M-sci calling out better RBLX +6% bookings; GM Cruise exiting robotaxi ambitions helping TSLA +6%/GOOGL; GOOGL +5% continuing to re-rate higher on AI Agents announcements and Yipit had a positive report on Waymo’s continuing share gains (hitting UBER-6% /LYFT-6% ); semis +3% finally getting a bid as Semi-analysis talked down limits of scaling laws.

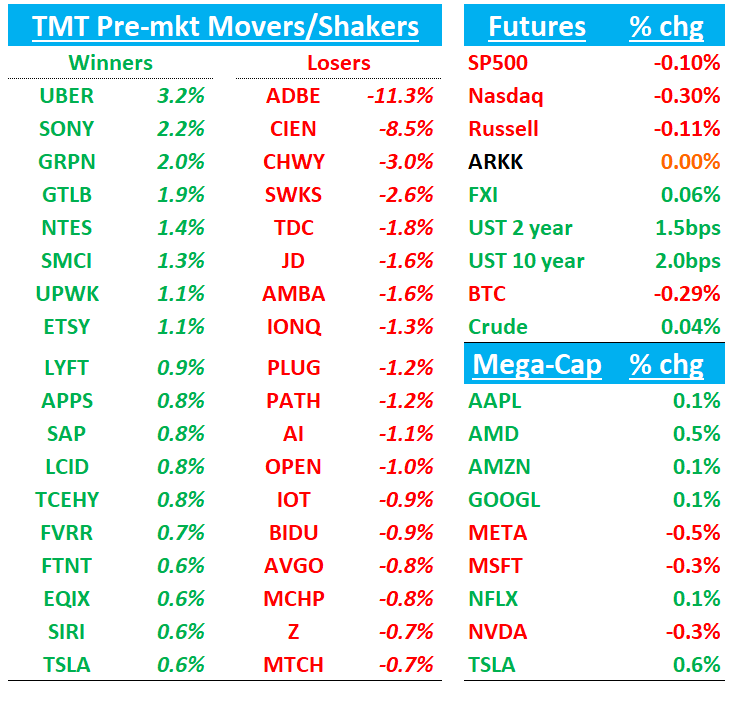

QQQs -35bps early today giving back some of yesterday’s gains. Barclays Day 2 TMT conf is today (agenda here) along with AVGO earnings post-close. BTC -1% hovering around $100k. Yields ticking up 2bps. ADBE -11% following ORCL and MDB misses. On macro front, we got a larger than expected hike from Brazil, larger than expected cut from SNB and 25bps cut from ECB.

Let’s get to it…

ADBE: Digital NNARR misses bogeys and guide lower than expected

Overall, #s worse than expected which will fuel bear concerns around AI ramp/competition (Open AI, Canva, Figma) slowing growth as we head into pricing tailwinds rolling off in 2H ‘25. GTM changes also create some disruption as we head into next year. Sentiment had sneakily crept up into the print, but will likely fall squarely in the funding short camp among HFs after this print. Stock doesn’t seem particularly cheap at 24x FY26 P/E for a low teens EPS grower with competitive/secular concerns.

Digital Media Net New ARR $578M (+2% Y/Y, slowing from +9% previous quarter), beating guidance by only ~5% and marking lowest beat percentage in two years and falling below 9% trailing twelve-month average (bogeys were closer to $590M+).

FY25 guidance of 8-10% growth (including 50-75bps FX headwind) disappoints versus Street's 11%, with mgmt projecting ~50bps operating margin decline against expectations for flat margins. ARR growth expected to decelerate from 13% to 11%.

Adobe's GenAI initiatives showing mixed progress - GenStudio gaining enterprise traction and modest Acrobat AI Assistant adoption, though revenue contribution remains limited. Plans include early 2025 Video Gen model launch and new tiered consumption-based pricing, targeting cross-sell/upsell within creative professional base. However, firm expects gradual rather than immediate revenue impact from these initiatives.

Gets a DG at Cowen this morning, mainly for the reasons outlined above.

UBER +3.5% in the pre as CFO sounded good at Barclays post close

CFO said they feel very comfortable that their mobility business is going to continue to be sort of a high teen low-20s grower for at least the next few quarters of 2025 (street is at mid to high teens for the next few quarters so significantly above), but reluctant to give a full year guide (pushback from investors is CFO’s comments are ex-fx which would mean it’s not a big an uptick as headlines suggest). Said insurance costs are expected to drop to +HSD to LDD rate in 25 allowing for more operating leverage. On waymo/SF he saidgrowth is still above the US avg and sequentially not seeing any change here. November yoy growth rates consistent with prior quarters, not seeing the deceleration if there was share loss.

Wells also out with a note this morning suggesting Uber stock prices in $1.9B 2026 US Mobility EBITDA impact, reflecting 10-20% market share loss to third-party AV networks and 6-9% industry price compression. WFS’s sensitivity modeling indicates $1.9B EBITDA reduction assumes 10-20% AV market penetration and high-single-digit price declines, with rideshare platforms absorbing 75% of pricing impact. Wells thinks Waymo currently has aper-ride cost disadvantage, reducing near-term competitive threat, but thinks AV disruption concerns likely persist barring Tesla partnership with rideshare platforms or safety/regulatory deployment delays.

3P Roundup:

ETSY: Hearing slight uptick in weekly data but still tracking 4ppts below street for the full q

AMZN: hearing Edgewater positive on retail noting early december strength

UBER/AFRM/MTCH: Hearing slight uptick in weekly 3p data

ARM: Hearing M-sci calling out positive outlook for DC biz driven by new Cobalt and Axion deployment

HUBS: Hearing Clev positive

AMZN: Cowen makes top large cap 2025 idea on rising margins and FCF, Accel’ing AWS

Firm names AMZN top large-cap pick for 2025 based on three core drivers: ongoing margin expansion with 2025 Operating Income forecast of $85.6B (6% above consensus) reaching 12.0% GAAP margins, driven by AWS and Advertising growth plus eCommerce efficiency gains. Cowen expects AWS revenue projected to accelerate for second consecutive year to 21% growth in 2025, up from 19% in 2024, supported by enterprise migration and GenAI offerings. Cowen notes strong cash position expected to grow from $67B end-2024 to $133B end-2025 despite accelerated capex, providing capital allocation flexibility.

CHWY: Announces $500M Class A common stock offering for holders

Chewy announced $500M Class A common stock public offering by Buddy Chester Sub (BC Partners Advisors affiliate and largest shareholder). Company will not sell shares or receive proceeds from the offering but will buy back $50M of the shares

PLTR: Baird initiates at neutral and $70PT

Baird notes that PLTR focused on providing AI capabilities to western institutions, leveraging AIP platform launch to drive significant U.S. Commercial growth acceleration (54.3% Y/Y in Q3), contributing to 30% overall revenue growth. Firm notes company's success in operationalizing generative AI applications, seen as key value driver going forward. While positive on fundamental positioning, Baird expresses caution on valuation following strong year-to-date performance.

TMTB: We were bulls on PLTR through the first 3/4 of the year but see it less appealing now. We’re not particular sticklers for valuation (we are believers you should never lead with valuation in tech, especially in this mkt) — it’s more about the set up. It’s hard to remember, but sw sentiment was in the dumps as recently as the summer and PLTR was one of the view AI plays in sw in 2023 and early 2024 as growth accelerated as comps got easier. PLTR’s multiple benefitted from both acceleration in growth and scarcity value of AI plays in sw. However, comps now continue to get tougher over the next several quarters while the opportunity set in sw for AI plays has expanded. While we still think co is firing on all cylinders, we find that a much less compelling set up than the 1H of the year.

AAPL: Citi says they’re still optimistic about iPhone17 refresh

Citi notes iOS 18.2 release yesterday includes Apple Intelligence features - ChatGPT-Siri integration, Writing Tools, Image Playground, Visual Intelligence, Genmoji, Image Wand, plus expanded English localization. Core Siri personal context functionality still planned for Spring, while current update outsources basic Siri functions to ChatGPT. Citi expects a staggered feature rollout expected to differentiate iPhone 16/17 cycle from previous ones and regional timing varies with EU launch in April and China pending regulatory approval while more advanced 'LLM Siri' announcement expected 2025 (iOS 19) with 2026 deployment. Citi maintains iPhone unit forecasts: 227M/246M/253M for CY24/25/26 (-2%/+8%/+3% Y/Y), including 24M iPhone SE 4 units in CY25.

Bernstein also comments on the release suggesting initial AI features launching in April may underwhelm bulls' expectations, with meaningful smartphone AI adoption requiring longer development timeline. While skeptical of iPhone 16 sales inflection, Bernstein sees strong iPhone 17 cycle driven by enhanced AI capabilities and design changes. Bernstein thinks stock is range-bound through early 2025, following historical patterns, but positive longer term on AI replacement cycle

ACN: Piper raises PT to $422 from $395 and maintains Overweight

Firm expects Q1 results to exceed consensus with improved macro view versus three months prior while their above-street estimates are supported by India IT Services field work and CIO survey data. Piper while 2025 budgets remain in finalization, early client discussions indicate favorable IT Services spending environment benefiting Accenture, Globant, and EPAM. Piper ntoes growth expected to be driven by GenAI implementation and AI readiness services (consulting, tech modernization, security). Despite investor concerns around Federal business exposure (>10%) due to DOGE, firm sees technology spending protected as productivity driver.

Macq initiates sw: TEAM (neutral) CRM (neutral) GTLB (Buy) MDB (neutral) DDOG (Buy)

CRM: MACQ likes the potential for Agentforce adoption and margin improvement, but it thinks Salesforce is facing a combination of macro-driven demand weakness and intensifying competition

DDOG: ⁃ MACQ likes DDOG's positive market dynamics, share gain prospects, healthy company revenue model, platform expansion, exposure to LLM inferencing, multi-product adoption, and strong FCF generation

GTLB: GTLB has emerged as a key vendor in the rapidly evolving developer security operations (DevSecOps) toolchain, with an AI-powered platform that is useful to managers, developers, testers, IT operations, security teams, analysts, solution architects, and other personnel across the software development lifecycle (SDLC).

TEAM: MACQ notes TEAM's conservative guidance creates a potential for near-term revenue and EPS upside, although the resignation of sales leaders could create hiccups. TEAM's seatbased model concerns MACQ, given a five-year trend of software developer employment declines.

NOW: CFO at Barclays said the quarter is shaping up as expected, and “we feel good about the guide”

MTCH: RBC comments on analyst day and reiterates buy

RBC notes positive developments include long-term growth and margin expansion targets, dividend initiation, increased buyback, and strong Hinge growth prospects. However, concerns emerge from Q4 guidance reduction (FX-driven), negative Tinder 2025 outlook, reduced segment disclosure, and limited response to market saturation worries while noting Tinder's product strategy focuses on free features rather than directly addressing payer penetration issues. While lowering near-term estimates and expressing skepticism about significant Tinder improvement, RBC maintains Buy noting Hinge comprising over half of enterprise value, suggesting undervaluation of remaining business segments, strong cash generation, and capital return potential.

Other News:

AAPL: Apple launches its ChatGPT integration with Siri – CNBC

AAPL, TSM: Apple is expected to adopt TSM’s 2nm nodes for the iPhone 18 Pro processor; market expects rising processor ASP w/ technology improvement, which could benefit TSM – Economic Daily

DELL: xAI reportedly expected to launch AI image generation model Aurora, likely benefiting DELL and Wistron – Economic Daily

GOOGL: Google races to bring AI-powered ‘agents’ to consumers– FT

MediaTek: Asia press chatter that MediaTek’s ARM-based AI PC processor, cooperated w/ NVDA, has entered the final stage of design and is expected to start production in 2H25 with 3nm nodes – Economic Daily

META: Meta Donates $1 Million to Trump’s Inaugural Fund – NY Times

MSFT: sees $800M charge on stake in GM's failed autonomous taxi initiative – Bloomberg

NVDA, China: steps up hiring in China to focus on AI-driven cars – Bloomberg

TSLA/EVs: Trump’s Push to Eliminate EV Tax Credits Hits GOP Lawmakers’ Home States - Bloomberg