ET

Cooling inflation sparked a furious rotation in the stock market as investors trimmed bets on big tech leaders and piled into laggards from industrials to small caps.

Data Thursday showed price pressures easing, deepening the market’s confidence that the Federal Reserve would begin cutting interest rates in September. Growing certainty that rate cuts were near at hand drove government bond yields lower and triggered a rush into beaten-down corners of the market that could benefit from falling rates.

The Russell 2000 index of small-cap stocks, which just days ago was flat for 2024, soared 3.6% in its best day since November. Real estate, the S&P 500’s worst-performing sector this year, jumped 2.7%, while the utilities and industrials groups advanced 1.8% and 1.3%, respectively.

Minute Briefing

Tesla Shares Fall, Snapping 11-Day Winning Streak

Tesla Shares Fall, Snapping 11-Day Winning StreakPlus: Costco shares fall after the retailer says it will raise its membership fees in September. Pfizer shares rise as the drugmaker says it would schedule additional human testing for an experimental once-daily weight-loss pill. J.R. Whalen reports. Sign up for the WSJ's free What's News newsletter.Read Transcript

At the same time, the mega-sized tech stocks that have powered the market to records slumped on the news. The Magnificent Seven collectively lost $597.5 billion in market value, their largest one-day loss since February 2022, according to Dow Jones Market Data.

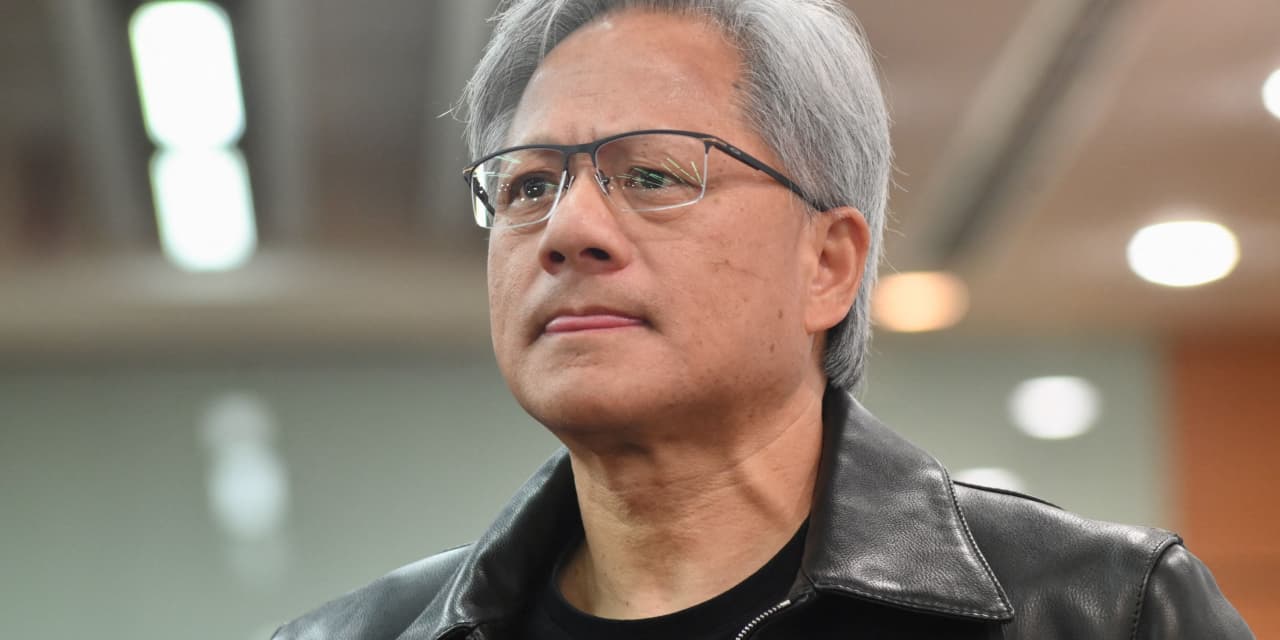

Chip maker Nvidia slid 5.6% and Facebook parent Meta Platforms declined 4.1%. Google parent Alphabet, Amazon.com, Apple and Microsoft each dropped more than 2%. Tesla retreated 8.4%, snapping an 11-session winning streak, after Bloomberg News reported the company was postponing plans to unveil its robotaxi.

“A lot of those names have performed very strongly over the first half the year,” said Sinead Colton Grant, chief investment officer at BNY Wealth. “There is some pent-up demand from investors to diversify more, to look for those names or those sectors that have been less well loved over the first half of the year.”

The declines by the market’s largest stocks pushed the S&P 500 down 0.9%, ending a streak of six record closes. The tech-heavy Nasdaq Composite retreated 2% in its worst day since April.

The Dow Jones Industrial Average, which doesn’t include all the big tech stocks, bucked the trend, to rise 0.1%, or about 32 points.

In one measure of the dramatic divergence within the market, the Russell 2000 notched its biggest one-day lead over the Nasdaq Composite in data going back to 1986, according to Dow Jones Market Data. Small companies tend to issue more floating-rate debt than their larger peers, making the group especially sensitive to changes in interest rates.

The bond market responded at once to the new inflation data. The yield on the benchmark 10-year U.S. Treasury note dropped to 4.192%, from Wednesday’s 4.280%.

Small-cap stocks rallied across the market, with Victoria’s Secret gaining 6.1%, Outback Steakhouse owner Bloomin’ Brands rising 7.1% and motor-home company Winnebago Industries adding 6.7%.

Within the large-cap world of the S&P 500, home builders D.R. Horton and Lennar advanced 7.3% and 6.9%, respectively. Deere shares gained 2.9% and Public Storage shares rallied 3.2%.

Although the decline in big tech stocks meant a down day for the S&P 500, some investors found reason to cheer the shift in leadership. Investors have fretted that the market’s reliance on a handful of tech stocks leaves the rally vulnerable.

“Rotation is the lifeblood of a bull market,” said Jamie Cox, managing partner for Harris Financial Group. “This is great news.”

The S&P 500 is now up 17% in 2024, while the Nasdaq Composite is up 22%.

The rotation kicked off after data showed U.S. inflation eased meaningfully in June. The consumer-price index rose 3% from a year earlier, a touch less than economists had forecast.

The evidence of easing inflation came after Fed Chair Jerome Powell earlier this week laid the groundwork for rate cuts by pointing to a cooling labor market and suggesting that further softening would be unwelcome.

Together, the developments have bolstered investors’ view that the Fed will pivot to lowering rates at its September meeting.

Investors are looking ahead to earnings season kicking off in earnest Friday with reports from JPMorgan Chase, Wells Fargo and Citigroup. Delta Air Lines shares fell 4% Thursday after the company reported a sharply lower profit in the second quarter.

Overseas, stocks were broadly higher. The Stoxx Europe 600 added 0.6%, while Japan’s Nikkei 225 advanced 0.9% to close at another record.

Write to Karen Langley at karen.langley@wsj.com

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the July 12, 2024, print edition as 'S&P Snaps Win Streak on Cooler Inflation'.

What to Read Next

8 hours ago

18 hours ago

Videos