TMTB Morning Wrap

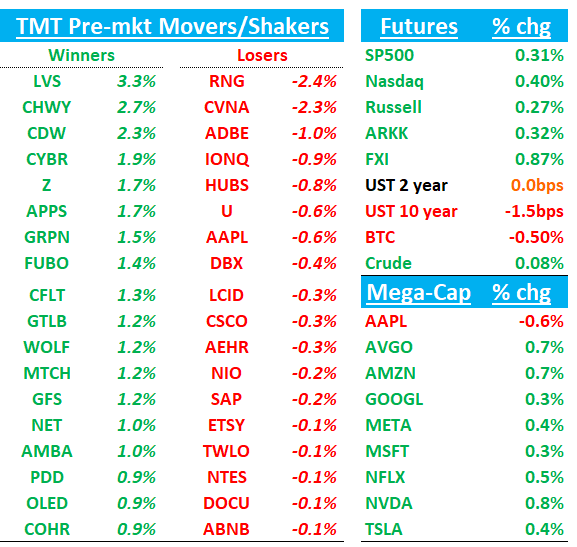

QQQs +40bps, BTC -60bps, yields flattish, China +1%. Let’s get straight to it….

AAPL: Some more negative news this morning following yesterday’s weakness with more weak China data pts + Bloomberg saying China now will subsidize domestic handsets

AAPL/Huawei: China to Subsidize Smartphone Purchases in Bid to Lift Spending

China will expand consumption subsidies to cover smartphones and other electronics, in a step to promote domestic spending as external headwinds pick up.

A national trade-in program that currently applies to home appliances and cars will broaden this year to include personal devices like phones, tablets and smartwatches, officials from the nation’s top economic planning agency said in a briefing Friday.

AAPL: Apple's China troubles mount as foreign phone sales sink for 4th month

Shipments to China of foreign-branded smartphones, including Apple Inc's iPhone, fell by 47.4% in November from a year earlier, according to data released on Friday from a government-affiliated research firm, down for the fourth month.

Calculations based on the data from the China Academy of Information and Communications Technology (CAICT) showed that foreign brand shipments decreased to 3.04 million units from 5.769 million units a year earlier.

Barclays also comments on weak China smartphone data saying Dec Q and March Q numbers at risk. Based on BARC's analysis of China smartphone unit shipment “sell in” data (MIIT), iPhone shipment momentum cooled further in Nov noting China iPhone units in the month of Nov. were down 48% Y/Y and down ~2.5M from Nov. 2023. According to BARC's sell-through checks, iPhone sell-through in China was muted since the IP16 launch, with China sell-throughs down roughly 20% Y/Y for the month of November. AAPL continues to experience market share losses in China, and BARC's checks suggested roughly 400bps share loss in November in China for iPhones. With October and November data points being softer than expected, BARC expects Dec-Q is at risk for AAPL with iPhone units tracking below expectations by 2M units.

AAPL: Bernstein raises target to $260 from $240

Bernstein raises Apple target to $260 from $240, viewing it as quality compounder with mid-single-digit revenue growth, margin expansion, and double-digit EPS growth. Values platform strength (2.3B+ devices, 1B unique users) but notes peak valuation and tepid iPhone 16 cycle. Suggests buying below $220 or February-April timeframe. Projects potential $290+ based on FY26 $9 EPS at 32x-33x multiple.

AAPL: Apple App Store revenue grew 15% in fiscal Q1, says BofA

BofA maintains Buy rating and $256 target on Apple, citing SensorTower data showing App Store Q1 revenue up 15.4% YoY to $8.1B, with December growth of 12.7% globally and 7.2% in China. Estimates unchanged.

3P Roundup:

NFLX: M-sci says gross adds accelerated significantly in US and Europe over the holidays but cancellations also increased…TMTB: We think big net add beat + stock split hopes likely have stock higher before the print in a few weeks

W: Yip saying orders now tracking in line with street, which is slight downtick from previous report

AMZN: 3p data continues to show 3.5-4% beat to NA Retail sales

CHWY: Wolfe upgrades to Buy from Hold

Wolfe Research upgrades Chewy to Outperform, citing expected revenue acceleration and margin expansion and points out four key drivers: improving customer growth (2025-26), healthy NSPAC from pet health and Autoship mix, new product launches, and international expansion. Analyst sees stock as reasonably valued at 17x '26 EBITDA, with estimates 2%/5% above consensus on Revenue/EBITDA. Notes subscription-like model (80% Autoship, 85% non-discretionary sales) supports mid-to-high single digit growth outlook.

SQ: Block upgraded to Outperform from Market Perform at Raymond James

Raymond James upgraded Block to Outperform from Market Perform with $115 target, driven by in-depth analysis showing strong potential for Seller payment volume acceleration in 2025. The firm expects double-digit growth returning in 2025, supported by multiple factors: easier year-over-year comparisons, enhanced distribution through partnerships with US Foods and Sysco, continued international expansion (currently growing >20% YTD), and ongoing product innovation. While Cash App user growth remains flat over recent quarters, the firm maintains high confidence in Seller volume growth outlook. For 2025, they project low double digit growth vs ~8% GPV growth in 2024 despite anticipated low-single-digit same-store-sales decline, with new business wins contributing approximately 10% to GPV growth. Valuation appears attractive at 16x 2026E AEBITDA including SBC, or EV/AEBITDA/growth of 0.5x.

TMTB: GPV accel is key to get stock sustainably above $100. RJ is not the first to lay out reasons for why it should accelerate (recall Bernstein note a month ago), but SQ needs to execute now.

CVNA: JPM says CVNA should be bought on short report selloff

JPMorgan addresses Hindenburg's short report on Carvana, focusing on two key concerns: potentially inflated gross profit per unit (particularly Other GPU and related party loan/warranty transactions) and broader auto loan default risks. While finding no red flags in gain on sale accounting or free cash flow, JPM suggests Carvana could improve transparency around partner economics and cash flow details. The firm sees industry-wide default concerns as valid but already known. JPM maintains Overweight rating, viewing EBITDA per unit metrics as reasonable and recommending buying on short report-driven weakness.

TMTB: We don’t have a strong opinion on the short report, but we do think GPU is reaching a ceiling at $7k+, which represents 25%+ of average ASP of a used car ($28.5k). Unit/ASP comps also will get tougher beginning in Q1 (the rev comp goes from -15% y/y to +17% y/y), which means we likely see a big decel in revs vs acceleration in the last year. The set up is completely different from where CVNA was starting last year.

SNAP: JMP says Snap's new ad formats should be tailwind to ad revenue

JMP Securities maintains Outperform rating and $16 target on Snapchat, citing new ad formats as 2025 revenue drivers. Analyst projects Sponsored Snaps to generate over $180M incremental run-rate revenue, with Promoted Places providing additional upside.

Gugg also out this morning saying december user growth data data generally consistent with guide, as it showed global audience reach increasing 5.2% vs 5.7% last q. Gugg forecasts global DAUs of 451M, in line with mgmt guide.

TMTB: $180M is about 3-4% of SNAP’s revenues. If they can execute on these new ad formats + get some tailwind from TikTok ban, might begin to be interesting.

UBER: BTIG lowers estimates on ride share data

BTIG is moderating Uber's bookings growth expectations to mid-teens from high-teens due to mixed signals. Despite positive management commentary intra-q, receipt data reveals rideshare deceleration from +15% to +9% in 3Q, partially offset by delivery growth from +8% to +10%. FX headwinds have intensified beyond initial guidance, with an additional point impact expected, while the company projects flat-to-down Q1 bookings seasonality. BTIG notes concerns about achieving +17% mobility bookings growth given challenging 2H23 comparisons, mounting FX pressures, and questions around US rideshare growth sustainability following 3Q results. The data suggests slowing ride volume despite fare increases, contributing to BTIG’s more cautious outlook on Uber's near-term growth trajectory.

UBER: Wolfe raises target to $92 from $90

Wolfe Research raises Uber target to $92 from $90, maintaining Outperform based on three factors: undervalued SOTP (Mobility trading below LYFT despite 50% international share, Delivery at a 1x turn discount to DASH), EBITDA upside from efficiency gains and product expansion, and limited near-term AV competition (Waymo lead over Tesla). While acknowledging long-term AV concerns, sees opportunity from current valuation dislocation given execution strength and potential estimate revisions. Wolfe expects Tesla to miss October AV targets based on technical challenges versus Waymo. Wolfe believes solid execution and upward estimate revisions, along with more robust AV disclosures, create a pathway for shares to outperform.

TMTB: UBER price action has definitely been better as of late shaking off some negative news and also helped by some weakness at TSLA yesterday. Have definitely heard of more investor interest near 60s which is only 15x FCF for 30% + FCF growth + investors playing it as a laggard play in January. Valuation/Sentiment definitely makes it interesting, but lack of very interesting catalyst path and mixed 3p data keeps us less interested than we otherwise would be, but acknowledge could very well work higher here.

ADBE: Adobe price target lowered to $475 from $525 at UBS

UBS cut Adobe target to $475 from $525, maintaining Neutral rating. UBS notes growing AI-generated content adoption, citing Coca-Cola's holiday ad as potential tipping point. While both Coca-Cola and Toys "R" Us used Adobe's core suite for editing, UBS says they utilized other AI tools for content creation. Analyst sees Adobe as competitive in creative AI space but faces strong competition.

TMTB: We’ve heard of increased investor interest in ADBE heading into 2025, but we remain skeptical given slow AI ramp, AI competition in addition to marketing cloud/creative cloud competition and don’t find the valuation that compelling (19x for low double digit decelerating eps growth for a company facing significant competitive challenges). Guide does seem conservative, but we wait for a better set up here.

TSLA: Sell-side recaps delivery miss from yesterday; ISI digs into call option value

Goldman maintains Tesla Neutral/$345 target after Q4 deliveries of 496K missed 500-510K consensus, citing Europe weakness offset by mid-high teens China growth. Cuts FY25 EPS to $2.80 from $2.85 and 2025 deliveries to 2.01M from 2.03M. Long-term view positive on software/services growth potential.

Canaccord raises Tesla target to $404 from $298, maintaining Buy despite soft Q4 deliveries. New target justified by mega-tech comp group (GOOGL, AMZN, AAPL, META, MSFT, NVDA) trading at 23x 2027E earnings with half Tesla's 2025-27 growth rate. Sees long-term growth from EVs, autonomy, energy storage, and robotics. Limited near-term upside acknowledged given volatility.

Wells Fargo maintains Underweight/$125 target on Tesla. Q4 deliveries of 496K missed 507K consensus but beat firm's 464K estimate. FY deliveries of 1.79M declined 1% YoY, missing "slight growth" guidance. Wells Fargo expects stock weakness despite results being unsurprising given weak Oct/Nov data and high financing incentives.

TSLA: Tesla's China sales hit record high in 2024, bucking global decline

U.S. electric vehicle maker Tesla said on Friday its China sales rose 8.8% to a record high of more than 657,000 cars in 2024, a strong performance in a competitive market in a year when its annual global deliveries fell for the first time.

Tesla's sales in the world's largest auto market also increased 12.8% in December from a month earlier to a record high of 83,000 units, according to Tesla China.

Evercore ISI analyst Chris McNally raised the firm's price target on Tesla to $275 from $195 and keeps a Hold. Consistent with the firm's valuation approach of a "Tale of 2 TSLAs," where it assigns one multiple to "core" industrial revenue for things "they make/sell now" and then backs into a market implied "call option" bucket, the firm increased the size of the "call option implied basket" to about $900B from $600B and the implied market probability of success to 50% from 30%-40%, the analyst tells investors. However, the analyst also notes that at Tesla's recent peak, the market assigned a 100%-125% probability of success for the "option basket" that it now valued at about $1T.

RNG: RingCentral downgraded to Outperform from Strong Buy at Raymond James

Raymond James downgraded RingCentral to Outperform from Strong Buy, lowering target to $45 from $50. Despite attractive FCF valuation and positive risk/reward, analyst sees UCaaS valuations continuing to lag peers with no near-term catalysts and thinks initial 2025 guidance could bring share volatility.

AMZN: Wolfe raises PT to $270 from $250

Wolfe Research raises Amazon target to $270 from $250, maintaining Outperform. Three key drivers to their bull thesis: retail margin expansion from operational efficiencies, ads and international profitability; AWS high-teens growth via AI workloads, Trainium chips and Anthropic; continued market share gains through fast delivery and non-discretionary items.

NFLX: Netflix price target raised to $720 from $555 at Benchmark

Benchmark raised Netflix target to $720 from $555, but maintains Sell rating. Analyst acknowledges strong execution and global scaling advantages versus peers but sees stock as overvalued in current momentum market. Benchmark notes that future growth will rely on pricing and new initiatives like ad-supported tier as paid sharing benefits diminish.

MSFT: ISI says MSFT has potential for “mini” revenge trade in 2025

Evercore ISI maintains MSFT Buy rating with $500 target, seeing potential for 2025 outperformance despite 2024's underperformance vs S&P 500 and IGV. ISI notes key catalysts: Azure acceleration in 1H25, potential capex moderation driving FCF growth in 2026, and Copilot adoption boosting M365 ARPC. ISI notes that in 4 years in which MSFT underperformed IGV and SP500, MSFT averaged 22% outperformance and 42% absolute gains in the following year, supported by enterprise portfolio, recurring revenue, and strong balance sheet. Despite $3T+ market cap limiting upside, ISI expects a "mini revenge trade" in 2025.

BIDU: BofA says stock is close to bottoming

Based on investor meetings, BofA says Baidu is positioned for a 2025 turnaround despite near-term headwinds, noting the company holds USD24b net cash (80% of market cap) plus USD6b in long-term investments as of 3Q24. BofA thinks core business expected to weaken through 4Q24 and bottom in 1Q25, with 2Q25 improvement projected as 2025 strategy focuses on AI monetization, including search product enhancement and robotaxi expansion. BofA notes initial AI search metrics show improved user engagement versus non-AI users, with successful small-scale monetization tests and next catalysts include next gen model, shareholder return, robotaxi expansion in China and overseas and AI in phone (including contribution from ads).

GOOGL: YouTube chief Neal Mohan bets on AI and ‘creators’ to supercharge growth…says YT still only in 1st or 2nd inning - Financial Times

Other News:

AAPL: Apple to pay $95 million to settle Siri privacy lawsuit (Reuters)

AAPL: Apple's China troubles mount as foreign phone sales sink for 4th month (Reuters)

ANTHROPIC/LABELS: Anthropic reaches deal with music publishers over lyric dispute (The Verge)

HYNIX: Solidigm Reportedly Discontinues All Consumer SSD Products, Now Focused On The Datacenter Segment (WCCFtech)

NET NEUTRALITY: Net Neutrality eviscerated by appeals court ruling (The Verge)

PARA: Skydance, Paramount dismiss objections to planned $8.4 billion merger (Reuters)

TEMU/SHEIN: Temu and Shein face fallout from Mexico's new tariff (Nikkei)

US/CHINA: China Flexes Lithium Dominance With Plans for Tech-Export Curbs (Bloomberg)