Huawei amid sanctions beats Ericsson and Nokia on every measure

华为在制裁中在各项指标上都击败了爱立信和诺基亚

The Chinese equipment vendor seems to have had a much better year than either of its Nordic rivals and now dwarfs them on R&D spend.

这家中国设备供应商似乎比其北欧竞争对手今年的表现要好得多,现在在研发支出上使他们相形见绌。

Huawei's default settings look like melodrama for the bad times and humility for the good. When it was first struck by US sanctions, the Chinese equipment maker compared itself to a fighter plane hit by flak whose sole mission was to remain airborne. After gaining significant altitude last year for the first time since 2019, it showed restraint rather than jubilation. "We've been through a lot over the past few years. But through one challenge after another, we've managed to grow," said Hu Houkun, the rotating chairman who currently sits in the pilot's seat, in its latest annual report.

华为的默认设置看起来像是坏时光的情节剧,也是好时光的谦逊。当它首次受到美国制裁的打击时,这家中国设备制造商将自己比作一架被高射炮击中的战斗机,而后者的唯一任务是保持空中飞行。在去年自 2019 年以来首次获得显着高度后,它表现出克制而不是欢呼雀跃。“在过去的几年里,我们经历了很多。但通过一个又一个的挑战,我们成功地实现了增长,“目前坐在飞行员座位上的轮值董事长胡 Houkun 在其最新的年度报告中表示。

If US sanctions were intended to put Huawei in a fatal tailspin, they have clearly missed their target. Yes, the company's sales last year were 21% down on the high point of 2020. But that is due entirely to a collapse at Huawei's smartphone business and not to any engine problems in networks, the unit that supposedly had US authorities in such a panic. Their justification for cutting Huawei off from vital US technologies (not, seemingly, as vital as everyone thought) was that dastardly Chinese forces might slip something nasty into Huawei's network products, then popular among US allies.

如果美国的制裁旨在让华为陷入致命的困境,那么他们显然没有达到目标。是的,该公司去年的销售额比 2020 年的高点下降了 21%。但这完全是由于华为智能手机业务的崩溃,而不是网络中的任何引擎问题,该部门本应让美国当局陷入如此恐慌。他们切断华为与美国重要技术联系的理由(似乎并不像大家想象的那么重要)是,卑鄙的中国势力可能会在华为的网络产品中塞入一些令人讨厌的东西,这些产品当时在美国盟友中很受欢迎。

Strikingly, this networks unit – today called the "ICT infrastructure" business – last year outperformed both Ericsson and Nokia, Nordic rivals allowed to cruise freely through airspace in Europe and other countries that Huawei had previously occupied. Its headline revenues were up 2.3%, to about 362 billion Chinese yuan (US$50 billion). On a constant-currency basis, Nokia's (generated almost entirely from network sales) fell 8% while revenues at Ericson's mobile networks unit dropped 15%.

引人注目的是,这个网络部门——今天被称为“ICT 基础设施”业务——去年的表现超过了爱立信和诺基亚,这两家北欧竞争对手被允许在欧洲和华为以前占据的其他国家的空域自由巡航。其整体收入增长 2.3%,达到约 3620 亿元人民币(500 亿美元)。按固定汇率计算,诺基亚(几乎完全来自网络销售)下降了 8%,而爱立信移动网络部门的收入下降了 15%。

The China syndrome 中国综合症

Both European companies were badly hurt by spending cuts in the US, from which Huawei has been largely excluded for years. And while Huawei has lost a few deals in Europe and other pro-US countries, American lawmakers can do little about its position in China, home to about 1.4 billion people and gazillions of mobile sites. Indeed, that position looks even stronger. An unwelcome consequence of the European backlash against Chinese vendors seemed to be the loss by Ericsson and Nokia of market share in a retaliatory China. At Ericsson, which breaks out the figure, China sales dropped from 15.9 billion Swedish kronor ($1.5 billion) in 2019 to SEK10.7 billion ($1 billion) last year.

这两家欧洲公司都因在美国削减开支而受到严重损害,华为多年来在很大程度上被排除在美国之外。虽然华为在欧洲和其他亲美国家失去了一些交易,但美国立法者对它在中国的地位无能为力,中国拥有约 14 亿人口和数以百万计的移动网站。事实上,这种立场看起来更加强大。欧洲对中国供应商的强烈反对的一个不受欢迎的后果似乎是爱立信和诺基亚在报复性的中国中失去了市场份额。据爱立信(Ericsson)统计,中国市场的销售额从2019年的159亿瑞典克朗(15亿美元)下降到去年的107亿瑞典克朗(10亿美元)。

Operators still buying network products from Huawei do not appear to have seen the drop-off in performance that someone buying a Huawei smartphone amid sanctions would have experienced. This is partly because Huawei has always designed its own network software, while its smartphones previously used the Android operating system that originated with Google. On the networks side, it also looks more self-sufficient in hardware.

仍在从华为购买网络产品的运营商似乎没有看到在制裁期间购买华为智能手机的人所经历的性能下降。部分原因是华为一直设计自己的网络软件,而其智能手机之前使用的是源自谷歌的 Android 操作系统。在网络方面,它在硬件方面看起来也更加自给自足。

What it currently lacks is access to Samsung and TSMC, the world's most advanced chip foundries, both furnished with US tools. Networks, however, are typically a couple of generations behind smartphones on the size of transistors. Forthcoming iPhones will reportedly feature chips based on the 2-nanometer (billionths of a meter) process. The Nokia basestations that include 5-nanometer chips are considered cutting edge.

它目前缺乏的是与三星和台积电这两家世界上最先进的芯片代工厂的联系,这两家公司都配备了美国工具。然而,网络在晶体管的大小上通常比智能手机落后几代。据报道,即将推出的 iPhone 将采用基于 2 纳米(十亿分之一米)工艺的芯片。包含 5 纳米芯片的 Nokia 定位器被认为是最先进的。

If Huawei now looks worse off here, it continues to boast other advantages. Those include the design of power amplifiers based on gallium nitride, seen as a more energy-efficient option than silicon. "For this component, we are leading the industry one generation ahead of our competitors, and that is why, according to third parties who report, we keep leading market share," said Philip Song, the chief marketing officer for carrier networks, during a press conference at the recent Mobile World Congress in Barcelona.

如果华为现在在这里看起来更糟,它将继续拥有其他优势。其中包括基于氮化镓的功率放大器设计,氮化镓被视为比硅更节能的选择。“对于这个组件,我们比竞争对手领先一代人,这就是为什么,根据第三方报告,我们保持领先的市场份额,”运营商网络首席营销官 Philip Song 在最近于巴塞罗那举行的世界移动通信大会的新闻发布会上说。

The seeds of growth 成长的种子

However its products measure up against those of Ericsson and Nokia, Chinese operators clearly source a bigger share of their equipment from Huawei and local rival ZTE than they ever have. As 5G matures, and questions surround the telco investment case for a future splurge on even more advanced equipment, Huawei faces many of the same business-model challenges as its western rivals. But unlike those companies, it has several growth stories to tell.

无论其产品与爱立信和诺基亚的产品相媲美,中国运营商从华为和当地竞争对手中兴通讯那里采购的设备份额显然比以往任何时候都大。随着 5G 的成熟,以及围绕电信公司未来挥霍更先进设备的投资案例的问题,华为面临着许多与西方竞争对手相同的商业模式挑战。但与这些公司不同的是,它有几个增长故事要讲。

These include a consumer unit in apparent recovery. Huawei seems to have obtained 7-nanometer chips from SMIC, a Chinese foundry, and used these along with in-house 5G designs and operating-system software to produce a smartphone branded the Mate 60 Pro, confounding critics who assumed US sanctions had put such technologies beyond reach. Demand for that gadget helped to boost consumer revenues by 17%, to about RMB251 billion ($34.7 billion).

其中包括一个明显恢复的消费者部门。华为似乎从中国代工公司中芯国际(SMIC)获得了7纳米芯片,并将这些芯片与内部的5G设计和操作系统软件一起生产了一款名为Mate 60 Pro的智能手机,这让批评者感到困惑,他们认为美国的制裁使这些技术遥不可及。对该设备的需求帮助消费者收入增长了 17%,达到约 2510 亿元人民币(347 亿美元)。

This is still far below the RMB483 billion ($66.8 billion) it reported in 2020, before Huawei sold off some of its smartphone assets. And critics doubt SMIC can profitably crank out large volumes of 7-nanometer chips without access to extreme ultraviolet lithography machines. The supply of those is currently monopolized by ASML, a Dutch company. And Dutch authorities have denied ASML export licenses to serve China.

Much smaller, but potentially important, are Huawei's cloud computing, digital power and intelligent automotive solutions units. The first, in particular, could ultimately play a big role in China, where the main rival is Alibaba, another local firm, and not AWS, Google or Microsoft, the "hyperscalers" that have put down roots elsewhere. International concern about the power of those three US companies could be an opportunity for Huawei in some countries, according to Huawei employees. Sales rose 22% last year, to more than RMB55 billion ($7.6 billion).

An R&D chasm

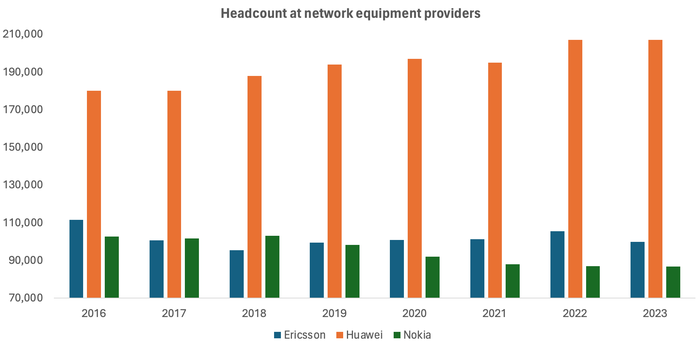

But the big difference between Huawei and its European rivals is at the resources level. A US spending slowdown has resulted in further shrinkage at Ericsson and Nokia, which together cut nearly 5,800 jobs last year and today employ about 27,500 fewer people than they did in 2016. Huawei, by contrast, made no changes last year and has gained 27,000 employees since 2016. What's more, at current exchange rates, Huawei makes dramatically more in sales per employee than either Ericsson or Nokia. Its figure of about $472,000 last year compares with roughly $276,000 at Nokia and $245,000 at Ericsson.

(Source: companies)

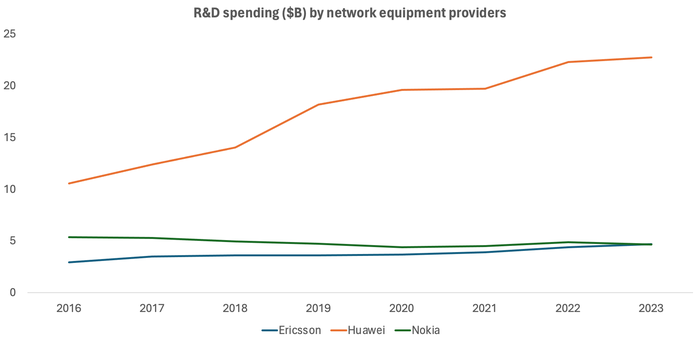

A chasm has opened in research and development (R&D). In 2016, a Huawei already generating more than a third of its revenues from consumer gadget sales outspent a combined Ericsson and Nokia by less than $2.3 billion, at today's exchange rates. Last year's difference was $13.4 billion. Ericsson has upped annual spending by around $1.8 billion over this period, while Nokia has cut it by $720 million. Huawei's annual investments have grown by $12.2 billion.

(Source: companies)

Critics insist a direct comparison is invalid because Huawei is active in sectors the Nordic vendors have either quit or never entered. As reasonable as that sounds, the gap would be significant even if R&D spending reflected the split of sales. Last year, for instance, some 51.4% of Huawei's revenues were generated at its ICT infrastructure unit. The same percentage of R&D expenditure equates to about $11.7 billion.

The US may be running out of ammunition. Its main weapon was always the west's dominance of the semiconductor industry. That came via companies like Intel, Qualcomm and Nvidia – the designers of chips – as well as the software and tools used in mainly Asian foundries. But the Biden administration has done about as much as it can to close loopholes and seal off Chinese access. As China works hard to develop homegrown alternatives, it is the west's own equipment vendors that are struggling.

About the Author

You May Also Like