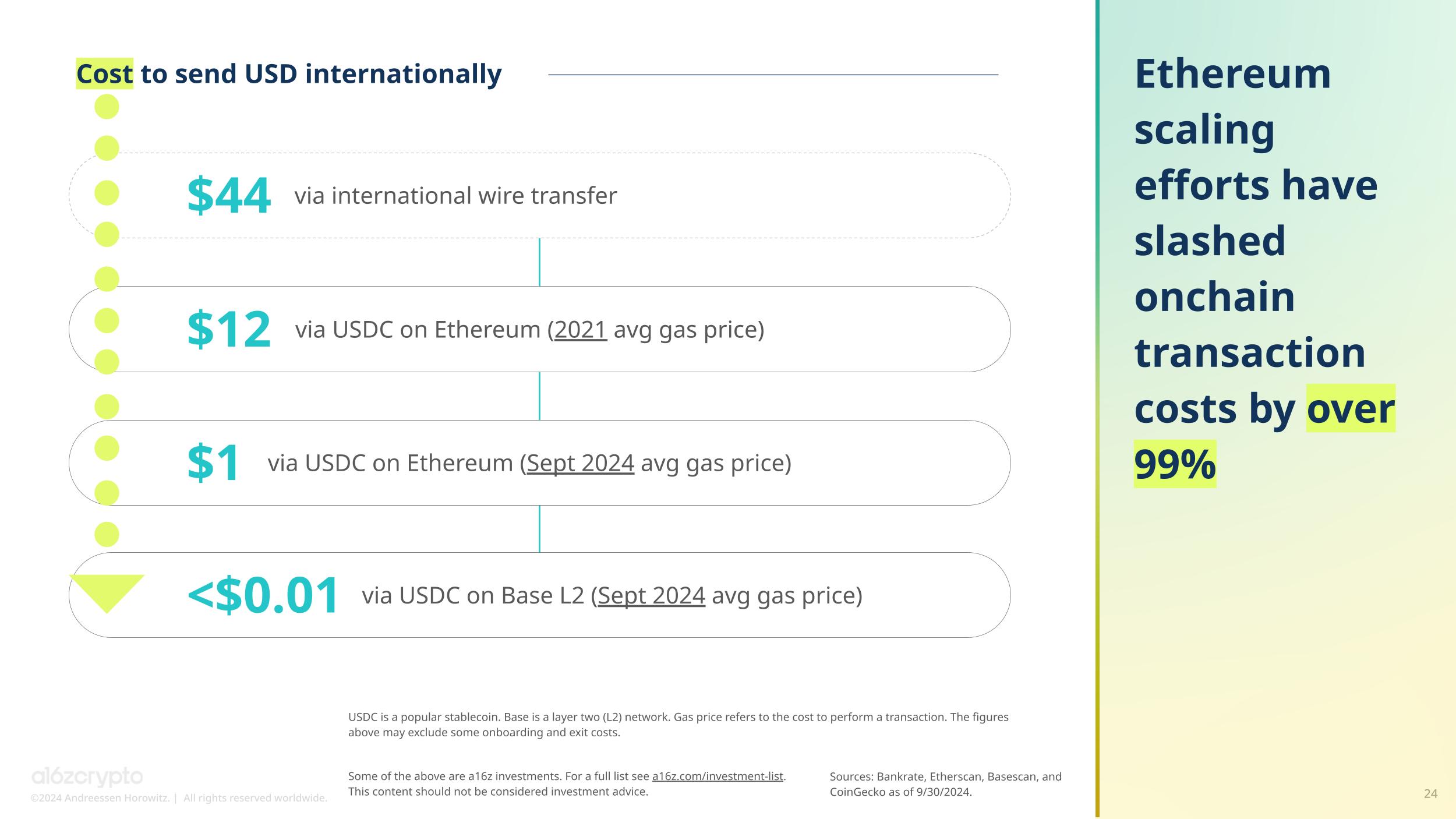

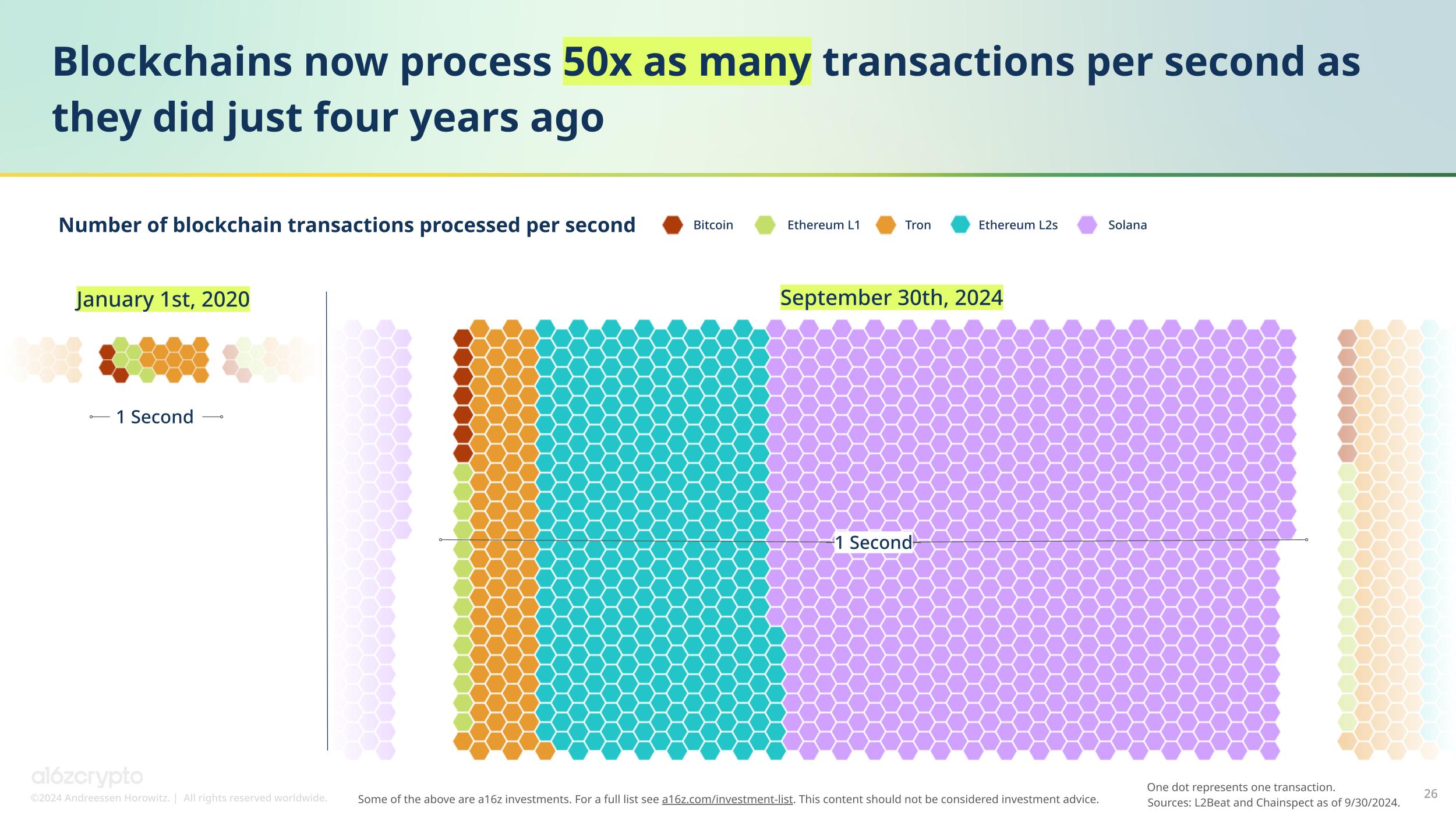

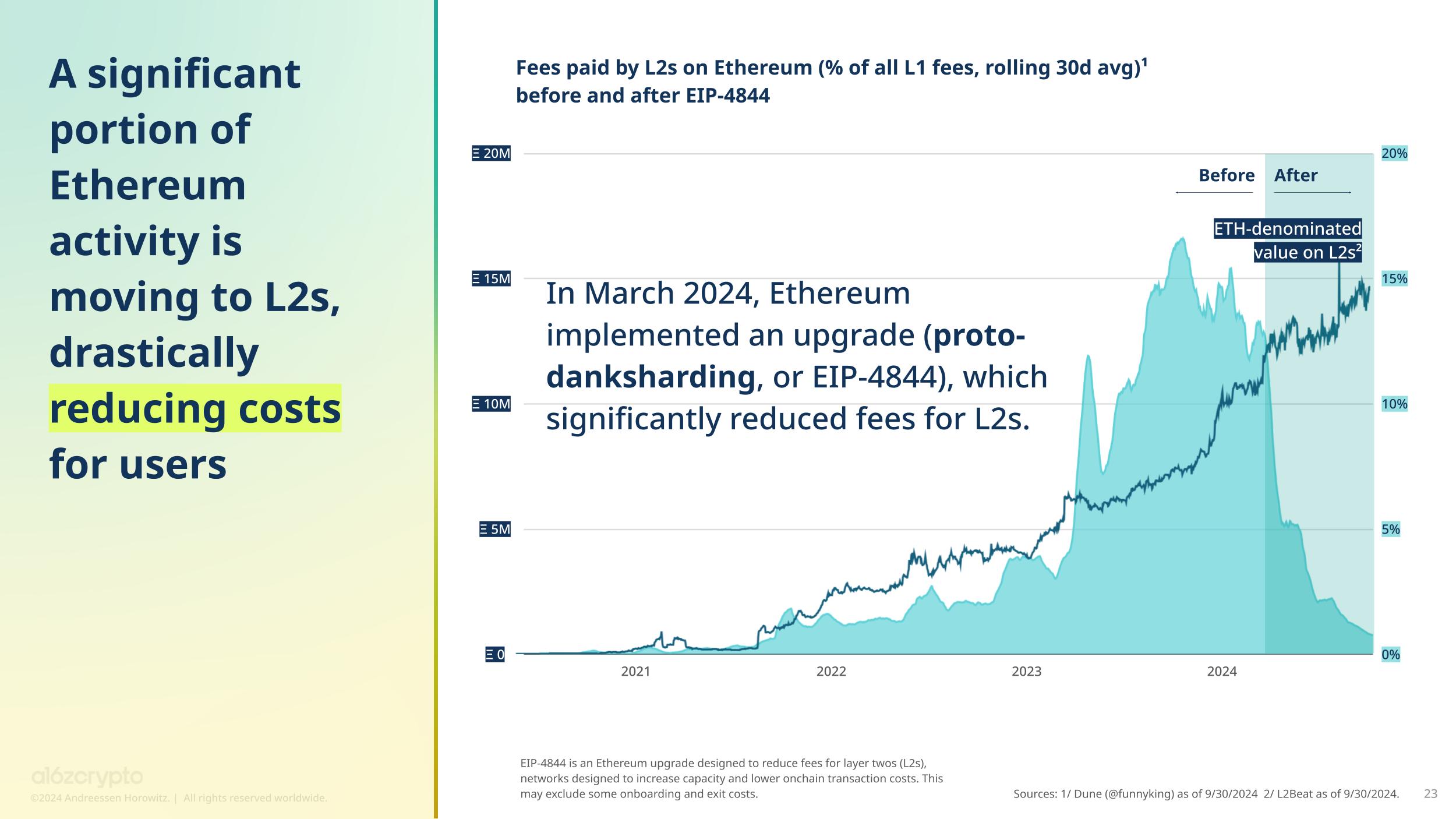

As transaction costs come down and blockchain capacity goes up, many other potential crypto consumer apps become possible.

隨著交易成本降低和區塊鏈容量增加,許多其他潛在的加密消費者應用程序變得可能。

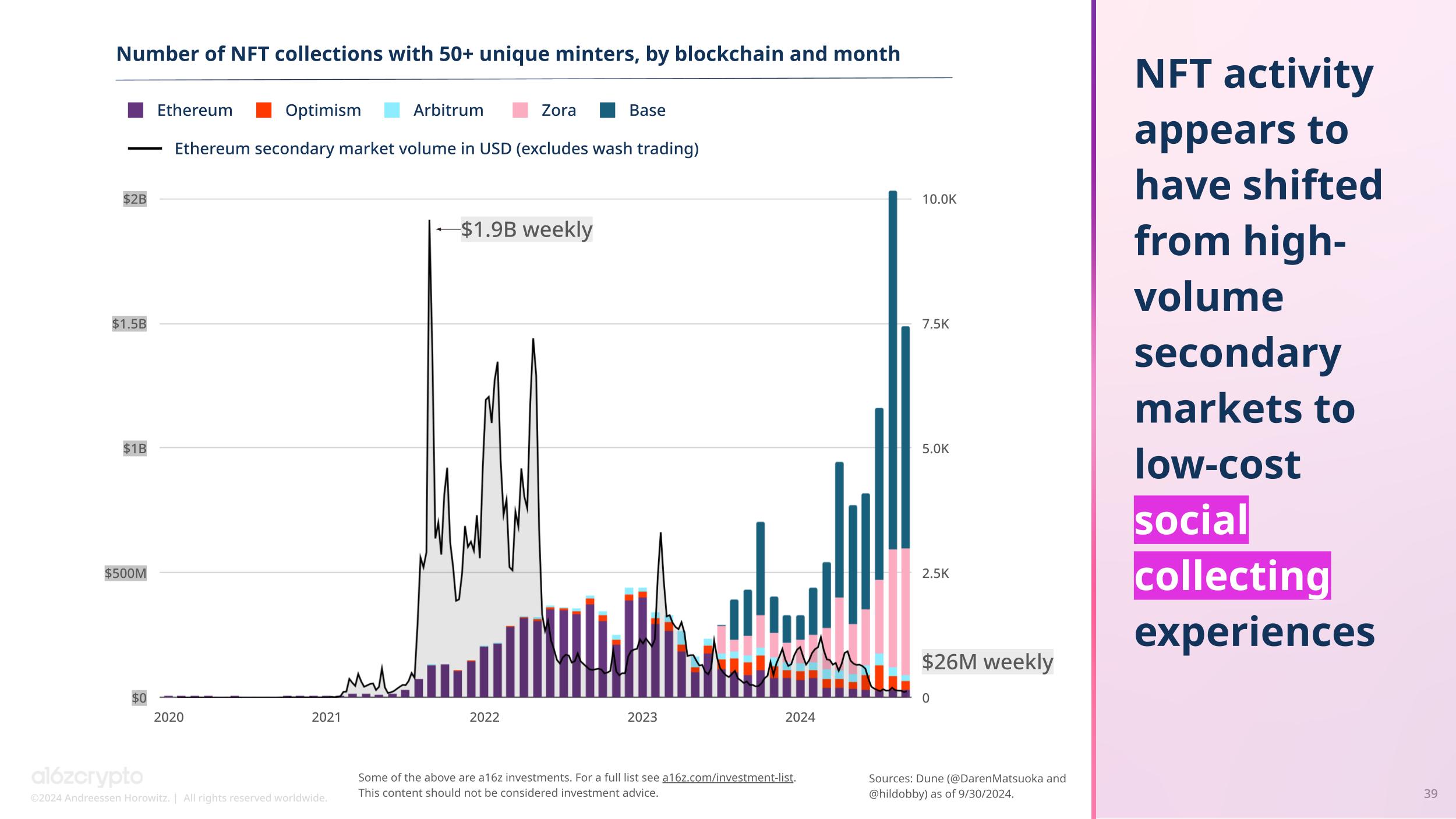

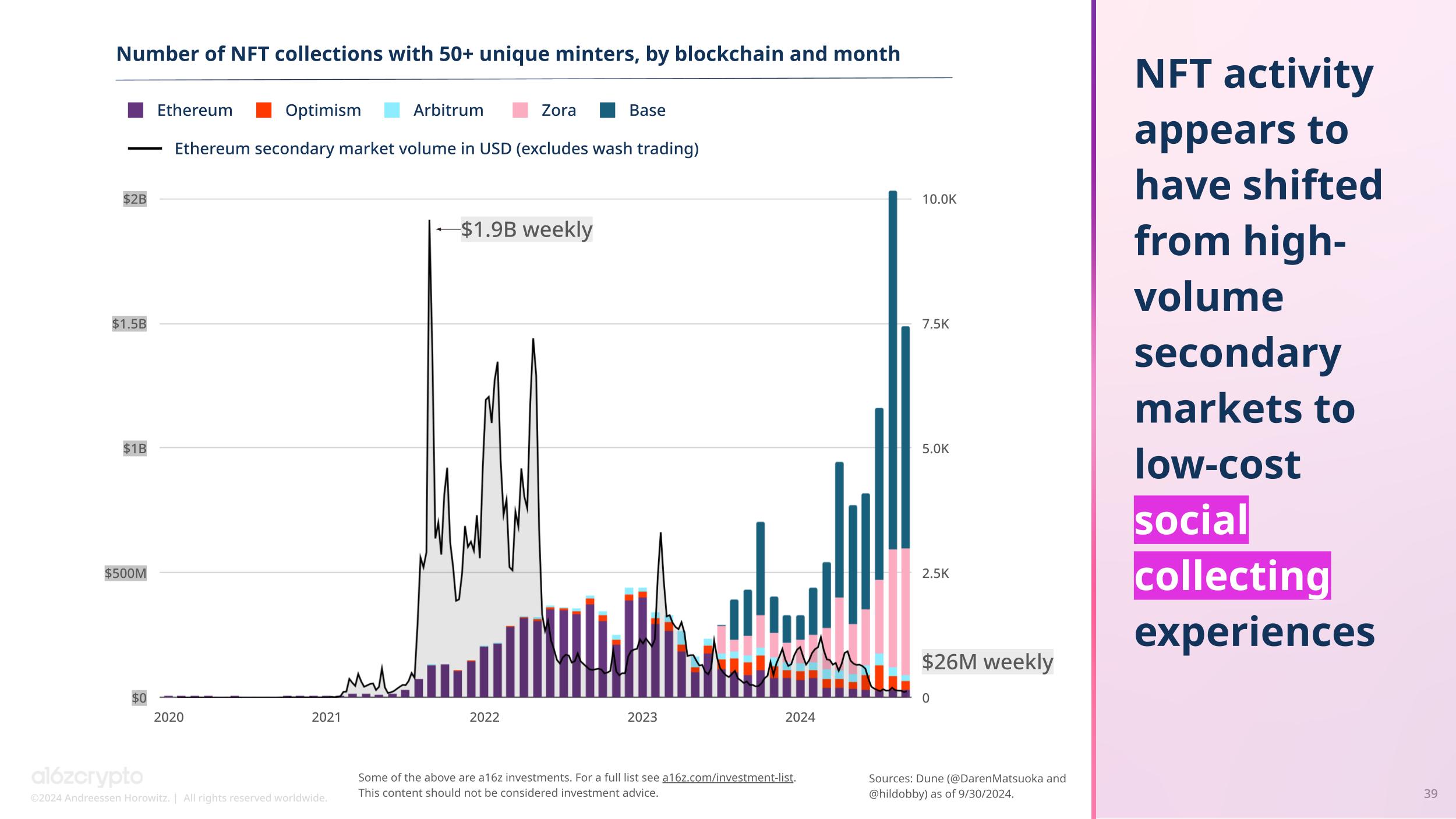

Take NFTs, for instance. When crypto transactions were much more expensive a few years ago, people were trading NFTs on secondary markets for large sums totaling billions of dollars. That activity has since subsided, and in its place has risen a new consumer behavior: minting low-cost NFT collections on social apps like Zora and Rodeo. This represents a significant shift for the NFT market, one that was largely inconceivable before a drastic reduction in transaction fees.

以 NFT 為例。幾年前加密交易費用更昂貴時,人們在二級市場上以數十億美元的巨額進行 NFT 交易。這種活動已經減弱,取而代之的是一種新的消費者行為:在 Zora 和 Rodeo 等社交應用程式上鑄造低成本的 NFT 收藏品。這代表了 NFT 市場的重大轉變,這在交易費用大幅降低之前幾乎是不可想像的。

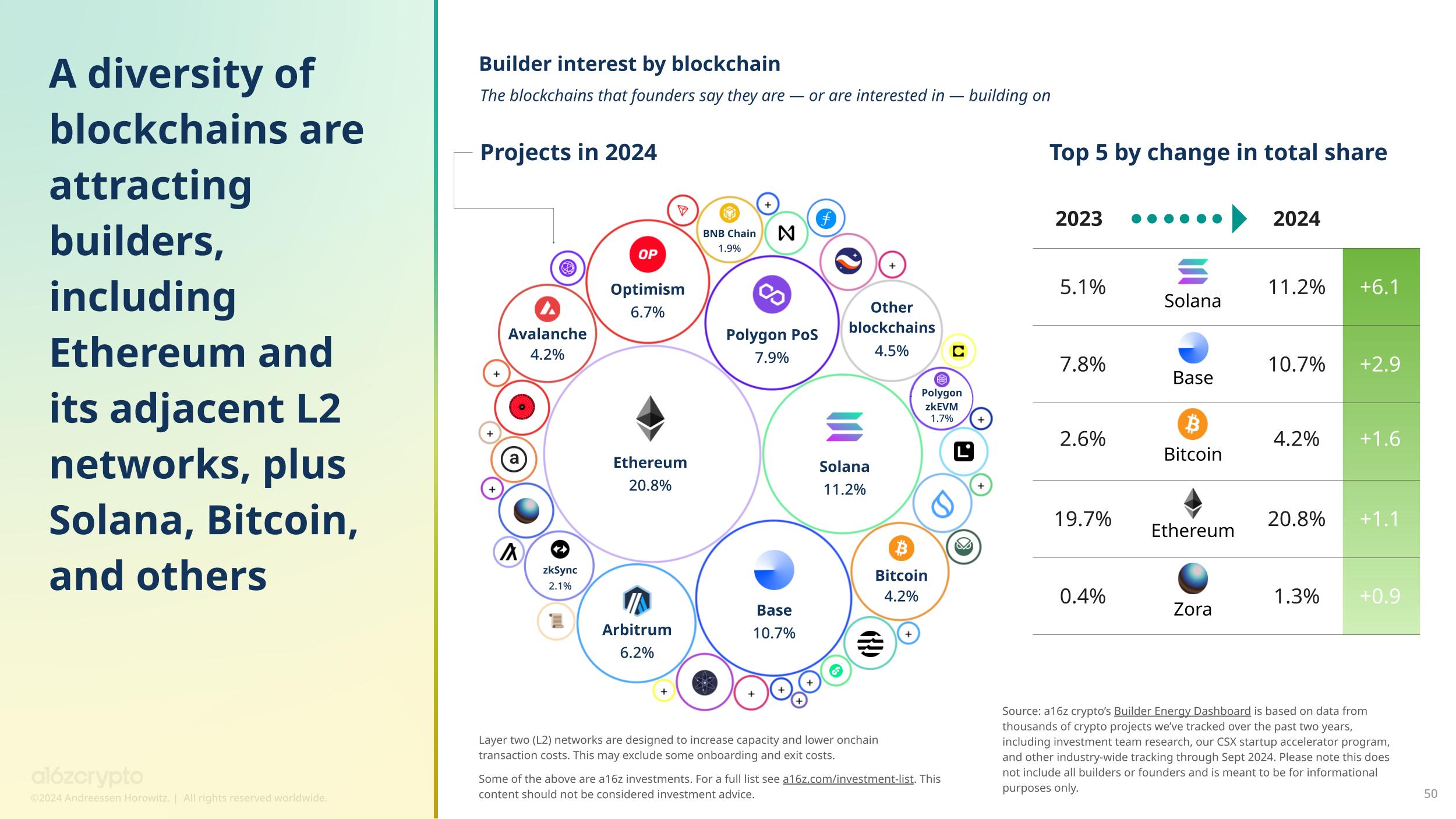

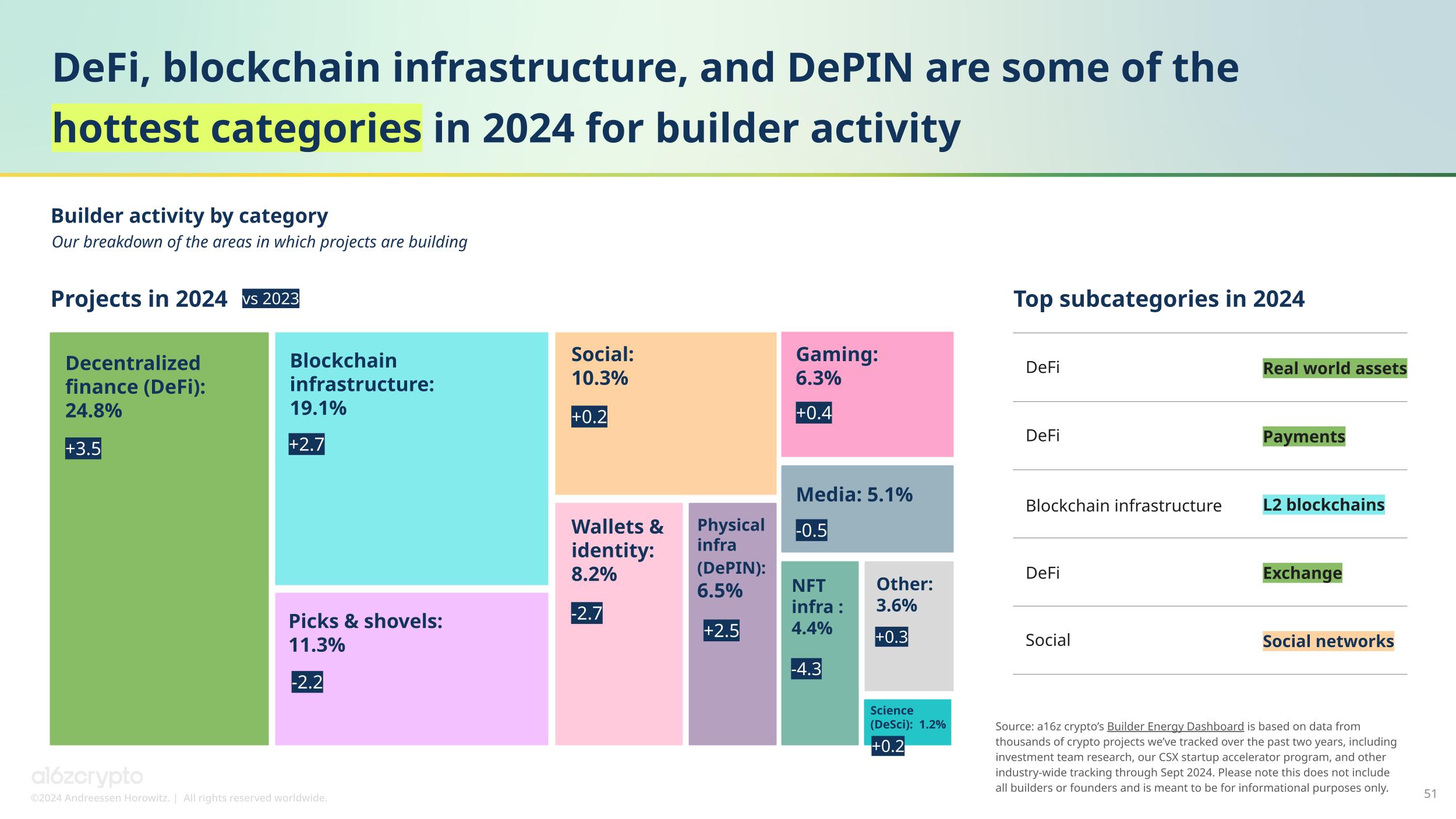

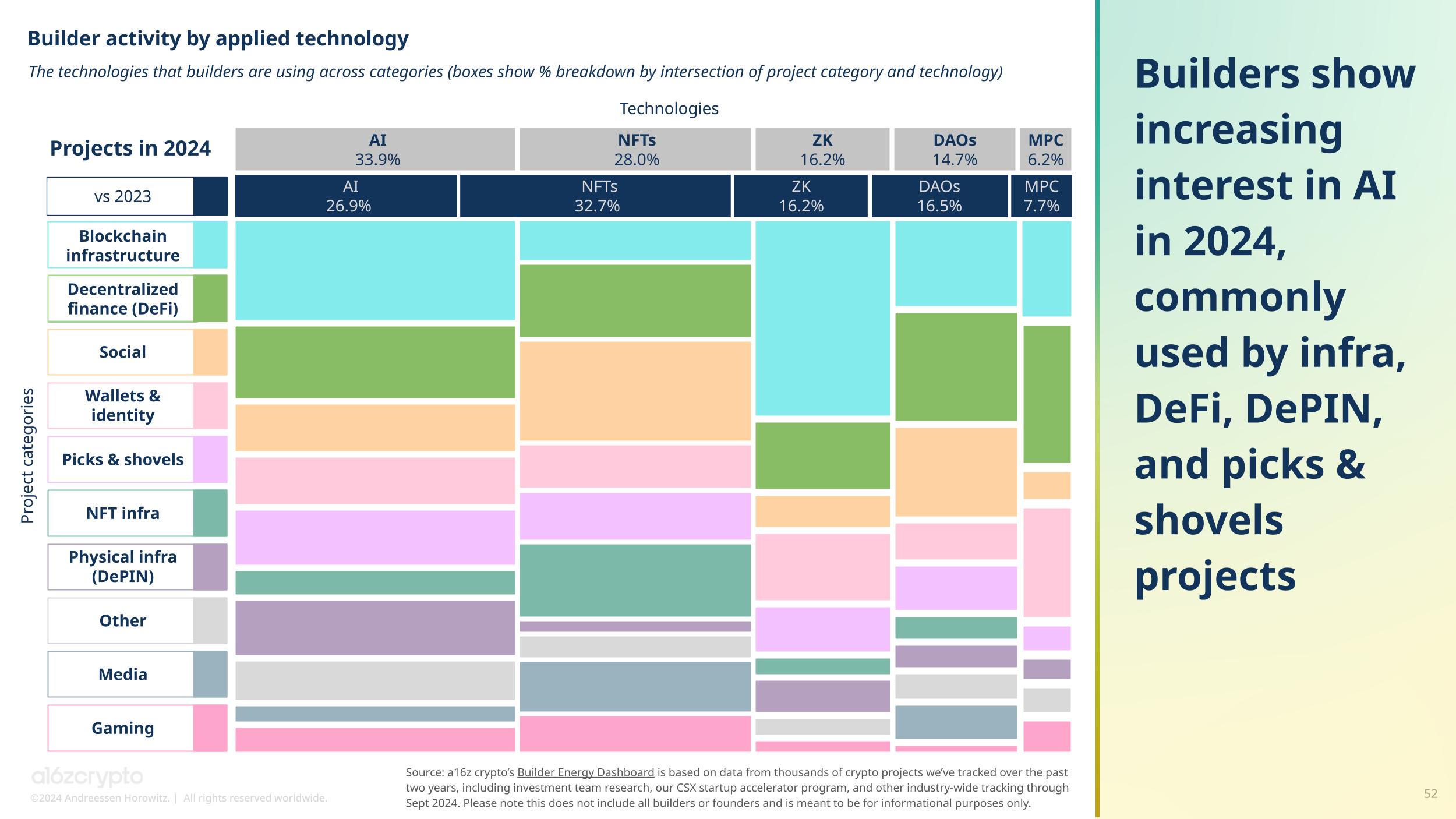

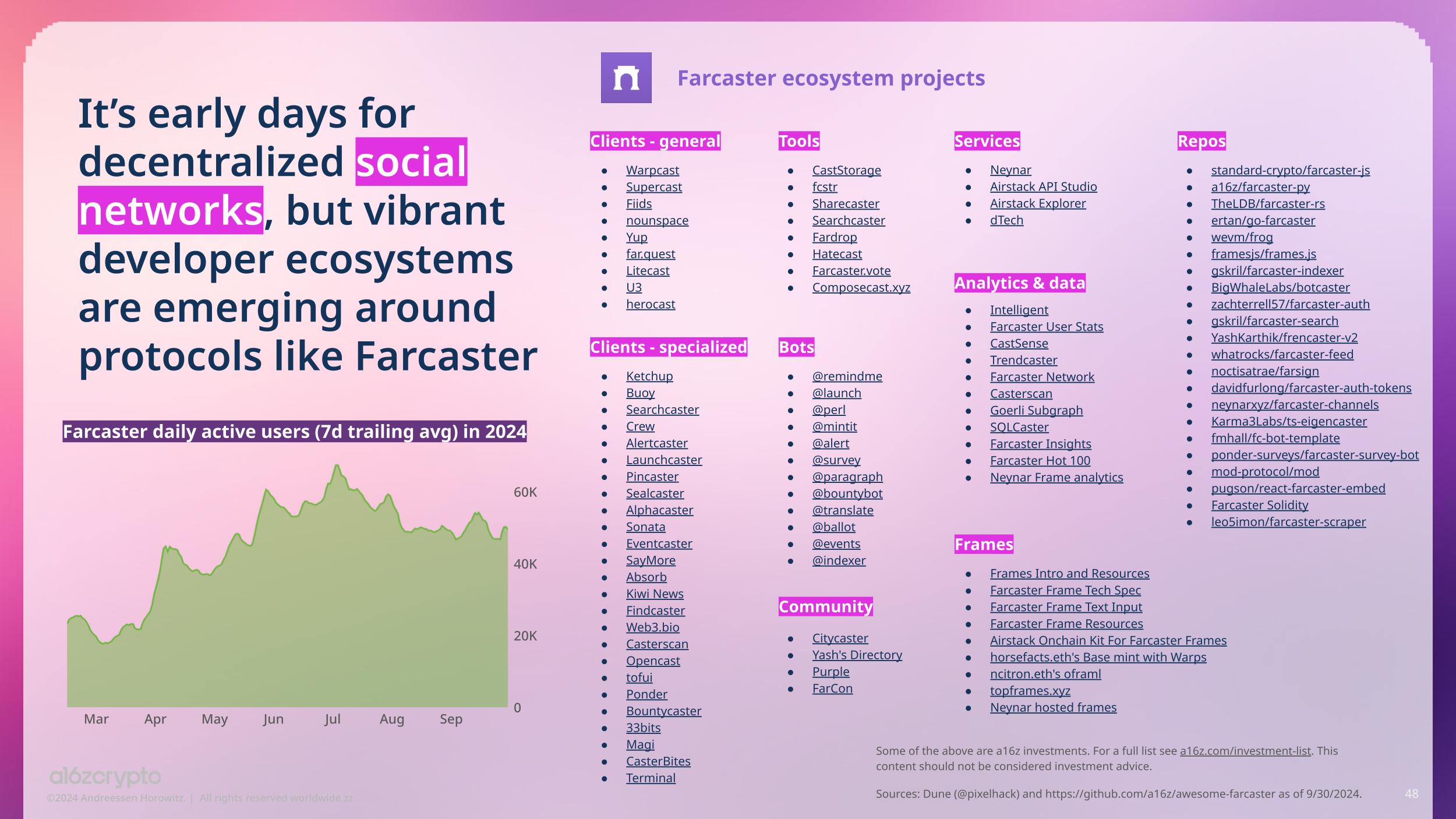

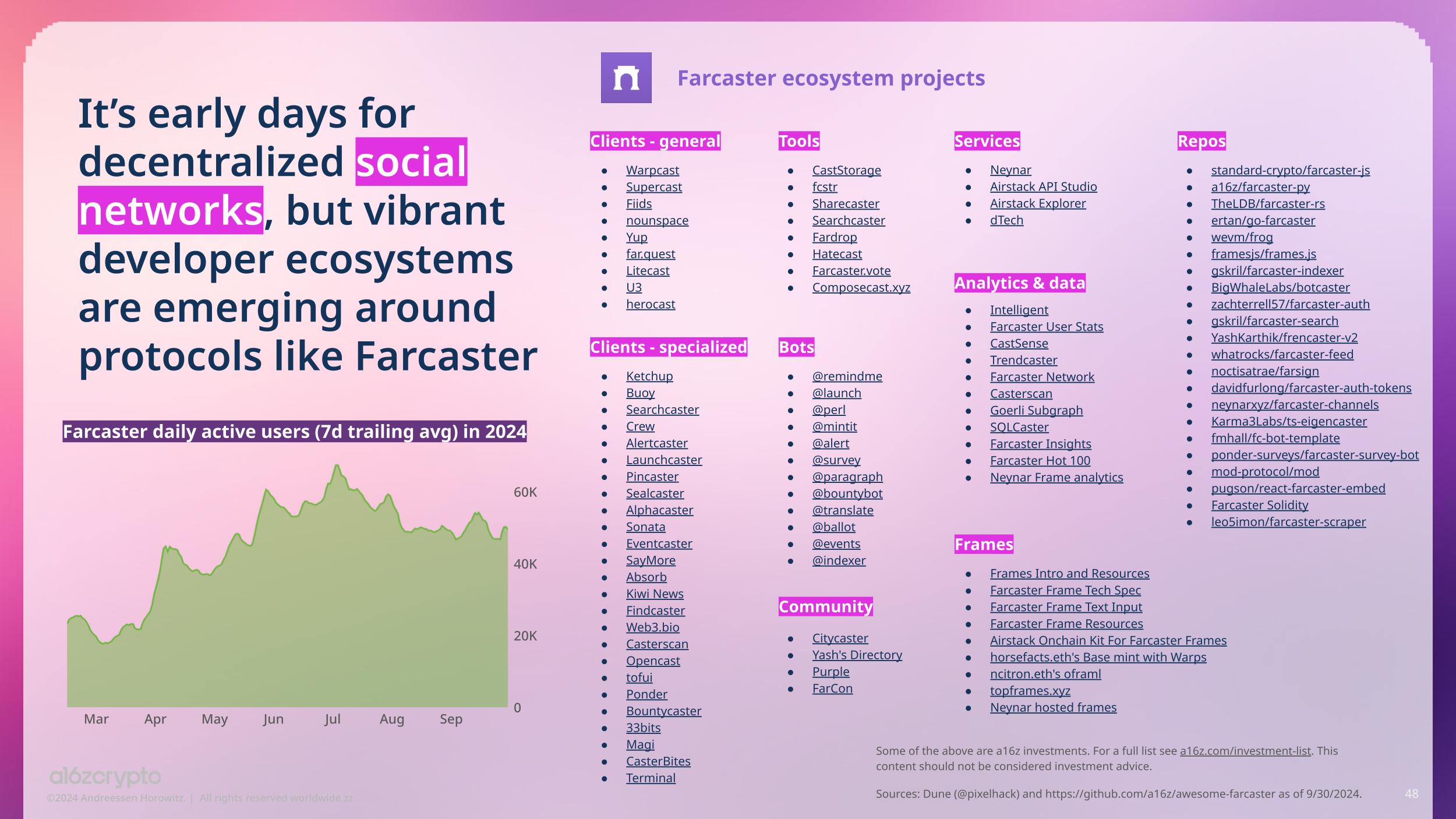

Social networks are another example. Even though they account for only a small portion of daily onchain activity today, they’re attracting strong builder activity: 10.3% of crypto projects are social-related in 2024, per our Builder Energy dashboard. In fact, social network-related projects, such as those related to Farcaster, are one of the top 5 hottest builder subcategories this year.

社交網絡是另一個例子。即使它們今天僅佔每日鏈上活動的一小部分,但它們吸引了強大的建造者活動:根據我們的建造者能量儀表板,2024 年有 10.3% 的加密項目與社交相關。事實上,與社交網絡相關的項目,例如與 Farcaster 相關的項目,是今年前五個最熱門的建造者子類別之一。

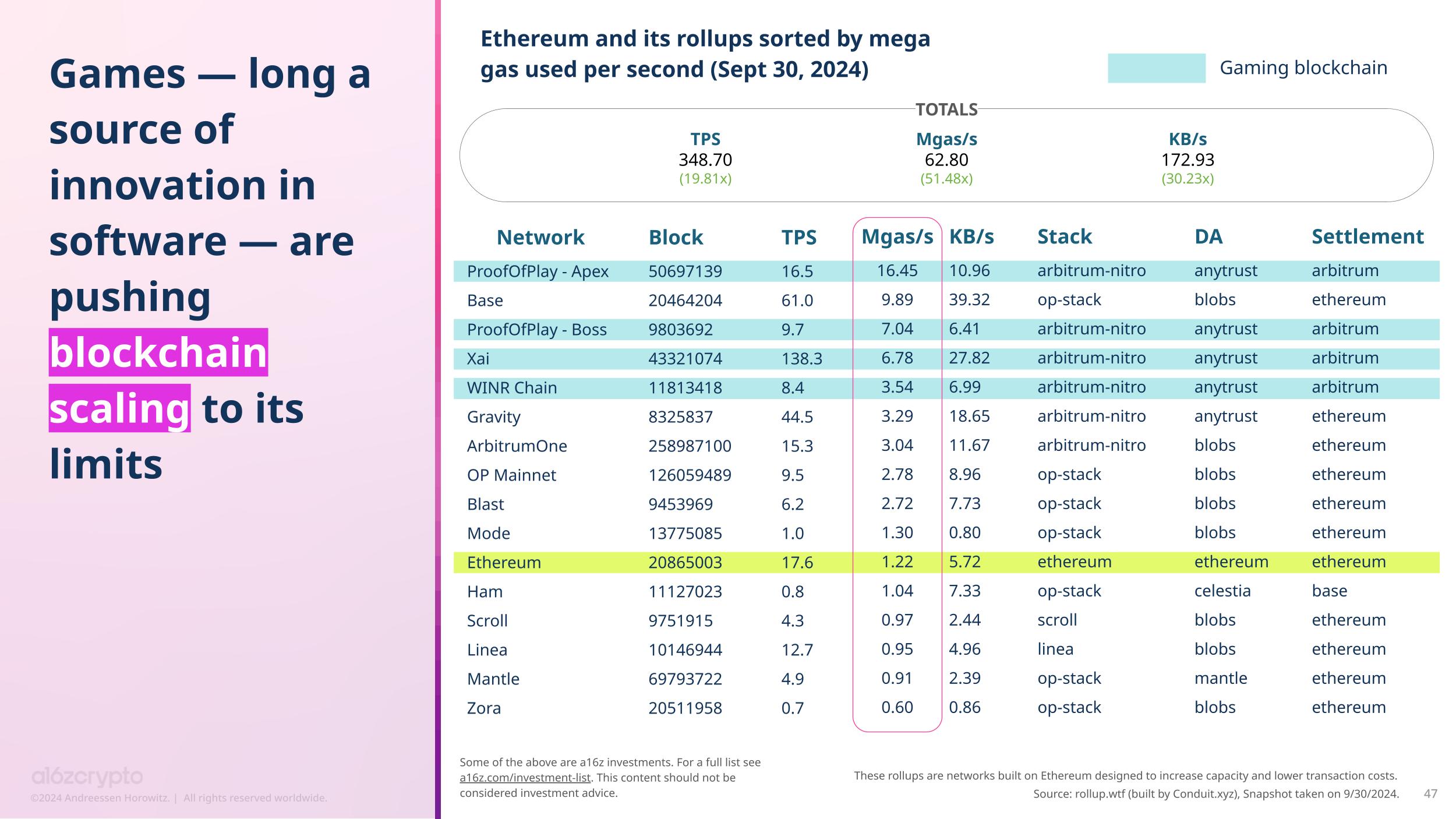

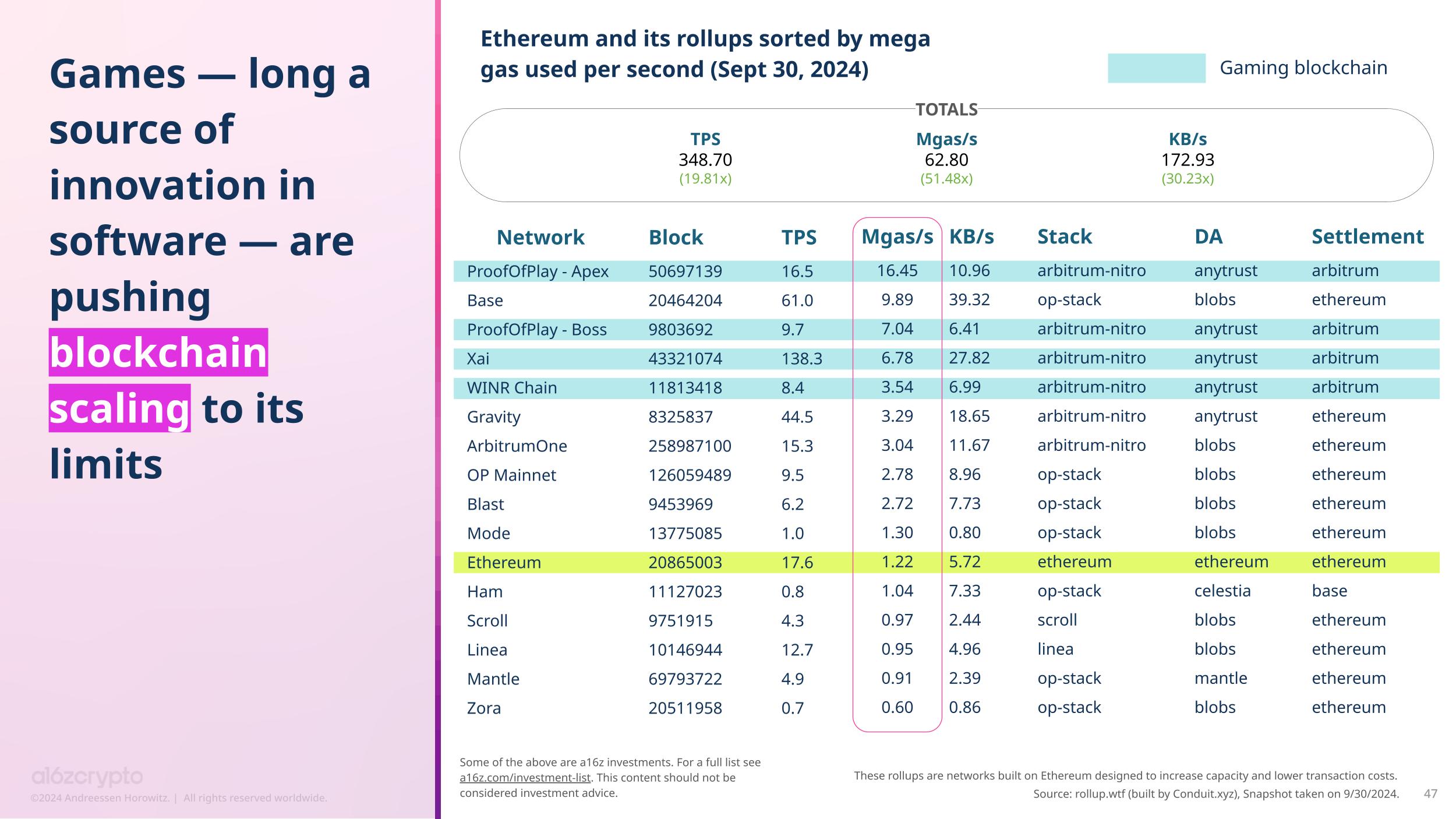

While builders and consumers explore more social experiences, onchain games are pushing blockchain scaling to its limits. Rollups such as those used by Proof Of Play’s high-seas adventure role playing game Pirate Nation are consistently using the most gas per second of any Ethereum rollups.

當建造者和消費者探索更多社交體驗時,鏈上遊戲正將區塊鏈擴展推至極限。像 Proof Of Play 的高海盜冒險角色扮演遊戲 Pirate Nation 所使用的 Rollups 一樣,它們一直是以太坊 Rollups 中每秒使用最多氣體的。

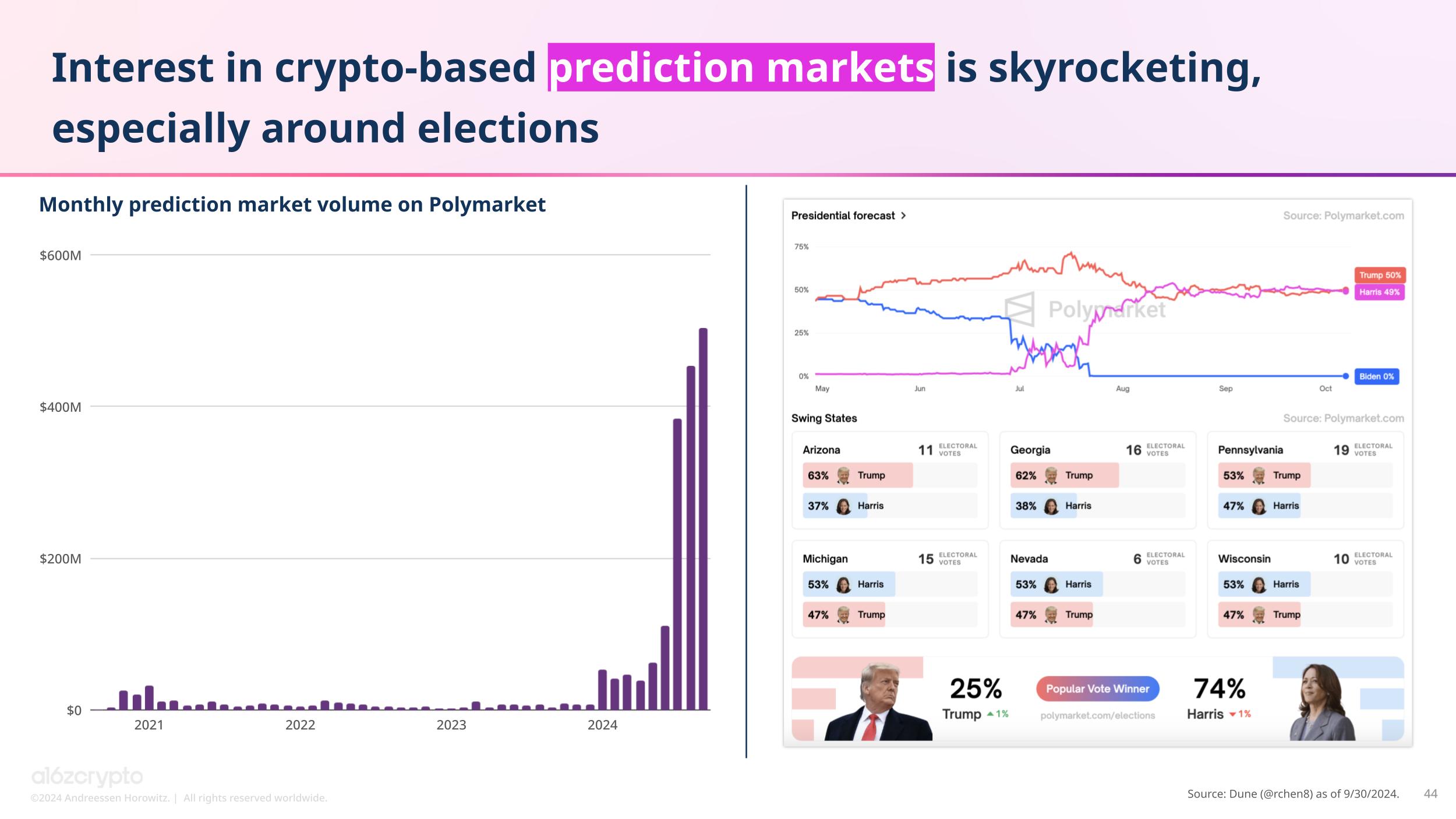

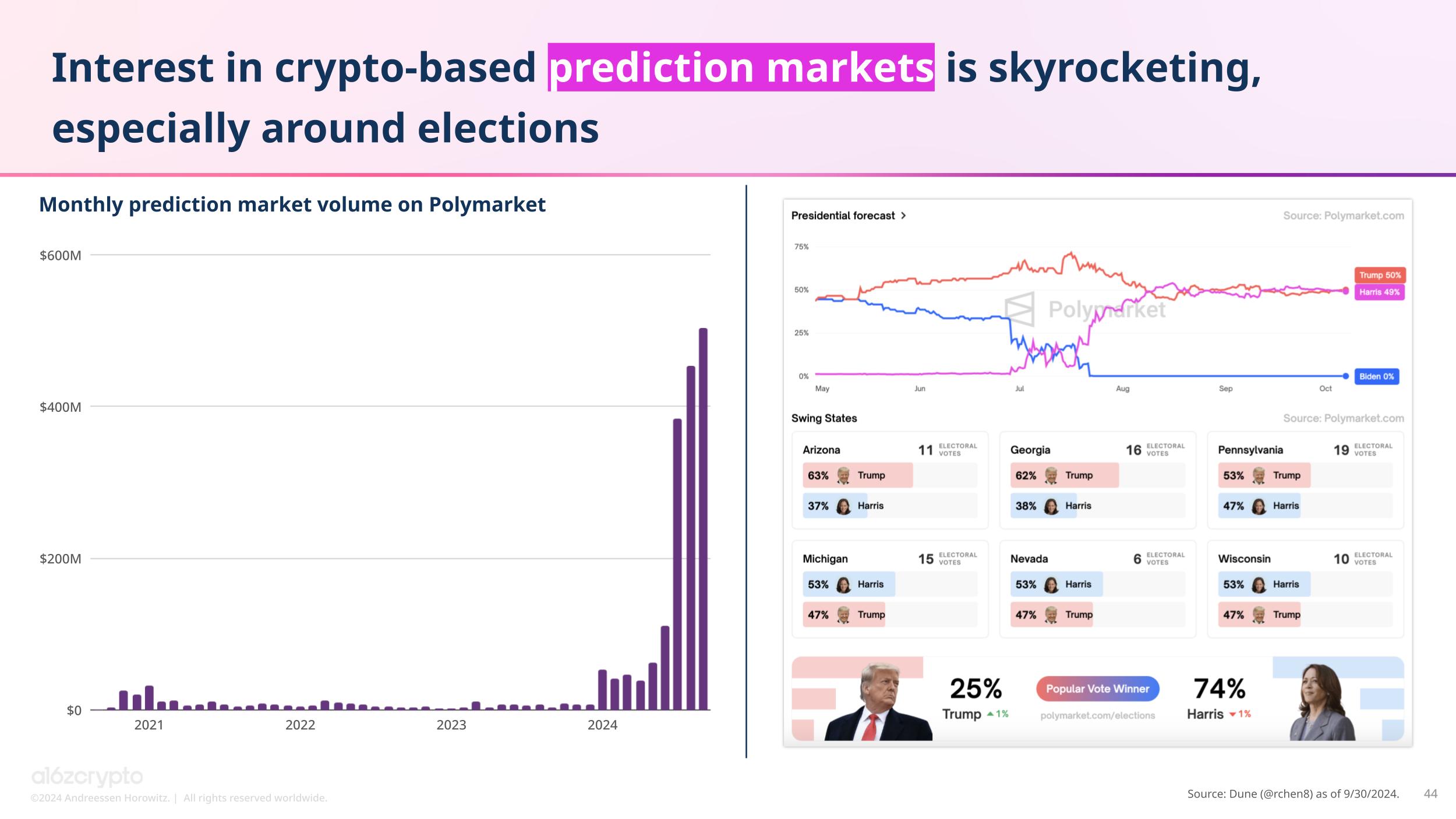

As the November election approaches, crypto-based prediction markets are having a moment — despite their illegality in the U.S. — and momentum is building for prediction markets in general. So much so that Kalshi, a non-crypto-based prediction market that’s registered with the U.S. Commodity Futures Trading Commission, gained a win in a lower court last month as it pursues a federal lawsuit around listing elections contracts. (As of now, registered exchanges are allowed to offer elections-based traditional futures contracts.)

隨著十一月的選舉日益臨近,基於加密貨幣的預測市場正處於風口浪尖,盡管在美國是非法的,但對於預測市場的動能正在積聚。以至於 Kalshi,一個非基於加密貨幣的預測市場,上個月在追求關於上市選舉合約的聯邦訴訟中在一家下級法院獲得勝訴,該市場已在美國商品期貨交易委員會註冊。(截至目前,註冊交易所被允許提供基於選舉的傳統期貨合約。)

Glimmers of novel consumer behaviors are beginning to be discernible. All these new and emerging experiences were intractable when blockchain infrastructure was clunkier and transaction costs were higher. As the blockchains improve along classic tech price-performance curves, expect more of these applications to thrive.

新型消費者行為的曙光開始變得可辨識。當區塊鏈基礎設施較笨重且交易成本較高時,所有這些新興體驗都是棘手的。隨著區塊鏈在經典技術價格性能曲線上的改善,預計這些應用將會蓬勃發展。

***

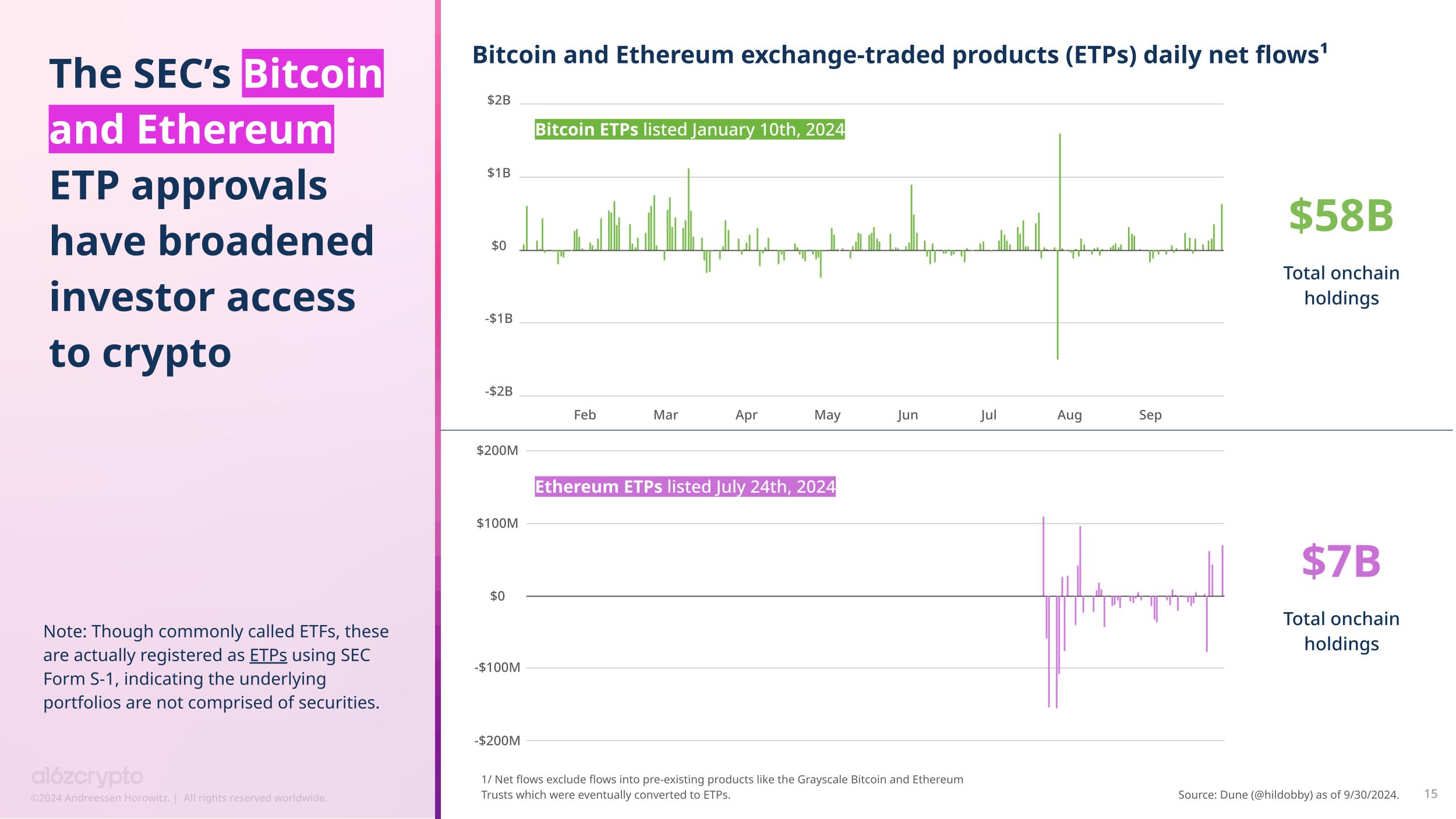

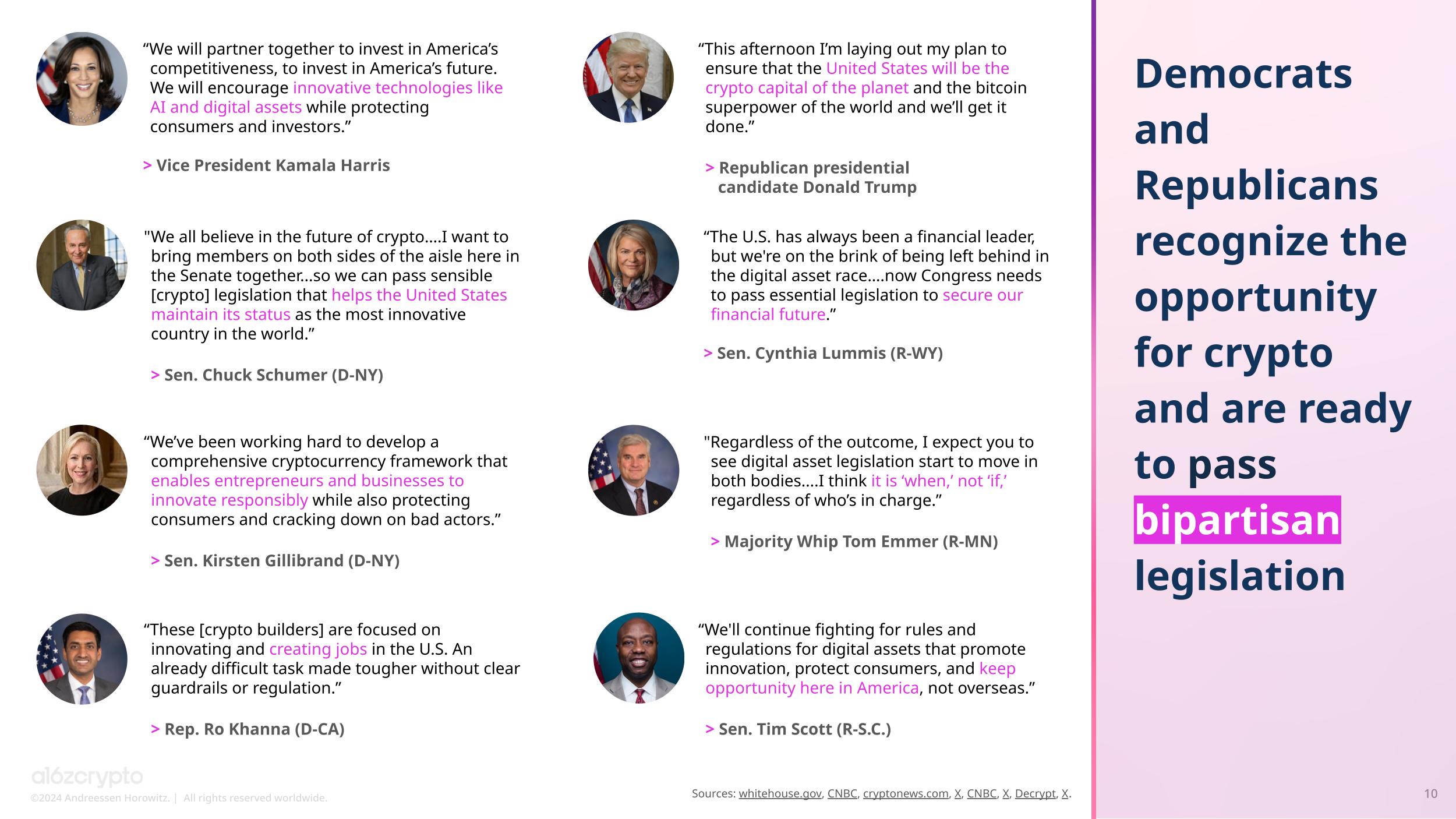

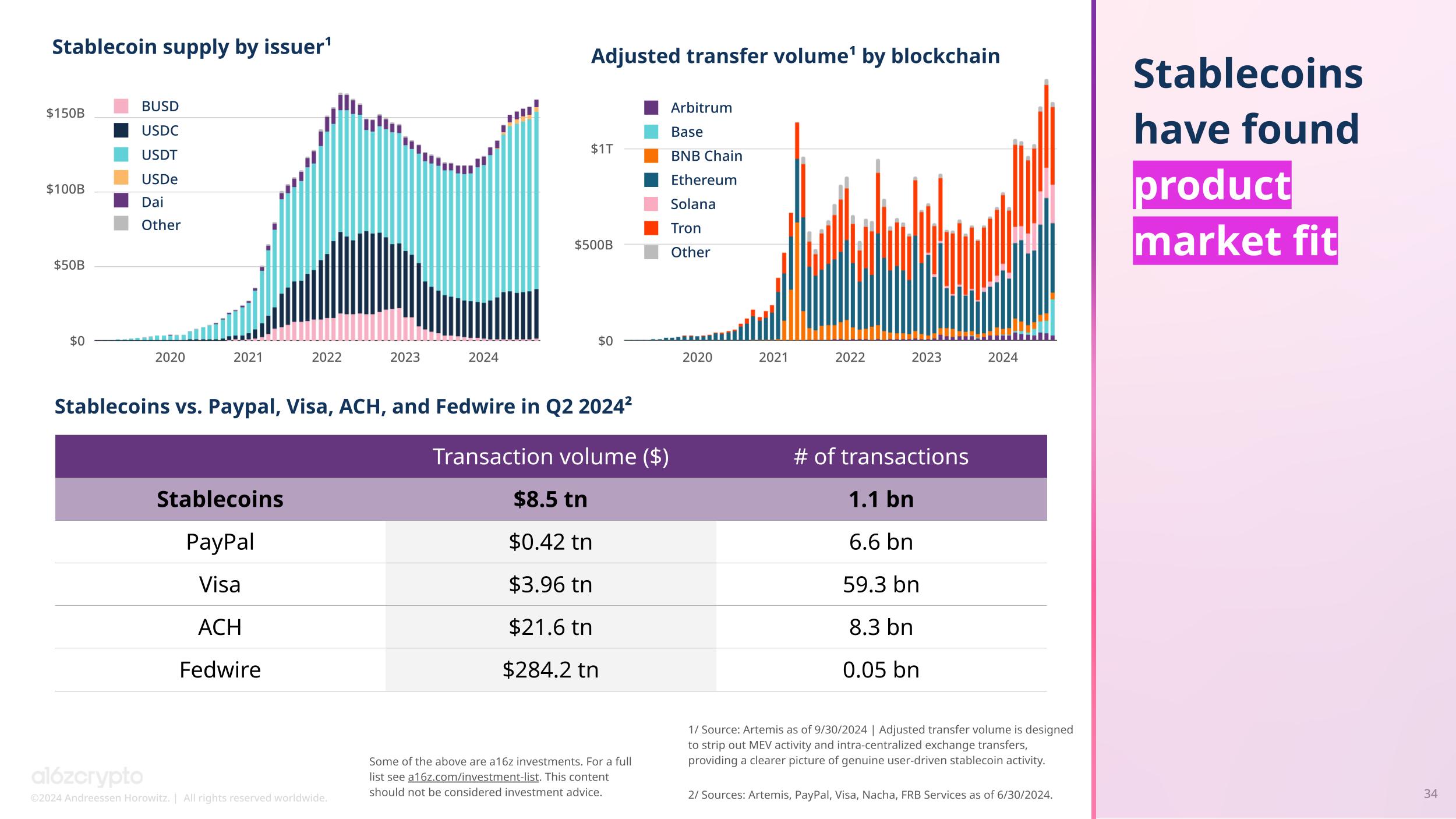

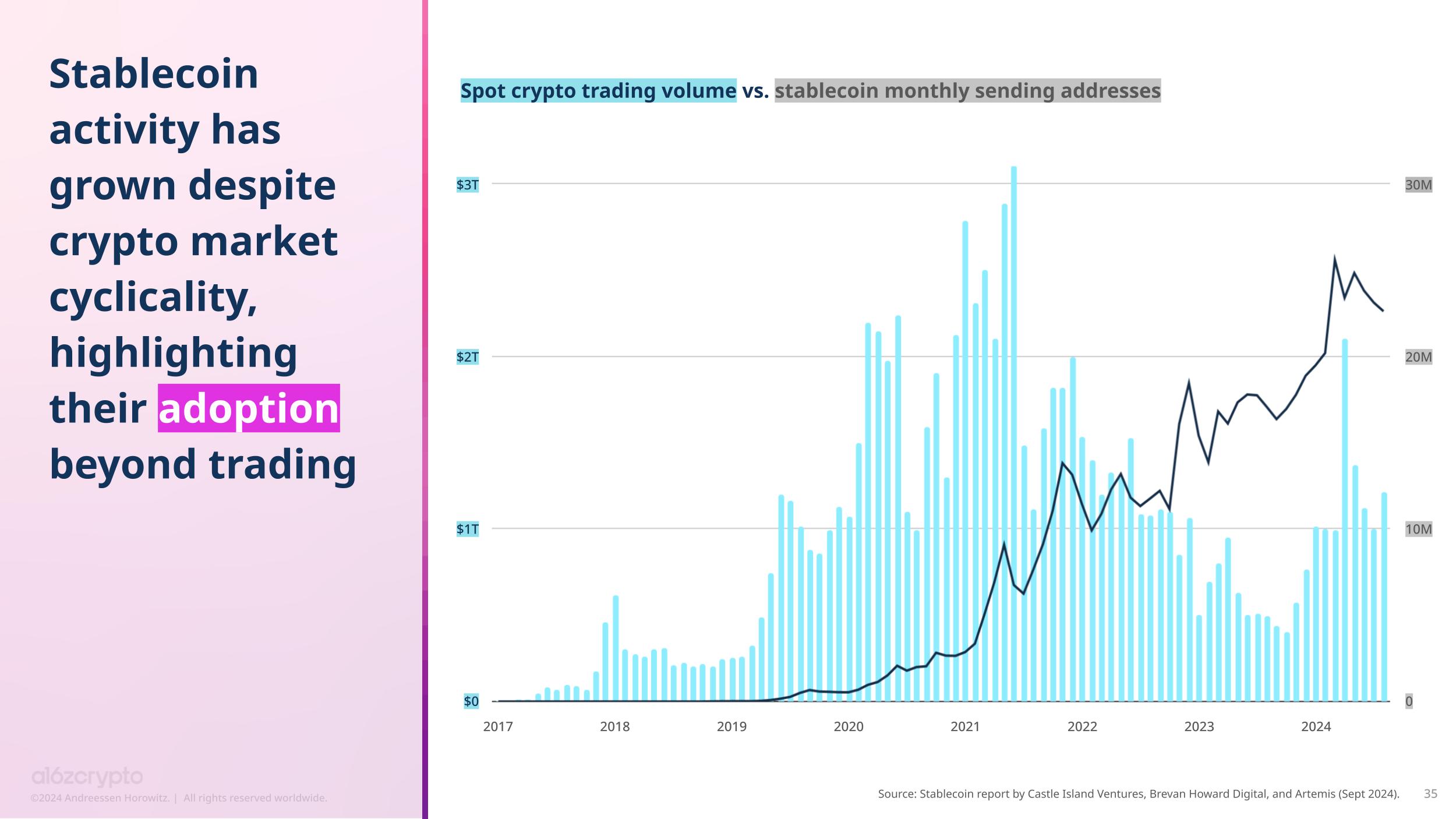

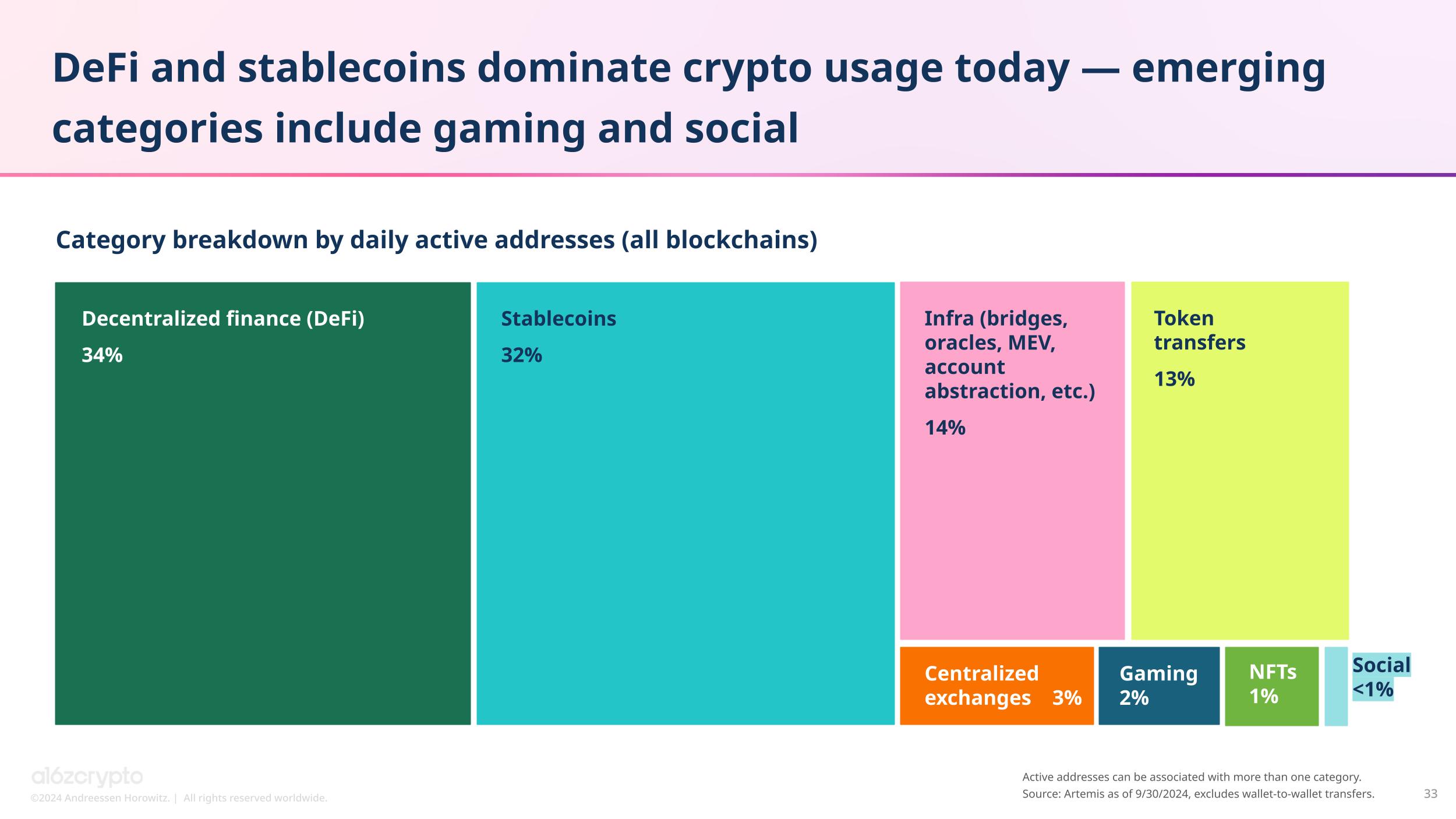

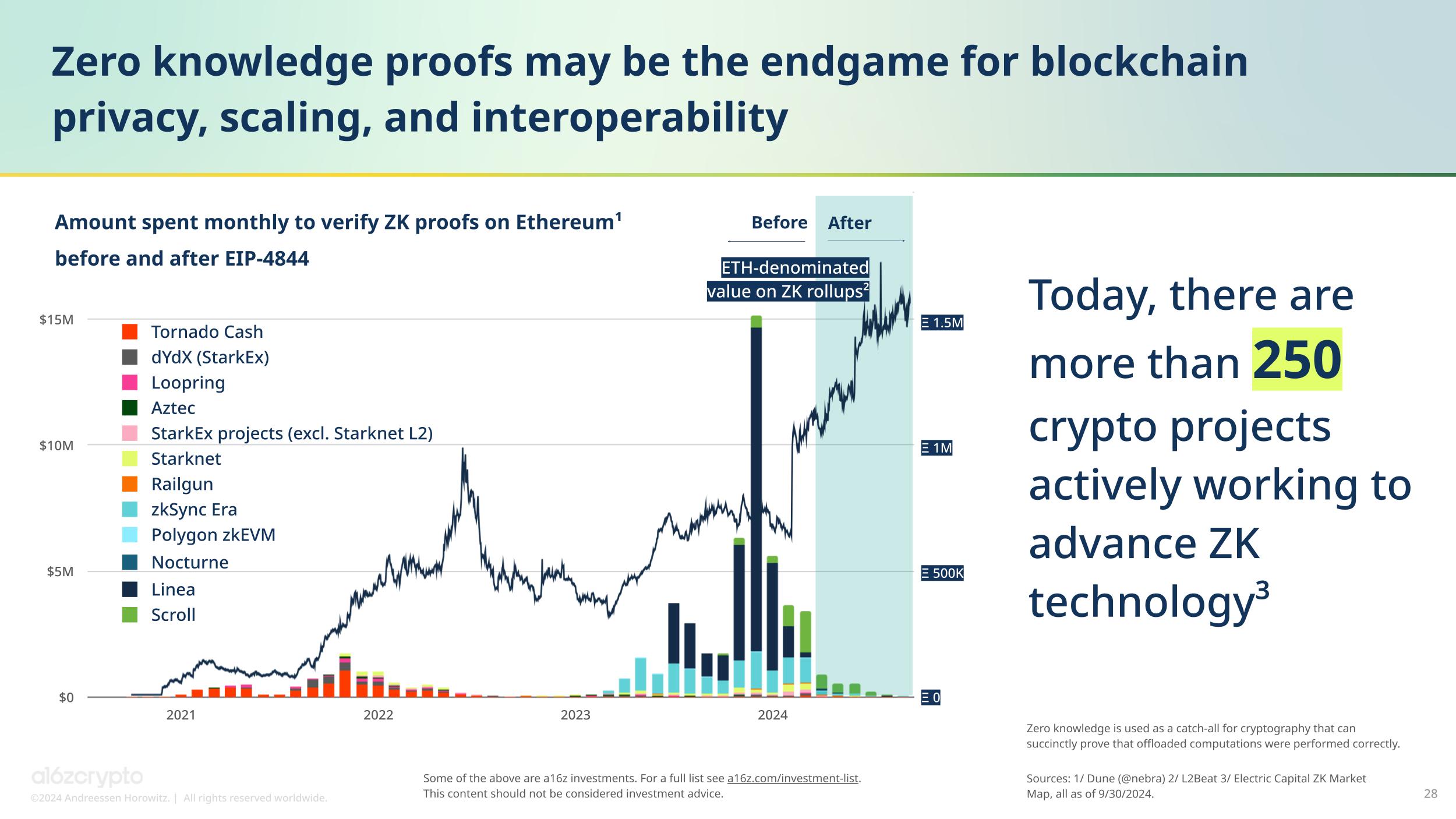

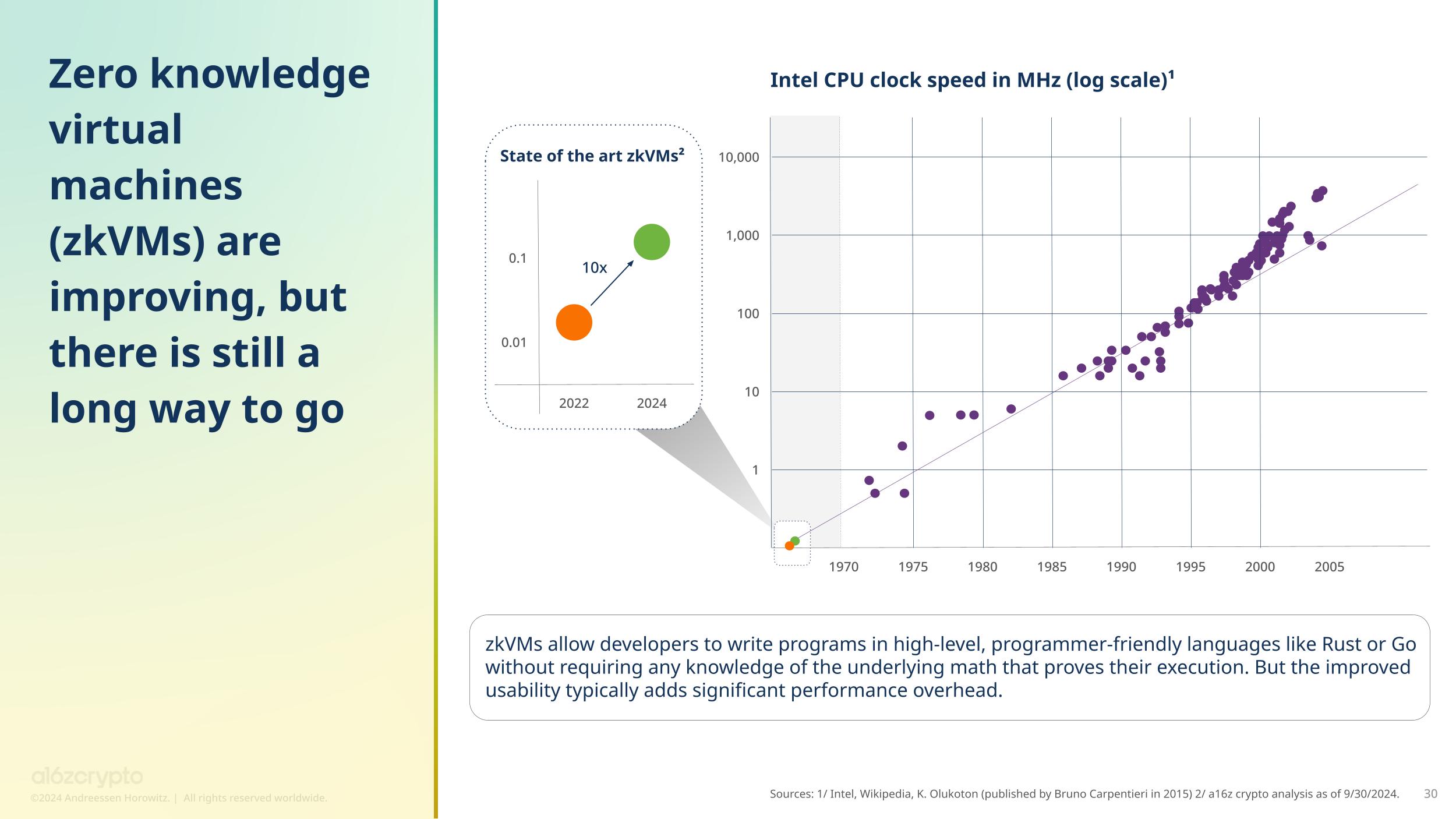

Where does that leave us? The state of crypto has made significant strides across policy, technology, consumer adoption, and more over the past year. There were policy milestones, including the sudden approval and listing of Bitcoin and Ethereum ETPs, as well as the passage of significant bipartisan crypto legislation. There were major infrastructure improvements, from scaling upgrades to the rise of Ethereum L2s and other high-throughput blockchains. And there were new apps being built and used, from the growth of mainstays like stablecoins to explorations of more nascent categories like AI, social networking, and games.

這讓我們處於何種狀態?過去一年來,加密貨幣在政策、技術、消費者採用等方面取得了重大進展。政策上有里程碑,包括比特幣和以太坊 ETP 的突然批准和上市,以及重要的跨黨派加密貨幣立法的通過。基礎設施方面有重大改進,從擴展升級到以太坊 L2 的崛起和其他高吞吐量區塊鏈。還有新的應用程式正在被建立和使用,從穩定幣的增長到對更新興類別如人工智慧、社交網絡和遊戲的探索。

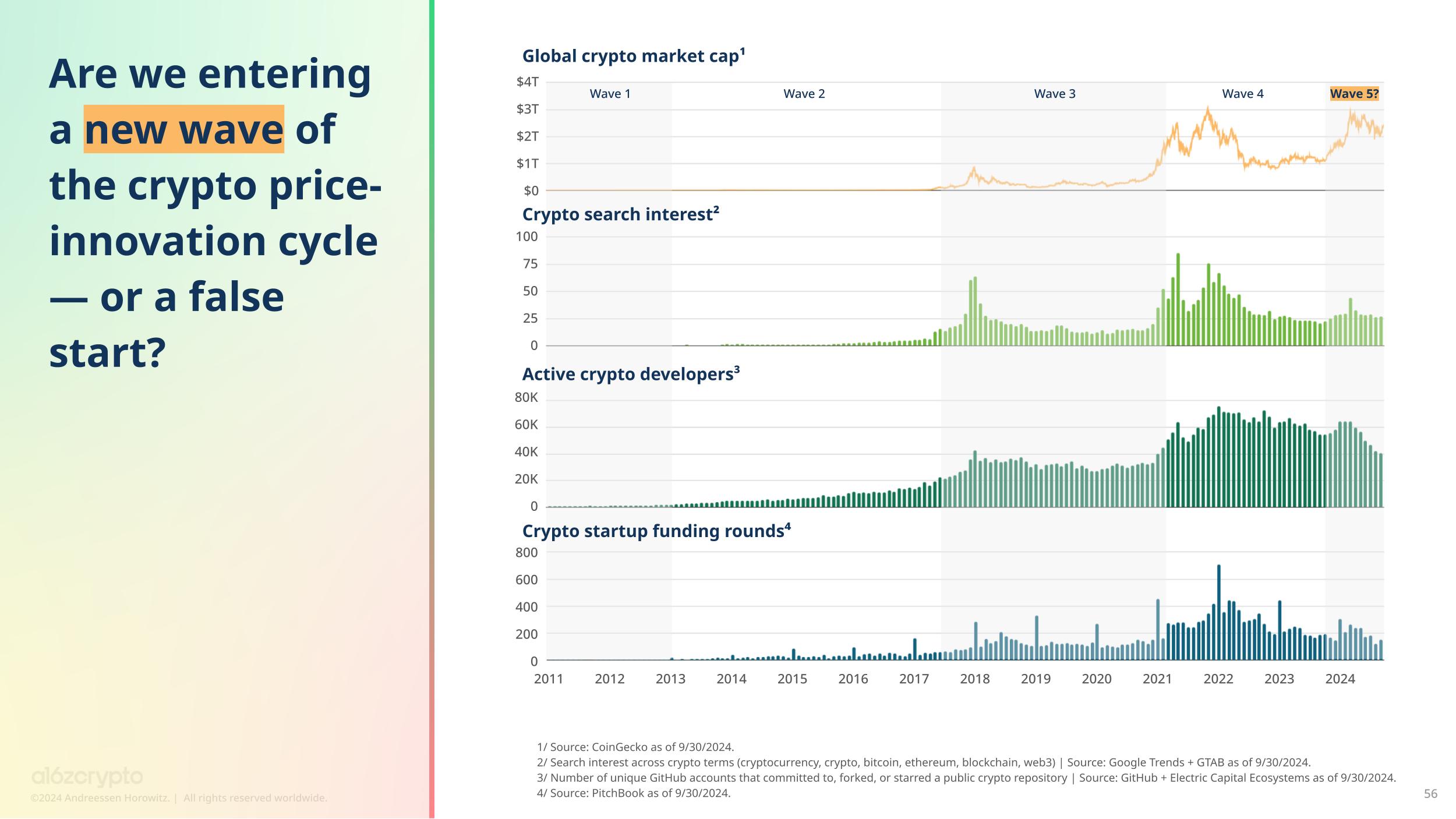

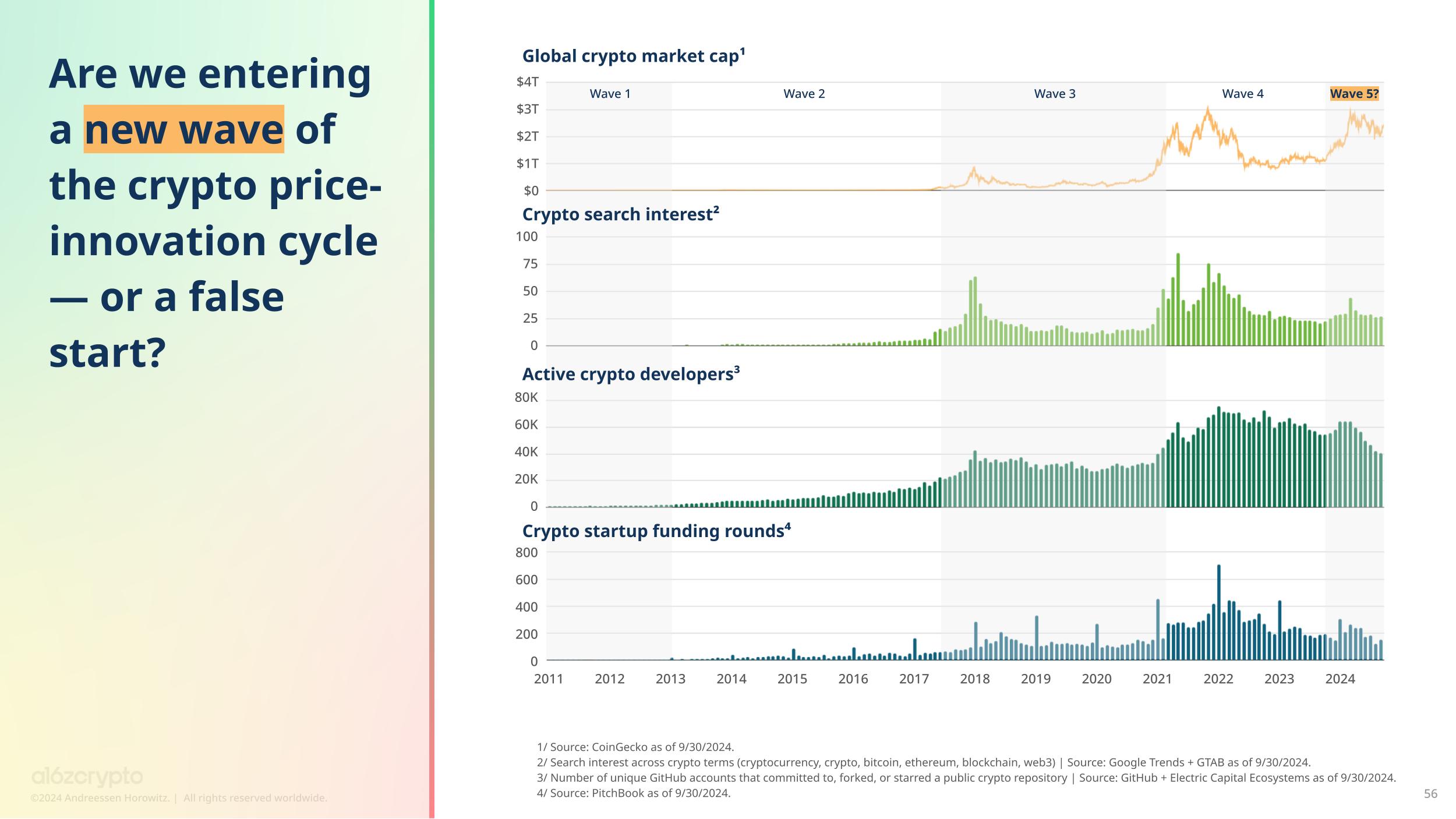

Whether we have entered the fifth wave of the price-innovation cycle, our framework for understanding the ups and downs of crypto’s many market cycles, remains to be seen. Either way, crypto, as an industry, has made inarguable progress over the past year. And as ChatGPT has proven, it can take just one breakout product to shift an entire industry.

無論我們是否已經進入價格創新周期的第五波,我們對於理解加密貨幣許多市場周期的起伏的框架,仍有待觀察。無論如何,作為一個行業,加密貨幣在過去一年中取得了無可辯駁的進步。正如 ChatGPT 已經證明的那樣,只需一款突破性產品就能改變整個行業。

***

Sign up for a16z crypto’s biweekly newsletter here. And for more regular data updates, keep an eye on our State of Crypto Index, an interactive tool, updated monthly, that tracks the health of the crypto industry from a technological, rather than financial, perspective through measures of industry rates of innovation and adoption. Also be sure to explore our new Builder Energy dashboard, which tracks where we’re seeing the most “builder energy” across crypto.

在這裡訂閱 a16z crypto 的雙週通訊。如需更頻繁的數據更新,請密切關注我們的加密狀態指數,這是一個互動工具,每月更新一次,通過行業創新和採用率來跟蹤加密行業的健康狀況,而不是從財務角度來看。同時,請務必探索我們的新 Builder Energy 儀表板,該儀表板追蹤我們在加密領域看到的最多「建造者能量」。

***

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the current or enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

本文所表達的觀點屬於個別 AH Capital Management, L.L.C.(“a16z”)員工的觀點,並非 a16z 或其聯屬公司的觀點。本文中包含的某些資訊來自第三方來源,包括由 a16z 管理的基金投資組合公司。雖然這些資訊來源被認為是可靠的,但 a16z 並未獨立驗證此類資訊,並不對該資訊的當前或持久準確性或其適用於特定情況作出任何聲明。此外,本內容可能包含第三方廣告;a16z 並未審查此類廣告,也不贊同其中包含的任何廣告內容。

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investment-list/.

此內容僅供參考之用,不應視為法律、商業、投資或稅務建議。您應就該等事項諮詢您自己的顧問。對任何證券或數位資產的提及僅為舉例,並不構成投資建議或提供投資諮詢服務的要約。此外,此內容並非針對任何投資者或潛在投資者,亦不得在做出投資於 a16z 管理的任何基金的決定時,以任何情況為依據。(投資於 a16z 基金的要約僅透過私募說明書、認購協議及任何該等基金的其他相關文件作出,應全文閱讀。)提及、參考或描述的任何投資或投資組合公司並非代表 a16z 管理的所有投資,且無法保證該等投資將有利可圖,或未來進行的其他投資將具有相似特徵或結果。 由安德森・霍洛维茨(Andreessen Horowitz)管理的基金所做的投資清單(不包括發行人未經許可不公開披露的投資以及未公開宣布的上市數字資產投資)可在 https://a16z.com/investment-list / 查看。

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures/ for additional important information.

本文中提供的圖表僅供參考,不應作為做出任何投資決定的依據。過往表現不代表未來結果。內容僅反映所指日期的情況。這些材料中提出的任何預測、估計、預測、目標、前景和 / 或意見均可能隨時更改,並可能與他人的意見不同或相反。請參閱 https://a16z.com/disclosures/ 以獲取其他重要信息。