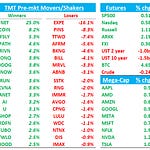

TMTB: MDB ORCL First Takes

MDB +10%: Looks Strong with Q3 rev numbers way above bogeys and Atlas stronger as well. Q4 inline-ish with buyside but co’s guide typically viewed as conservative.

The bull case of accelerating revs heading in 2025 gets strong support as overal revs +22% vs 13% last q on a 10 pt easier comp. Comps get easier over the next several quarters, so guide will be viewed as conservative and bulls will hope that rev growth can get back to mid 20s.

Revenue $529.4M, +22% y/y, EST $497.5M - we pointed out low estimates in our preview and this is more in line with historical beat of 6% vs 3-4% in the last couple of q’s.

Atlas revenue growth was 26% vs. the Street at ~24%, inline to slightly better than buyside

Q4 rev guide $517m vs Street at $509m inline with buyside and will be viewed as conservative.

COO/CFO stepping down

ORCL -9%: Misses Revs - Cloud weaker; IaaS inline; EPS inline

Revs missed and IaaS and Cloud came in weaker at +24% vs bogeys at 25% (street at 23%). Waiting for the guide on the call…

ORCL RESULTS: Q2

- ADJ revenue $14.06B, +8.6% y/y, EST $14.12B

- Revenue in constant currency +9%, EST +8.34%

- ADJ EPS $1.47 vs. $1.34 y/y, EST $1.48

- Cloud revenue (IaaS plus SaaS) $5.9B, EST $6B

- Cloud Infrastructure revenue (IaaS) $2.4B, EST $2.42B

- Cloud Infrastructure revenue (IaaS) in constant currency +52%, EST +50.9%

- Cloud Application revenue (SaaS) $3.5B, EST $3.58B

- Cloud Application revenue (SaaS) in constant currency +10%, EST +10.6%

- Cloud services and license support revenue $10.81B, +12% y/y, EST $10.81B

- Cloud license and on-premise license revenue $1.20B, +1.4% y/y, EST $1.17B

- Hardware revenue $728M, -3.7% y/y, EST $717.8M

- Service revenue $1.33B, -2.8% y/y, EST $1.32B

- ADJ operating income $6.10B, +10% y/y, EST $6.13B

- ADJ operating margin 43% vs. 43% y/y, EST 43.3%