felixmizioznikov/iStock Editorial via Getty Images

It has been over six months since I last covered Tesla, Inc. (NASDAQ:TSLA) and nearly 10 years since my first article on the stock. Earlier this year, I noted that at around $150/share the valuation had become difficult to ignore, and in a separate article, I detailed how full self-driving (“FSD”) presented a major upside catalyst and upgraded to a strong buy. Since then, Tesla has tripled off its lows and investors in the stock are very aware of FSD. In fact, I will argue that very aspirational targets for the software are required to support the present valuation of the company. The Optimus robot is another potential catalyst, but sales remain far away, even though the company's charismatic CEO Elon Musk predicts that Optimus will contribute to sales sooner.

自我上次覆蓋特斯拉,Inc. (NASDAQ: TSLA) 以來已經過了六個多月,而自我的第一篇關於該股票的文章以來已經接近 10 年。今年早些時候,我指出,當股票價格約為每股 150 美元時,其估值變得難以忽視,而在另一篇文章中,我詳細闡述了全自動駕駛(“FSD”)如何成為一個主要的上行催化劑,並將其評級提升為強烈買入。自那以來,特斯拉的股價已經從低點翻了三倍,股票投資者對 FSD 非常熟悉。事實上,我將論證,要支撐公司當前的估值,對該軟件的目標必須非常雄心勃勃。Optimus 機器人是另一個潛在的催化劑,但銷售仍遙遙無期,儘管公司首席執行官埃隆·馬斯克預測 Optimus 將更快地貢獻銷售。

Tesla's stock has priced in very optimistic targets for both these emerging technologies, anticipating their arrival. As such, buying Tesla today presents far more risk than buying the stock early this year did. FSD, while a transformational technology, may not be material enough to power the substantial revenue and EPS growth that analysts are anticipating in the coming years. As a Tesla owner, I have used FSD for several months and have been impressed by it, while declining to pay for it. This is largely due to my current residence (Pittsburgh), which is not a friendly location for FSD. Perhaps this gives me a more realistic outlook on the technology.

特斯拉的股票已經計入了對這兩種新興技術的非常樂觀的目標,預期它們的到來。因此,今天購買特斯拉的風險遠大於今年早些時候購買股票的風險。FSD 雖然是一項轉變性的技術,但可能不足以推動分析師預期的未來幾年的大幅收入和每股收益增長。作為特斯拉的車主,我已經使用 FSD 幾個月了,對其印象深刻,但拒絕為其付費。這主要是因為我目前的居住地(匹茲堡)對 FSD 並不友好。或許這讓我對該技術有更現實的看法。

In my opinion, FSD is a useful driver assistance tool, but remains far from achieving autonomous driving in all locations. As such, I expect there are future bumps in the road as Tesla as investors become aware that FSD is not quite as transformational as they are pricing in, at least in the short term. Therefore, I am downgrading Tesla to HOLD.

在我看來,FSD 是一個有用的駕駛輔助工具,但距離在所有地點實現自動駕駛還很遠。因此,我預期隨著投資者意識到 FSD 的轉變性不如他們所預期的那麼大,特斯拉將會遇到一些困難。因此,我將特斯拉降級為持有。

Tesla's Value as a Car Company

特斯拉作為汽車公司的價值

CEO Elon Musk has stated that Tesla is “not a car company,” instead proposing that the company should be considered “an AI and robotics company.” Personally, I prefer to view Tesla as multiple companies: a car and energy company, an AI company with its FSD, and a robotics company (Optimus). We can break these segments down to determine how optimistic the market is overall on Tesla.

首席执行官埃隆·马斯克表示,特斯拉“不是一家汽车公司”,而是应该被视为“一家人工智能和机器人公司”。我个人更愿意将特斯拉视为多家公司:一家汽车和能源公司、一家拥有其 FSD 的人工智能公司,以及一家机器人公司(Optimus)。我们可以将这些部分分解,以确定市场对特斯拉的整体乐观程度。

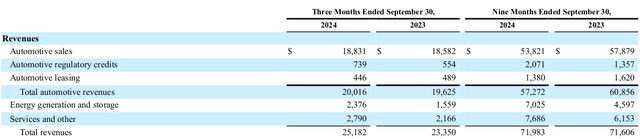

In the most recent quarterly report, $20.0 billion (79%) of revenues were automotive, with the remainder in energy generation and storage ($2.38 billion, 9%) as well as services (11%). Since the company's services relate mostly to servicing its automotive fleet, the current revenues of Tesla are dominated by its automotive business.

在最近的季度报告中,200 亿美元(79%)的收入来自汽车,其余部分来自能源生产和储存(23.8 亿美元,9%)以及服务(11%)。由于公司的服务主要与其汽车车队相关,特斯拉的当前收入主要由其汽车业务主导。

Tesla: Revenues by Segment (Tesla Q3 2024 10-Q Report)

特斯拉:按部门划分的收入(特斯拉 2024 年第三季度 10-Q 报告)

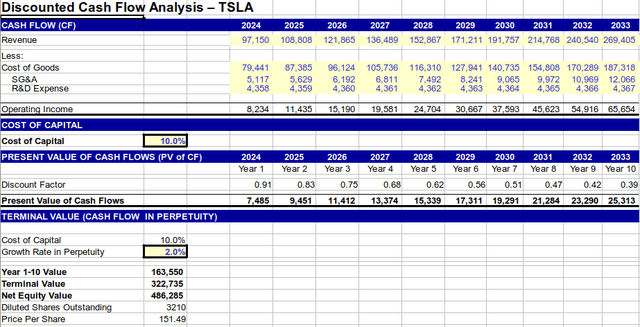

Putting a value on the automotive business is relatively straightforward. This segment is no longer in a hyper-growth phase. Expecting revenues to grow by 12% per year for the next 10 years, while margins expand (costs increasing by 10% a year) nets a present value of approximately $151/share.

为汽车业务估值相对直接。该部门已不再处于超高速增长阶段。预计未来 10 年收入每年增长 12%,同时利润率扩大(成本每年增加 10%),得出的现值约为每股 151 美元。

Tesla: Legacy Automotive Business DCF (Author's Analysis)

特斯拉:传统汽车业务 DCF(作者分析)

In other words, fairly rosy assumptions of 12% revenue growth, expanding margins and low costs only reach a value greatly lower than the current market price for Tesla. Perhaps I can entertain that as a premium car company, Tesla should enjoy a premium valuation.

换句话说,即使假设收入每年增长 12%,利润率扩大且成本低,也只能达到远低于特斯拉当前市场价格的估值。或许我可以认为,作为一家高端汽车公司,特斯拉应该享有溢价估值。

In the table below, Tesla is compared with several other companies that make cars or premium cars. The most highly valued peer is Ferrari N.V. (RACE) with Tesla far surpassing the valuation of any standard car manufacturer.

在下表中,特斯拉与几家制造汽车或高端汽车的公司进行了比较。估值最高的同行是法拉利 N.V. (RACE),特斯拉的估值远远超过了任何标准汽车制造商。

| Company 公司 | Symbol 代码 | P/E (FWD) 前瞻市盈率 (P/E) | Market Cap. (billions) 市值 (十亿美元) | Price/Sales 市销率 (Price/Sales) | EV/EBITDA 企业价值/息税折旧摊销前利润 (EV/EBITDA) |

| Tesla 特斯拉 | TSLA | 175.6 | $1,400 | 14.3 | 104.2 |

| Ferrari 法拉利 | RACE | 53.0 | $81.4 | 11.4 | 35.6 |

| Toyota 丰田 | TM | 7.70 | $230.0 | 0.73 | 8.66 |

| Ford 福特 | F | 5.77 | $41.3 | 0.23 | 18.48 |

| GM | GM | 5.12 | $57.8 | 0.34 | 8.88 |

The most optimistic comparison from this table is that Tesla would trade around $347/share to achieve the same price/sales ratio as Ferrari. However, as a business segment, it is difficult to value the automotive legacy business of Tesla above $200/share or certainly $250/share. As seen from the market capitalization, Ferrari enjoys a very specific niche.

从这张表中最乐观的比较是,特斯拉的股价可能达到每股 347 美元,以实现与法拉利相同的市销率。然而,作为业务部门,很难将特斯拉的传统汽车业务估值超过每股 200 美元或肯定不超过 250 美元。从市值可以看出,法拉利享有非常特定的市场定位。

Thus, the question for current buyers of the stock remains. Can FSD and Optimus support a valuation of at least $200/share?

因此,对于当前的股票买家来说,FSD 和 Optimus 能否支持至少每股 200 美元的估值仍然是一个问题。

Valuing the Intangible: How Much is FSD Worth?

评估无形资产:FSD 值多少?

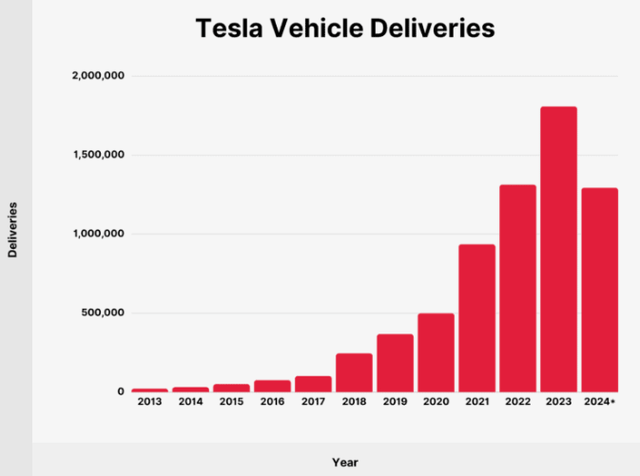

Since Tesla began selling cars, there have been approximately 6.7 million deliveries from 2013 until the first half of 2024. With FSD typically costing $8000 per license, the most optimistic math would put the value at $53.6 billion ($16.70/share) with a 100% penetration rate. Obviously, this is unrealistic and Tesla has reduced the price of FSD to $4500 on new cars in an attempt to increase penetration.

自特斯拉开始销售汽车以来,从 2013 年到 2024 年上半年,大约交付了 670 万辆汽车。FSD 通常每个许可证售价 8000 美元,最乐观的计算将价值定为 536 亿美元(每股 16.70 美元),假设 100% 的渗透率。显然,这是不现实的,特斯拉已将 FSD 的价格降低到 4500 美元,以尝试提高渗透率。

However, it must be repeated for emphasis: if every Tesla driver paid $8000 per car, this would represent a one-time profit of $16.70/share (6.7 million cars * $8000/3210 million shares outstanding). The difficult aspect is that Tesla has become so huge that even major advances in sales move the needle only modestly.

然而,必须再次强调:如果每位特斯拉司机每辆车支付 8000 美元,这将代表每股 16.70 美元的一次性利润(670 万辆车 * 8000 美元 / 32.1 亿股流通股)。困难在于特斯拉变得如此庞大,即使在销售方面取得重大进展,也只能适度推动股价。

Tesla Deliveries by Year (backlinko.com/tesla-stats)

特斯拉按年交付量 (backlinko.com/tesla-stats)

However, Tesla intends to introduce an entirely separate robotaxi business could create even greater value for FSD. In this case, we have some idea of the value of such a network because ride-sharing is a mature business with Uber Technologies, Inc. (UBER) and Lyft, Inc. (LYFT) representing a market capitalization of $126 billion and $5.9 billion respectively.

然而,特斯拉打算引入一个完全独立的机器人出租车业务,这可能会为 FSD 创造更大的价值。在这种情况下,我们对这种网络的价值有一些了解,因为共享出行是一个成熟的业务,Uber Technologies, Inc. (UBER) 和 Lyft, Inc. (LYFT) 分别代表 1260 亿美元和 59 亿美元的市值。

In this case, if Tesla dominated to completely upend and capture Uber and Lyft's business, it would be worth $131.9 billion or $41.09/share. Of course, Tesla is not without competition, Alphabet Inc.'s (GOOG), (GOOGL) Waymo is rapidly expanding as well. While Tesla is a fearsome competitor, it is difficult to imagine it capturing the entire business.

在这种情况下,如果特斯拉完全颠覆并捕获 Uber 和 Lyft 的业务,其价值将达到 1319 亿美元或每股 41.09 美元。当然,特斯拉并非没有竞争,Alphabet Inc. (GOOG), (GOOGL) 的 Waymo 正在迅速扩张。虽然特斯拉是一个可怕的竞争对手,但很难想象它能捕获整个市场。

However, the simplistic analysis above shows that even with perfect penetration, it is difficult to see how FSD alone can achieve the minimum $200/share valuation premium that exists today for Tesla. What the market seems to expect moving forward is not simply rosy growth, but rather a complete upending of the entire automotive model. While I can entertain that this could happen, I find it very unlikely that it will occur fast enough to justify the current rally.

然而,上述简单的分析显示,即使完全渗透,也很难看到 FSD 单独如何实现特斯拉目前存在的每股 200 美元的估值溢价。市场似乎期望的不仅仅是乐观的增长,而是对整个汽车模式的彻底颠覆。虽然我可以想象这可能发生,但我认为它不太可能足够快地发生以证明当前的反弹是合理的。

Tesla: Analyst Expectations for Growth

特斯拉:分析师对增长的预期

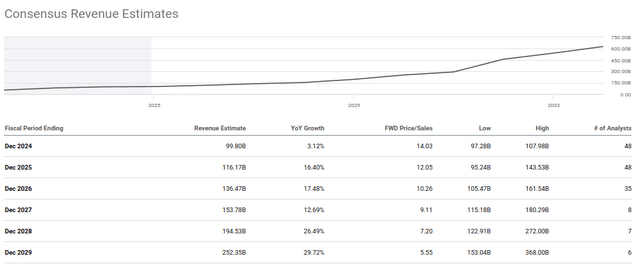

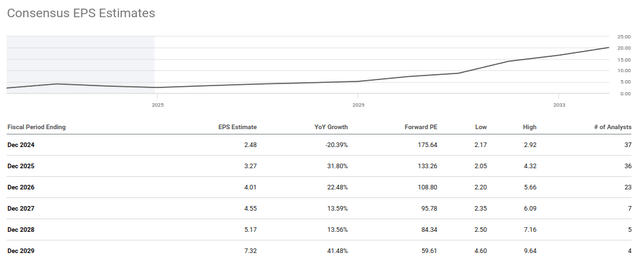

A stock can move higher, but over the long term, it is the growth of revenues and earnings per share (EPS) that must ground it in reality. The difficulty for Tesla is that the company is already so large that the greater than double-digit growth in sales expected by analysts begins to seem very aspirational.

股票可以走高,但从长期来看,必须基于收入和每股收益 (EPS) 的增长来支撑其现实性。特斯拉的困难在于,公司已经如此之大,分析师预期的销售额两位数以上的增长开始显得非常雄心勃勃。

To justify increasing price targets, analysts must increase their projections for revenues and EPS. The share price has now run up so substantially that modest year-over-year growth of 3.1% this year is expected to reach double-digits and nearly 30% annualized by 2029. This level of sales growth from a company as large as Tesla would be nearly unprecedented.

为了证明更高的价格目标,分析师必须提高他们对收入和 EPS 的预测。股价已经大幅上涨,今年预计的年同比增长仅为 3.1%,到 2029 年预计将达到两位数,年化接近 30%。对于像特斯拉这样大的公司来说,这种水平的销售增长几乎是前所未有的。

Tesla: Consensus Revenue Estimate (Seeking Alpha)

特斯拉:共识收入预测 (Seeking Alpha)

Even achieving this level of growth over 5 years with expanding margins amounts to a P/E of 59.6x on 2029 earnings. It is simply becoming impossible to value Tesla by any standard metric of valuation. This is even true bearing in mind that analyst's expectations for growth are ambitious.

即使在 5 年内实现这一增长水平并扩大利润率,2029 年的市盈率也将达到 59.6 倍。根据任何标准的估值指标,特斯拉的估值已经变得不可能。即使考虑到分析师的增长预期非常雄心勃勃,也是如此。

Tesla: Consensus EPS Estimates (Seeking Alpha)

特斯拉:共识 EPS 预测 (Seeking Alpha)

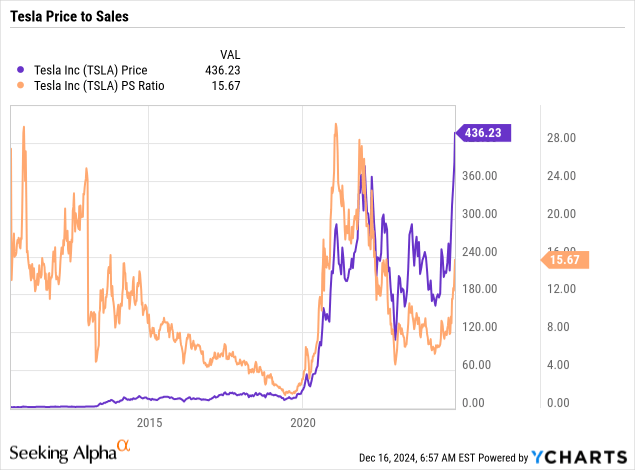

At this stage, perhaps the best way to predict where the current rally could end is based on Tesla's own history. In 2021, the stock eventually peaked with a price-to-sales multiple of approximately 28x. Revisiting this stratospheric level would require a price target of $780/share.

在这个阶段,或许预测当前反弹可能结束的最佳方式是基于特斯拉自身的历史。2021 年,股票最终以约 28 倍的市销率达到峰值。重新达到这一天文数字的水平将需要每股 780 美元的目标价。

To be clear: I am not predicting that Tesla will reach this level. Among the spectrum of possible outcomes for the stock, this is the level that seems the most optimistic based on the company's historical valuation. Next year, analysts expect 16.4% revenue growth, if Tesla can continue to outperform expectations, the stock could approach these levels, but eventually, a drop will occur because no company this large can maintain such aggressive growth.

需要明确的是:我并不是预测特斯拉将达到这一水平。在股票可能的结果范围内,这是基于公司历史估值的最乐观水平。明年,分析师预计收入增长 16.4%,如果特斯拉能够继续超出预期,股票可能会接近这些水平,但最终会因为没有如此大的公司能够维持如此激进的增长而下跌。

Perhaps I am too pessimistic about the prospects of Tesla's Optimus robot. Clearly, much of the later sales growth is assuming a successful launch in this field. While the implications of Optimus may be massive, I expect the humanoid robot to be a very niche product to begin with. Optimus is projected to sell for $30,000, but how many individuals will be willing to pay for such a product? Since there is not yet a working prototype it is difficult to say, but in this case, I prefer not to assign value as yet.

也许我对特斯拉 Optimus 机器人的前景过于悲观。显然,后期的销售增长很大程度上假设该领域的成功推出。虽然 Optimus 的影响可能巨大,但我预计这种人形机器人一开始将是一个非常小众的产品。Optimus 预计售价为 30,000 美元,但有多少个人愿意为此付费?由于目前还没有工作原型,很难说,但在这种情况下,我更愿意暂时不赋予其价值。

Conclusions 结论

Tesla is a wonderfully innovative company, but the price to invest has become very high. As such, I am downgrading Tesla, Inc. stock to HOLD based on valuation concerns. While this piece is not investment advice, I think investors looking to allocate new capital to the concept of FSD should consider Google as an alternative. Personally, I consider it to have been a great opportunity to invest in a wonderful company like Tesla at a fair price earlier this year. However, today seems like a much better time to take chips off the table, hoping that a fair price will reemerge someday.

特斯拉是一家非常创新的公司,但投资的价格已经变得非常高。因此,我基于估值问题将特斯拉,Inc. 股票降级为持有。虽然本文不是投资建议,但我认为寻求投资 FSD 概念的新资本的投资者应考虑 Google 作为替代选择。我个人认为,今年早些时候以合理的价格投资像特斯拉这样一家伟大的公司是一个很好的机会。然而,今天似乎是一个更好的时机来减少持股,希望有一天公平的价格会重新出现。

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

編輯注:本文討論了一種或多種不在主要美國交易所交易的證券。請注意這些股票的相關風險。

Comments (33)

恭喜那些在 我建議的 160 美元買入的人。

無法預測市場,因為你做不到。長期投資。你將會得到巨大的回報。

@easyxpress 關鍵在於特斯拉的定價已經完美無缺。如果一切順利,十年後它的股價確實可能達到每股 1000 美元——市值超過三萬億。要獲得巨大回報,最好購買那些不是每個人都喜歡的股票。這就像巴菲特說的,當其他人貪婪時要保持恐懼。

它被高估了,但我認為我們正朝著 500 美元以上前進。一旦取消電動車補貼,我認為許多傳統汽車製造商將無法競爭,最終特斯拉將以更低的價格生產出本質上更好的產品。特斯拉的股票似乎已經計入了這種情況——未來十年,傳統汽車製造商將受到沉重打擊。

@dlevine007 對美國傳統汽車製造商來說確實如此。但請記住,特斯拉在中國銷售了很多車輛,如果中國國內汽車製造商在亞洲和歐洲佔有更多份額,特斯拉在中國的銷售可能會受到嚴重影響。

今年可能是 7500 美元電動車稅收補貼的最後一年。此外,當唐納德·特朗普上任時,租賃漏洞也可能消失。特斯拉的價格將會下降。There is a fairly high chance for an across-the-board price-cuts in the beginning of January ... Probably on the first itself ... Very similar to the 2023 story.

1 月初全面降價的可能性很大……可能就在第一天……非常類似於 2023 年的故事。However, this time the price cut affected all carmakers as Tesla is now much bigger than 2 years back ... A likely drop in the TSLA, STLA, GM and F prices ... A drop in the share prices as well.

但這次價格下調影響了所有汽車製造商,因為特斯拉現在比兩年前大得多……特斯拉、STLA、GM 和 F 的價格可能會下降……股票價格也可能下降。

如果中國正在準備大幅貶值,這對特斯拉來說顯然是非常利好的。希望這不會引發貨幣戰爭,這是大蕭條和第二次世界大戰的主要原因之一,但鑑於第三次世界大戰正在進行,很容易看到一羣非常壞的人突然變得機遇主義。在此期間,長期持有特斯拉股票遠遠不止這些,當然也是如此。

10 月 23 日,TSLA 的價格為 213.65 美元。54 天前。118%的增長,54 天內市值增加了 7000 億美元。我想這些數字應該讓每個人都思考一下。

是的,因為埃隆現在是特朗普的朋友……Shorts getting squeezed. 空頭被擠壓。$ 471+ go baby go !!!! 120.45% increase now

$ 471+ 去吧寶貝!!! 120.45%的增長

@Clark158f1 是的,這太瘋狂了。購買長期看跌期權並賣出抵消的短期看跌期權,同時賣出一些股票。不確定這場派對何時結束,但 3 個交易日內 25%的增長太瘋狂了。

我認為這已經超出了荒謬,但我已經沒有持倉,因為我在低位賣出了。I can't go long here and I'm not going short either. My guess is we see sellers in January once investors can put profits into the next tax year.

我在這裡不能做多,也不會做空。我的猜測是,一旦投資者可以將利潤轉入下一個稅年,1 月份我們會看到賣家。

@Clark158f1 這是明智的,我已經平倉了一些對銀行股的看跌期權,所以需要找到其他投資標的,這就是其中之一。我試圖保持整體中立,所以這是我的下行對沖之一。很有趣觀看!

特斯拉“遠離”完全自動駕駛?當特斯拉可以連續幾個小時無需干預地行駛,就像今天 v13 版本一樣,並計劃明年生產 RoboTaxi 時,我發現這很難相信。作者持有谷歌的立場(即 Waymo),所以對這種感覺有偏見。Waymo 在市場滲透率方面將是一個微不足道的數字。特斯拉將佔據市場並繼續保持不可動搖的領先地位。打賭對抗埃隆,就像許多人在 SA 上所做的那樣,並沒有取得好結果,所以從這次經歷中吸取教訓,將情緒從投資策略中剔除,並查看數據。

The doubters concentrate on the noise!

質疑者只關注噪音!

And miss the big picture!

而忽略了大局!

這家公司在過去兩年裡營收零增長,利潤負增長。業務簡直是平的。今年它的每股收益將達到 2 美元。希望是不存在的自動出租車和機器人產品將價值萬億美元。你無法編造這些東西。On the other hand, the hype machine is running full blast and the stock price is headed to the stratosphere. The stock price is totally disconnected from the floundering business. If bitcoin can be $100,000 with zero earnings then Tesla can be $100,000 with two-dollar earnings.

另一方面,炒作機器正在全速運轉,股票價格正在衝向平流層。股票價格完全脫離了掙扎的業務。如果比特幣可以在零收益的情況下達到 10 萬美元,那麼特斯拉可以在每股收益 2 美元的情況下達到 10 萬美元。

Floundering business? 掙扎的業務?

The market disagrees! 市場不同意!

And that’s what matters! 這才是關鍵!

新車的車載電腦故障。

electrek.co/...Interesting read....wonder how they can go to ROBOTAXI with these type of issues.

有趣的文章……不知道在這些問題的情況下他們如何轉向 ROBOTAXI。Seems like a forumla for disaster.

這看起來像是災難的公式。

Several reports? Out of how many???

多份報告?有多少份?

今天無消息上漲 5%。這就是我們在互聯網泡沫末期看到的那種狂熱的價格走勢,當時股票圖表直線上升。

必須同意。TSLA 將長期佔據主導地位,但哇,基於選舉的這波漲勢真是驚人。

你是否考慮到埃隆正在發明產品以使社會更有效地運作,這就是你支持一家推動變革的公司的原因?

以這種速度,TSLA 到新年時將達到 600 美元。Wedbush 下周的目標價將達到 1000 美元,這場遊戲將繼續進行,直到它不再進行。每個人都知道他們的價值。

我無法想像在 460 美元時買入……也許我應該用別人的錢投資,這樣我就可以大膽一搏。

@Clark158f1 讓弱手出局

謝謝你公正而理智的分析。但問題在於,許多人不是根據估值而是根據情緒買入股票。他們最終往往會受到損失,這是事實,但我懷疑特斯拉的股票價格將保持非理性的高位,直到 Waymo 對特斯拉的明顯優勢被更廣泛地認知。

I definitely agree and for what it's worth trying to ride the momentum train higher is a fine decision. But if I was still long the stock I would keep my eye on the exit at these valuations. Thanks for reading/commenting!

我完全同意,值得嘗試跟隨動量列車上漲是一個明智的決定。但如果我仍然持有股票,我會在這些估值下關注退出點。謝謝閱讀/評論!

@garycd 谷歌 CEO 已經駁斥了 Waymo 的明顯優勢。你的信息來源是什麼?你開過裝有 FSD 的特斯拉嗎?我每天都在開。

@Brendan O'Boyle 我在原則上同意,但問題在於,當所有人都跑向出口時,他們跑得太晚了。2000 年 4 月,當情緒轉變時,最初每個人都認為這是逢低買入的機會。當它下跌時,每個人都說,“好吧,這是一次調整。”然後它繼續下跌,人們認為,“好吧,我錯過了賣出的時機,所以我最好堅持下去,等待恢復。”然後它繼續下跌,人們說,“天哪,我將失去一切!”所以他們以 80%的損失賣出一切,試圖挽救他們剩下的少數財產。

@garycd 它將保持非理性的高水準,直到炒作冷卻。這已經完全脫離了任何理性的估值。

People think Waymo is a competitor to Tesla. 2 separate categories!

人們認為 Waymo 是特斯拉的競爭對手。兩個不同的類別!

@Brendan O'Boyle 非常歡迎!並繼續提供像這樣的優秀文章!

@StockJamm 請查看我在此處的帖子,內容是來自 ChatGPT 的早期分析師文章信息。Waymo 目前每周提供 150,000 次付費乘車服務,覆蓋超過 100 萬英里。特斯拉則沒有提供。Waymo 和 Zoom 都處於第 4 級,特斯拉則不是。Though Tesla stock recently got a boost from GM dropping out of the Robitaxi "race", this is really not good news for Tesla. It is another indication of how competitive and costly this endeavor is -- GM had spent $10 billion and determined not to continue.

雖然特斯拉股票最近因通用汽車退出機器人出租車「競賽」而受到提振,但這對特斯拉來說並不是好消息。這是另一個表明這項事業競爭激烈且成本高昂的跡象——通用汽車已花費 100 億美元並決定不再繼續。Waymo uses Lidar -- expensive but superior to relying on just visual cues like Tesla. I know from experience how hard it is to drive in bad weather -- LIDAR is a significant boost over relying on sight alone in such weather.

Waymo 使用雷達——雖然昂貴,但比特斯拉僅依靠視覺提示要優越。我從經驗中知道在惡劣天氣下駕駛有多難——在這種天氣下,雷達比單純依靠視覺有著顯著的優勢。And this whole endeavor is risky -- one bad accident can set a company back. This, apparently, was part of what happened to Uber and GM Cruise. Currently Waymo has a strong track record with fewer accidents, most of which are minor and caused by human drivers of other vehicles. Tesla has had some high profile accidents, where the blame is assigned to Tesla and not some other driver.

這整個事業都是有風險的——一次嚴重的事故可能會使公司倒退。顯然,這就是 Uber 和 GM Cruise 發生的部分情況。目前,Waymo 的事故記錄良好,事故較少,大多數事故都是輕微的,且由其他車輛的駕駛員引起。特斯拉則發生了一些高調的事故,責任被歸咎於特斯拉而非其他駕駛員。As I said you can check my posts on the earlier article -- but in brief here is what ChatGPT will say more or less if you ask how Tesla and Waymo compare:

正如我所說,您可以查看我對早期文章的帖子——但簡而言之,如果您問 ChatGPT 特斯拉和 Waymo 如何比較,它會這樣說:"While Tesla has made impressive advancements in consumer-accessible driver-assistance systems, its technology and real-world implementation are far behind Waymo in achieving true autonomy. Waymo is seen as a leader due to its focus on Level 4 systems, safer operation, and deployment of functioning robotaxis. Tesla’s reliance on cameras and its Level 2 system make it innovative but currently less capable than Waymo in delivering fully autonomous driving."

「雖然特斯拉在消費者可訪問的駕駛輔助系統方面取得了令人印象深刻的進展,但其技術和實際應用遠遠落後於 Waymo 在實現真正自動駕駛方面的成就。Waymo 被視為領導者,因為其專注於第 4 級系統、更安全的操作和機器人出租車的部署。特斯拉依賴於攝像頭和其第 2 級系統,使其具有創新性,但目前在提供完全自動駕駛方面的能力不如 Waymo。」

@NYCDart25 同意。可以在幾週後以 600 美元的價格出售期權,獲得一些額外的現金。